Premium Only Content

The power of your signature

Cestui que trust and taxes

Income taxes MADE EASY!

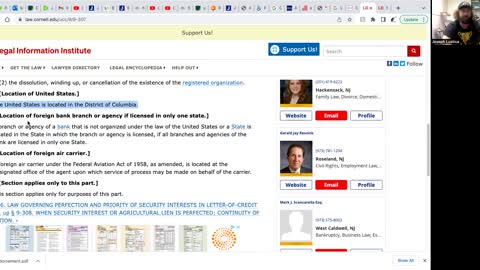

Definition of "State" capital S

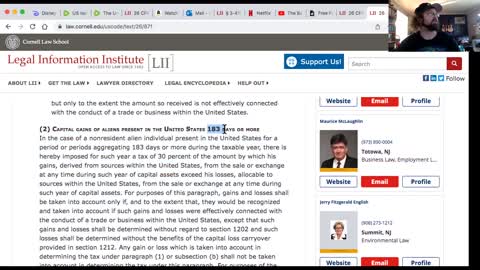

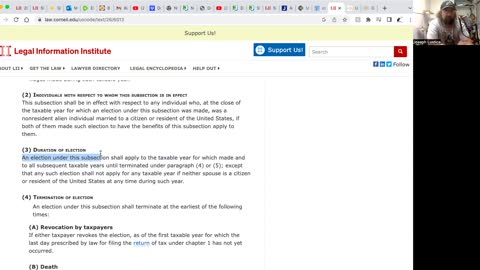

What taxes does a nonresident alien pay?

The IRS forms after the Revocation of Election

The United States government has to pay you?

The law that says you do not have to pay taxes

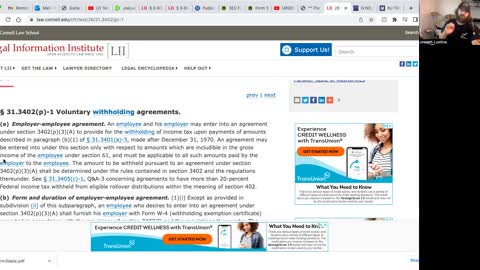

How to peacefully end the W-4 agreement with your employer

You volunteered to have your taxes taken from your paycheck

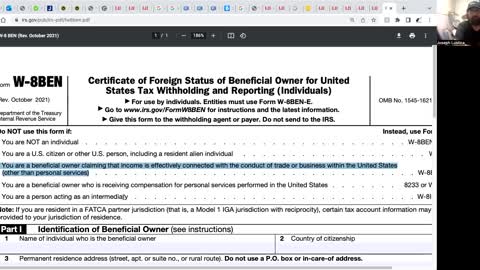

W-8BEN not accepted by your job? Maybe this can help

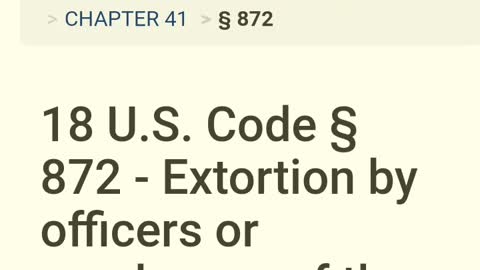

Extortion by officers or government employees

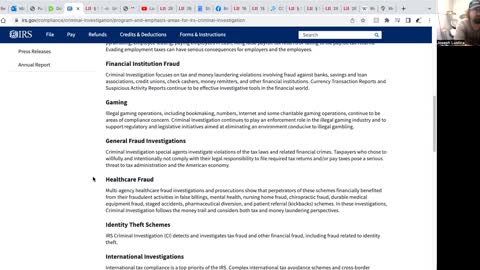

What does the IRS Criminal Investigation (CI) do?

