Premium Only Content

Tips for Fiscal Year End Close

IRS Audit Letter (How To Prevent It)

The Difference Between An LLC and S-Corp

W-2 Form Vs 1099 with Angela Sticca Snyder

IRS payments and Transcripts

A quick recap of IRS.gov

Planning to Switch To S-Corp?

No Financial Statements? No Books?

What are LLC, SCorp, and Partnership

S-Corp Overview

How are Business Partnerships formed

What is a Balance Sheet

Newly Accepted as S Corp

How Do Taxes Work For Small Business? // With Eric Elam

Getting Ready for Taxes

Tax Brackets Explained for 2020

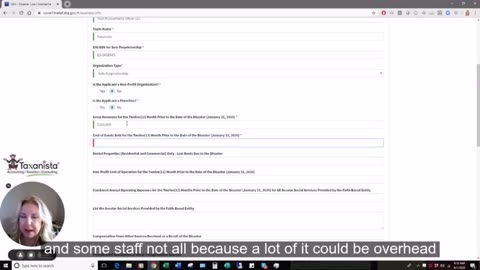

Cost of Goods Sold (CGS), Gross Revenue, and FTE Explained --- STIMULUS LOAN HELP

Paycheck Protection Program (PPP) Q&A

Emergency Economic Injury Disaster Loans, EIDL, Paycheck Protection Program

Tips for Fiscal Year End Close

It’s Year-End Close! Are You Ready? Here are some tips for fiscal year end close.

“Invest in A Good Bookkeeping and Accounting System.” -Angela Sticca Snyder (06:07-06:10)

Are you prepared for the year-end? It’s critical to review your business financials as this information will be used to prepare your tax returns. How else are you supposed to analyze the performance of your business? In this episode, Angela Sticca Snyder will give you some actionable year-end accounting advice that you don’t want to miss.

Part One of ‘It’s Year-End! Are You Ready?’

If you’re sitting on a huge profit, you might want to make some asset purchases before the end of the year. For instance, if your highest tax bracket is 30% and you buy a new computer for $1,000. That means you saved $300 on your federal taxes. So, it’s a good time to take a look and see everything that you know you’re going to need to buy soon. It’s a good idea for you to buy it now before the end of the year.

“Keep in mind that you’re technically supposed to have all your taxes paid by the end of the year.” – Angela Sticca Snyder (02:13-02:17)

For some reason, I have received notices about penalties. The tax was due back in December or at the latest April 15th, but they didn't get it filed. They filed an extension but only an extension of time to file and not an extension to pay. What you can do is you can go to irs.gov/payments and go ahead and set up an account and make a payment that way. Nobody wants to make a payment to the IRS, but you also don't want penalties or interest. So, that's one thing to keep in mind.

If you think you have any balance due or you think you've got an under-withheld for your taxes, do something about it. Make sure that you file on time to cut those penalties or put in estimated tax payment.

It's super simple to organize your taxes. We have amazing tools to make your life easier in terms of tax and accounting. Even if you don't do anything with it throughout the year and you have it for tax time, at least you've got it organized. If you don't have some type of checks and balances, something's going to fall through the cracks.

Part Two of ‘It’s Year-End! Are You Ready?’

Here’s another cool tip for you. When you get 'frequent flyer points' or 'credit card points', don't use it for business purchases. Your business buy would be deductible anyway. You can use it for other things like Christmas gifts for a holiday item, or for yourself.

“If you’re sitting on any old capital losses or mutual funds, consider selling some of your investments.” - Angela Sticca Snyder (03:49-04:03)

There’s another important thing you need to keep in mind. If you have a flexible spending accounts or an HSA, make sure to maximize that before year-end. It’s a good idea to fund your HSA each year because that money can grow, and it comes out tax-free for medical purposes. When you pull it out in your later years with your flexible spending account, you've got to use it or lose it. So, look at your flexible spending account and see if there's anything in there, any stock sales.

Now is a good time to sell some of your investments or your mutual funds if you're sitting on any old capital losses. The market is up so high that you would be able to offset those capital gains with any leftover capital loss. Remember, you're limited only to 3000 a year. So, if you capture some of those gains, then you can offset it with some of those losses and not have to pay it.

To end this podcast episode, make sure that you start the year off right with a mileage tracking app. Consider getting some type of good bookkeeping and accounting system. No receipt, no deduction.

How to Get Involved

Taxanista is a leading certified public accountant who offers reliable professional tax and accounting services. She is a consummate strategist. She loves listening, analyzing and developing strategic plans. Do you have bigger issues? Taxanista can help you fight off the IRS. Angela knows how unsettling some of your struggles may be that’s why she offers private consultations for your business and tax matters. Increase your profit by knowing your numbers. Reach out to her now. https://www.taxanista.com/

-

LIVE

LIVE

Steven Crowder

2 hours ago🔴 Why the Deported El Salvador Father Story Is One Huge Media Lie!

94,554 watching -

UPCOMING

UPCOMING

Nerdrotic

3 hours agoNerdrotic Nooner 477

1.8K -

The Rubin Report

1 hour ago‘The View’s’ Whoopi Goldberg Shocks Crowd by Going Even Further Left

5.29K12 -

LIVE

LIVE

Y Combinator

3 hours agoY Combinator Little Tech Competition Summit - Washington DC

539 watching -

LIVE

LIVE

Scammer Payback

23 minutes agoCalling Scammers Live

186 watching -

1:01:43

1:01:43

VINCE

3 hours agoWhat REALLY Happened In Wisconsin? | Episode 13 - 04/02/25

201K184 -

LIVE

LIVE

LFA TV

12 hours agoLFA TV - ALL DAY LIVE STREAM 4/2/25

4,385 watching -

UPCOMING

UPCOMING

Tudor Dixon

1 hour agoMAHA Meets DC with RFK Jr. Advisor Calley Means | The Tudor Dixon Podcast

29 -

Rethinking the Dollar

40 minutes agoGOLD Has Been The True LIBERATOR To Date | Morning Check-In

-

LIVE

LIVE

MYLUNCHBREAK CHANNEL PAGE

20 hours agoThe Old World Marathon #2

729 watching