Premium Only Content

THIS Stock Market Rally ENDS on Friday 👀

🟢 BOOKMAP DISCOUNT (PROMO CODE "BM20" for 20% off the monthly plans): https://bookmap.com/members/aff/go/figuringoutmoney?i=79

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

___________________________________________________________________________________________

In this video, we explore market seasonality and the Consumer Price Index (CPI) to predict a potential end to the current rally on Friday.

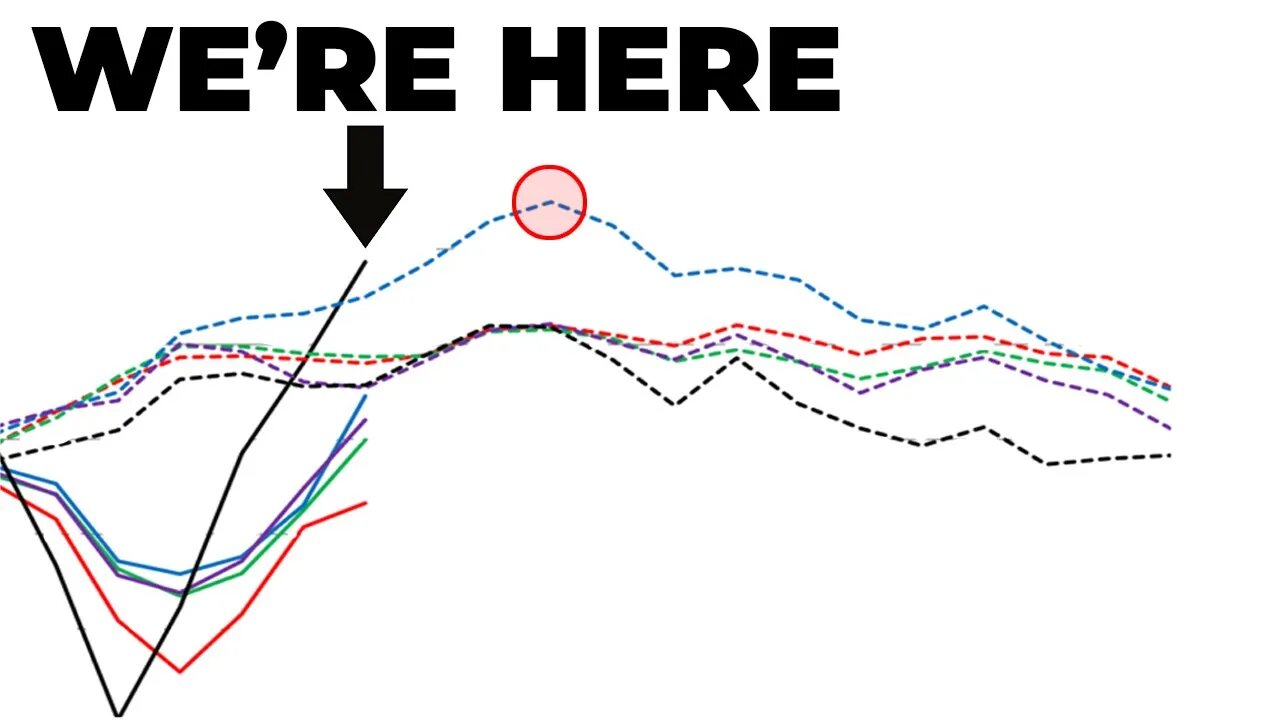

We start by examining July's market trends, noting a peak around the eighth trading day. This pattern, often seen in pre-election years and in the NASDAQ, hints at a possible market pivot.

Next, we discuss the recent CPI report. Initially, the market surged as the report was lower than expected, but later began to sink. Interestingly, utilities, a rate-sensitive sector, led the way, possibly due to a significant decrease in two-year and ten-year rates post-CPI report.

We also touch on inflation data, which came in at 3% year over year, lower than the consensus and the CPI nowcast by the Federal Reserve. This underperformance was perceived positively by the market.

The Fed Watch tool suggests a 94% chance of a rate hike in the July meeting, but a decreased probability for September, indicating a potential pause in rate hikes.

Lastly, we highlight the significant drop in the dollar and its impact on various sectors. We also discuss the S&P 500 and the NASDAQ, both trading outside of their weekly expected moves. However, the big mega cap names, which have a large weighting in the S&P 500 and NASDAQ 100, have not moved outside of their expected moves, which could potentially alleviate the market even if some products fall.

In conclusion, while signs of a potential market pivot are emerging, it's crucial to monitor the big mega cap names and be prepared for various scenarios. Stay tuned for more updates!

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at FiguringOutMoney@gmail.com

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

How To Predict How Far Stocks Can Go (EXPECTED MOVES):

○ https://youtu.be/JT32L89ZpEk

Saylor To Schiff Bitcoin Indicator:

○ https://youtu.be/zuG9Tjnud9k

Show Me The Money Scan:

○ https://youtu.be/dzRjEuUUb5g

Party Starter Scan:

○ https://youtu.be/zzaN91gcJOI

Bouncy Ball Scan:

○ https://youtu.be/7xKOo6vNaq8

Dark Money Scan:

○ https://youtu.be/ZUMuHaSg1ro

Sleepy Monster Scan:

○ https://youtu.be/C9EQkA7uVU8

High Volatility Scan:

○ https://youtu.be/VC327ko8DfE

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#Stockmarket #StockMarketAnalysis #DayTrading

#CPIReport

#Macroeconomics

#MarketAnalysis

#ImpliedVolatility

#SPY

#QQQ

#IWM

#TechnicalAnalysis

#TradeIdeas

#Investing

#Trading

#StockMarket

#FinancialNews

-

20:11

20:11

Figuring Out Money

1 year agoLet's Get Ready To Rumble!

32 -

4:16:41

4:16:41

CatboyKami

5 hours agoStalker 2 Blind playthrough pt1

6.7K1 -

1:06:27

1:06:27

Russell Brand

5 hours agoNeil Oliver on the Rise of Independent Media, Cultural Awakening & Fighting Centralized Power –SF498

171K245 -

1:39:14

1:39:14

vivafrei

5 hours agoSoros Karma in New York! Tammy Duckwarth Spreads LIES About Tulsi Gabbard! Pennsylvania FLIPS & MORE

80.1K62 -

1:57:36

1:57:36

The Charlie Kirk Show

4 hours agoInside the Transition + The Bathroom Battle + Ban Pharma Ads? | Rep. Mace, Tucker, Carr | 11.21.24

129K50 -

59:20

59:20

The Dan Bongino Show

7 hours agoBitter CNN Goes After Me (Ep. 2375) - 11/21/2024

850K3.42K -

57:28

57:28

TheMonicaCrowleyPodcast

2 hours agoThe Monica Crowley Podcast: Mandate into Action

16K -

1:02:09

1:02:09

TheAlecLaceShow

5 hours agoGuests: Alex Marlow & Terry Schilling | Justice For Laken Riley | Russian ICBM | The Alec Lace Show

31K8 -

1:51:15

1:51:15

Danny Haiphong

4 hours ago $10.82 earnedMARK SLEBODA & SCOTT RITTER: NATO ATTACKS RUSSIA, PUTIN FIRES ICBM WARNING SHOT AT UKRAINE—WW3 NEXT?

74.9K12 -

40:47

40:47

Dave Portnoy

8 hours agoThe Unnamed Show With Dave Portnoy, Kirk Minihane, Ryan Whitney - Episode 37

55.8K2