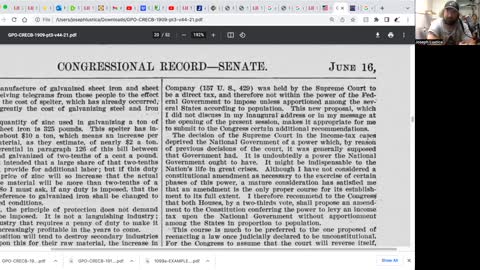

Treasury Decision

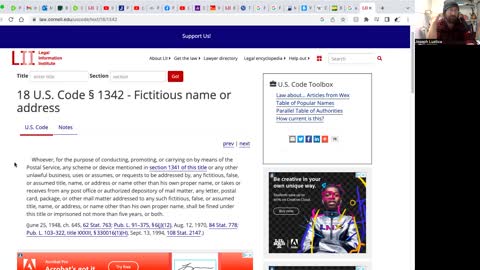

Mail Fraud

Getting the W-8BEN accepted by your job

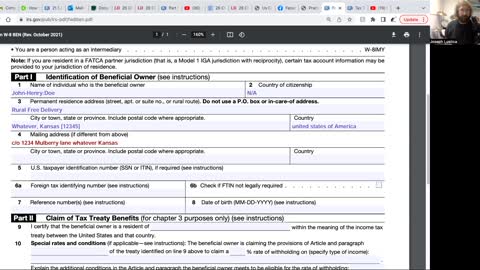

How to fill out the W-8BEN form

Don't renounce your citizenship just repatriate as a national

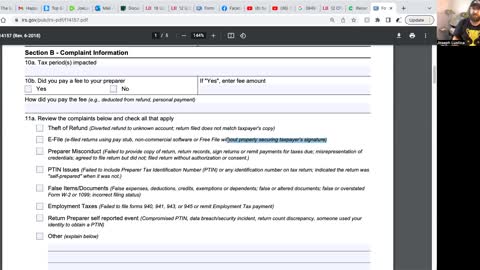

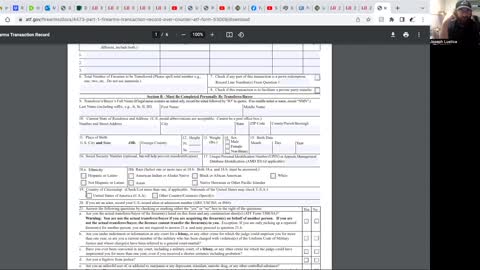

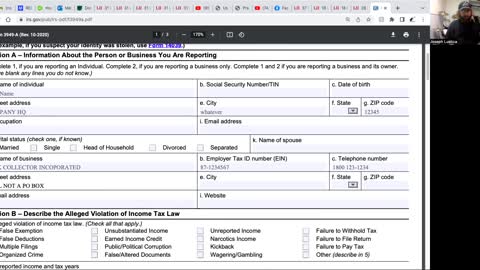

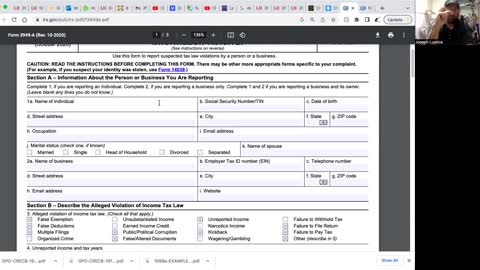

How to fill out the 3949a form

Tax liability for non-resident aliens

Rejecting mail contracts (fictitious name)

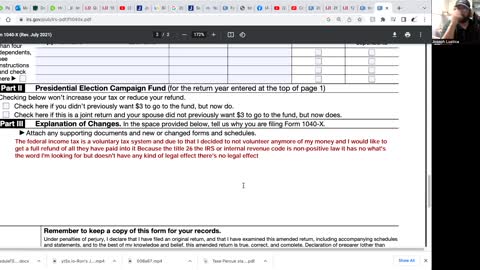

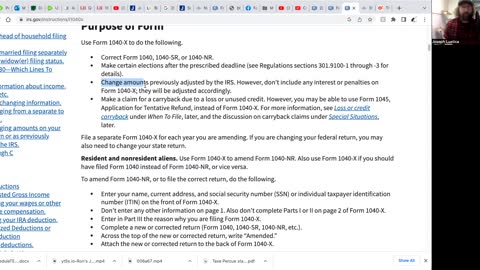

How to get back all your tax money for the year

More on the 1040 X form

Every state is a registered business

The right to rescind any contract

Revocation of election (part 1)

