Premium Only Content

Tips for Fiscal Year End Close

IRS Audit Letter (How To Prevent It)

The Difference Between An LLC and S-Corp

W-2 Form Vs 1099 with Angela Sticca Snyder

IRS payments and Transcripts

A quick recap of IRS.gov

Planning to Switch To S-Corp?

No Financial Statements? No Books?

What are LLC, SCorp, and Partnership

S-Corp Overview

How are Business Partnerships formed

What is a Balance Sheet

Newly Accepted as S Corp

How Do Taxes Work For Small Business? // With Eric Elam

Getting Ready for Taxes

Tax Brackets Explained for 2020

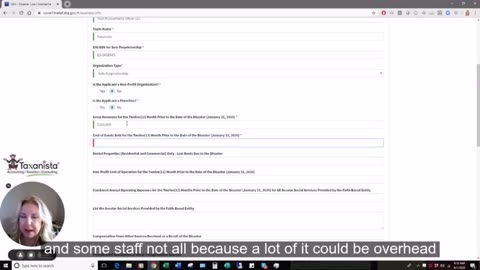

Cost of Goods Sold (CGS), Gross Revenue, and FTE Explained --- STIMULUS LOAN HELP

Paycheck Protection Program (PPP) Q&A

Emergency Economic Injury Disaster Loans, EIDL, Paycheck Protection Program

W-2 Form Vs 1099 with Angela Sticca Snyder

There's a difference between a 1099 and a W2. Most people get W2's. W2 is when you're an employee and you're working for someone else, and they're withholding taxes for you. It's the most common way of getting paid. 1099, on the other hand, is when you're doing side work, maybe a gig or some extra work for somebody, or you have your own business and your customers then give you a 1099, that income is not taxed before you receive it. So, when you get your income, it comes to you in a gross format. With that, then you get to write off deductions that go against that income. In this week's episode, Angela Sticca Synder talks about W2 vs. 1099.

Part One of ‘W2 vs. 1099’

It is imperative that you save your financial documentation. Credit card statements will not support you in an audit. What you need to have is a receipt that shows what was purchased. So, if you go to a store and they hand you that receipt, you need to make sure you take a picture of it to save it. If you buy something online, set up a folder on your computer that's called invoices or receipts. You want to make sure you have a copy of every item on your tax return.

Now that you're using a 1099 form, you want to make sure that you're keeping track of all expenses involved and carrying out your duties of whatever function you're doing to earn that money. If you're driving for business purposes, then you need to make sure you have a mileage tracking app. That's the second thing that's most important. When you get your 1099 form, there's a lot of good free apps out there. You can turn it on, and it just runs in the background. Technically and legally, you are supposed to have the starting and stopping odometer reading. Also keep track of where you went, who you went to see and the business purpose. Keep your mileage tracked and use an electronic calendar that's got your appointments.

Part Two of ‘W2 vs. 1099’

Now if you're audited, you have a backup. If you're organized, do it now. Many business owners have more time to spend on making money than keeping track of this. As long as you've got outstanding support, you'll be fine. With a 1099 form, even if you're a sole proprietor or an LLC, you still report your income and expenses on a Schedule C small business form.

It gets filed with your 1040 tax return if you report your gross income. which would be all of the income you received before any expenses. It is crucial that the total gross income on your Schedule C at least equals or exceeds the sum of all your 1099. If you have 1099 that's greater than what you're reporting as income, you will automatically receive a notice from the IRS. They have a matching system. If they mismatch and your income reported is last, you'll get a notice.

Once you reported all of your income on Schedule C, there are lots of deductions that you can take. Anything that you incur to operate your business is deductible. For instance, things like advertising, marketing, promotion, and anything you're doing to get your name out there. This also includes pins, business cards, or flyers, all that kind of stuff that you are expanding to get people to notice you.

Other expenses that you can incur would be retirement plans. You can set aside money for yourself in retirement: any office expenses or office supplies, your cell phone use, and even your home office. The home office is not the risk it used to be. So, for instance, if you do work out of your house and you have a home office, but you're conservative, or you're unsure, then take the standard home office because you can take that, and it doesn't require any supporting items. Again, the difference between the W2, which is when you're truly an employee and 1099, is that your social security and medicare taxes come out of the W2, and the employer also pays their half. When you get 1099, you report your gross income; you have deductions to come out of your net income, but remember there are no taxes withheld from your 1099.

Tune into the full episode for more tips.

How to Connect

Taxanista is a leading certified public accountant who offers reliable professional tax and accounting services. She is a consummate strategist. Do you have bigger issues? Taxanista can help you fight off the IRS. Angela knows how unsettling some of your struggles may be that’s why she offers private consultations for your business and tax matters.

Increase your profit by knowing your numbers. Reach out to her now. https://www.taxanista.com/

-

LIVE

LIVE

TimcastIRL

2 hours agoBail DENIED For Leftist Who FIREBOMED Democrat Governor's Mansion, Mangione Effect | Timcast IRL

12,740 watching -

24:05

24:05

Glenn Greenwald

7 hours agoAs U.S. Censorship Escalates, New Poll Reveals Declining Support for Israel: UNLOCKED Episode

82K70 -

LIVE

LIVE

We Like Shooting

1 day agoWe Like Shooting 606 (Gun Podcast)

759 watching -

1:00:41

1:00:41

Donald Trump Jr.

8 hours agoMake Main St Great Again, Interviews with Alex Marlow & John Phillips | TRIGGERED Ep.233

117K49 -

DVR

DVR

megimu32

4 hours agoON THE SUBJECT: 2008 Called.. It Wants Its Chaos Back!

28.7K5 -

1:01:53

1:01:53

BonginoReport

6 hours agoPolitical Violence on the Rise in America - Nightly Scroll w/Hayley Caronia (Ep.26) - 04/14/2025

101K59 -

LIVE

LIVE

BlackDiamondGunsandGear

53 minutes agoThey Don’t want you to Purchase 2A Related Products?

112 watching -

DVR

DVR

Joe Pags

4 hours agoThe Joe Pags Show 4-14-25

58.2K -

56:14

56:14

Sarah Westall

4 hours agoGlobal Agenda: Starve Small Business of Funds w/ Bruce De Torres

42.1K12 -

2:17:29

2:17:29

2 MIKES LIVE

7 hours ago2 MIKES LIVE #205 with guest Nick Adams!

39.8K