Premium Only Content

Repay the mortgage…or invest? What's best for you?

Hey! Like what you've heard today?

I'm on a mission to help improve levels of wealth for everyday Kiwi's. After all, it's good to build wealth...right?

Here's some ways you can get alongside the NZ Everyday Investor - no pressure, but I'd appreciate any help you could offer:

Use the following referral/affiliate links

Hatch: https://app.hatchinvest.nz/share/uqhcj8y8. $10 for you, and $10 for me, if you sign up and deposit $100NZD.

Sharesies: https://sharesies.com/r/RRPR6X. $10 for you, and $10 for me, if you sign up for the first time with them.

Easy Crypto: easycrypto.com/nz?ref=19599. One of NZ's most trusted places to buy/sell your digital assets.

Share this Spotify link with your friends: https://open.spotify.com/show/0MA6EGur387YT1ENKIffMx?si=b1C28fV7TmWib8qXnZLDoA

_______________

You don't like paying 'interest to the man', that's totally understandable, but who really wins in the long term: Those who aggressively pay down their mortgage before investing seriously, or those who invest AT THE SAME time as having a mortgage still in place?

It's not a 'one-size fits all' thing here though and you need to consider: 1 - your appetite for risk, 2 - how your other investments are structured, 3 - the risks (changing interest rates and changing rates of return in the sharmarket) 4 - your investing timeframe, and most importantly 5 - how you will react when times of volatility hit.

-

34:52

34:52

MYLUNCHBREAK CHANNEL PAGE

22 hours agoThe Lost City

183K97 -

9:04

9:04

Tundra Tactical

14 hours ago $23.79 earnedTrump's AG Pick Pam Bondi is TROUBLE!

90.1K36 -

1:02:02

1:02:02

PMG

19 hours ago $14.36 earned"Man Films FBI Coming to His Home Over Alleged Social Media Posts - Jeremy Kauffman"

63.6K12 -

23:21

23:21

Stephen Gardner

1 day ago🔥Trump DISCOVERS exactly who BETRAYED Him!!

171K594 -

11:04

11:04

Silver Dragons

18 hours agoCoin Dealer Exposes the "German Silver" Scam & MORE

92.8K20 -

39:56

39:56

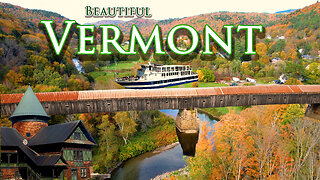

TampaAerialMedia

19 hours ago $18.76 earnedBeautiful VERMONT - 15 Towns & 7 Scenic Highways - Burlington, Woodstock, Brattleboro, & More

100K26 -

1:04:24

1:04:24

Tactical Advisor

22 hours agoBattlehawk Build Of The Month /Giveaway Winner | Vault Room LIVE Stream 009

167K41 -

2:51:26

2:51:26

I_Came_With_Fire_Podcast

1 day ago"Houska Castle: Gateway to Hell, Nazi Occultism, & Ancient Legends"

128K42 -

26:20

26:20

Degenerate Jay

1 day ago $11.23 earnedThe Best Transformers Movie? - Bumblebee Movie Review

93.8K12 -

10:12

10:12

This Bahamian Gyal

1 day agoInfluencer hired HITMEN to OFF social media rival

77.1K22