Revocation of election (part 2)

Filling out the 3949a form for the W4 sandwich

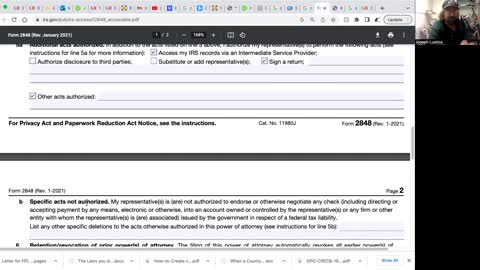

Filling out the 2848 form

Revocation of election (part 3) Nonresident alien

Where the federal taxes go

Revocation of election (part 4)

Revocation of election (part 5)

The difference between W-4V, W-8BEN, W-8BEN-E and the 1040-NR

How to use a notice of default

W4s, W2s, 1099s are all gift and Estate tax

Non-employee compensation for nationals

Income taxes MADE EASY!

The Internal Revenue Code (IRC) is about FOUR MILLION words long, more than FIVE times longer than the Bible! Even when printed on tissue-thin paper with small font, the book is still large and weighs several pounds. The IRC is possibly the most convoluted and complicated book ever written, sometimes listing exceptions to exceptions to exceptions. Who can make sense of such brain-numbingly long, rambling legalese?

In this presentation, Peymon Mottahedeh, founder of Freedom Law School, who has been studying income tax laws for 30 years, will break down the income tax laws, as found on the US government’s official legal websites, simplifying who must file and pay federal income tax and Social Security taxes and how much you must pay, and making the code so clear and simple that even a DUMMY can understand it!

-

LIVE

LIVE

AlaskanBallistics

2 hours agoI love this Gun PodCast #26

90 watching -

LIVE

LIVE

yellow_1ron

3 hours agoFIRST EVER RUMBLE STREAM | MARVEL RIVALS | WARZONE | JOIN UP!!!

73 watching -

30:08

30:08

QNewsPatriot

10 hours ago(4/14/2025) | AUDIO CHAT 160 | SG Sits Down w/ CA Patriots "The Shasta Five": Election Security Efforts in Deep Blue California

9.71K4 -

LIVE

LIVE

Anthony Rogers

1 day agoEpisode 361 - Stargates & Ancient Civilizations

71 watching -

1:00:55

1:00:55

BonginoReport

6 hours agoCalifornia BROKE After Bankrolling Illegals’ Healthcare - Nightly Scroll w/ Hayley Caronia (Ep.27)

101K80 -

1:13:35

1:13:35

Kim Iversen

5 hours agoYou Cheered When They Deported Him. Now They’re Building Black Sites for You.

84.5K105 -

1:18:29

1:18:29

Redacted News

6 hours agoSHOCKER! Trump's latest would-be ASSASSIN has Ukraine connections, Real ID backlash | Redacted

172K135 -

54:20

54:20

LFA TV

10 hours agoJCPOA 2.0 | TRUMPET DAILY 4.15.25 7PM

39.3K1 -

1:46:20

1:46:20

vivafrei

12 hours agoBilly Baldwin DESTROYED! Canadian Liberal Politicians are THE WORST! Interview with PPC & MORE!

121K56 -

1:23:48

1:23:48

The Officer Tatum

7 hours agoLIVE: Karmelo Anthony RELEASED From JAIL As GiveSendGo NEARS $500K + MORE | EP 94

88.7K53