Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

311 - Limitations on Foreclosure

3 years ago

190

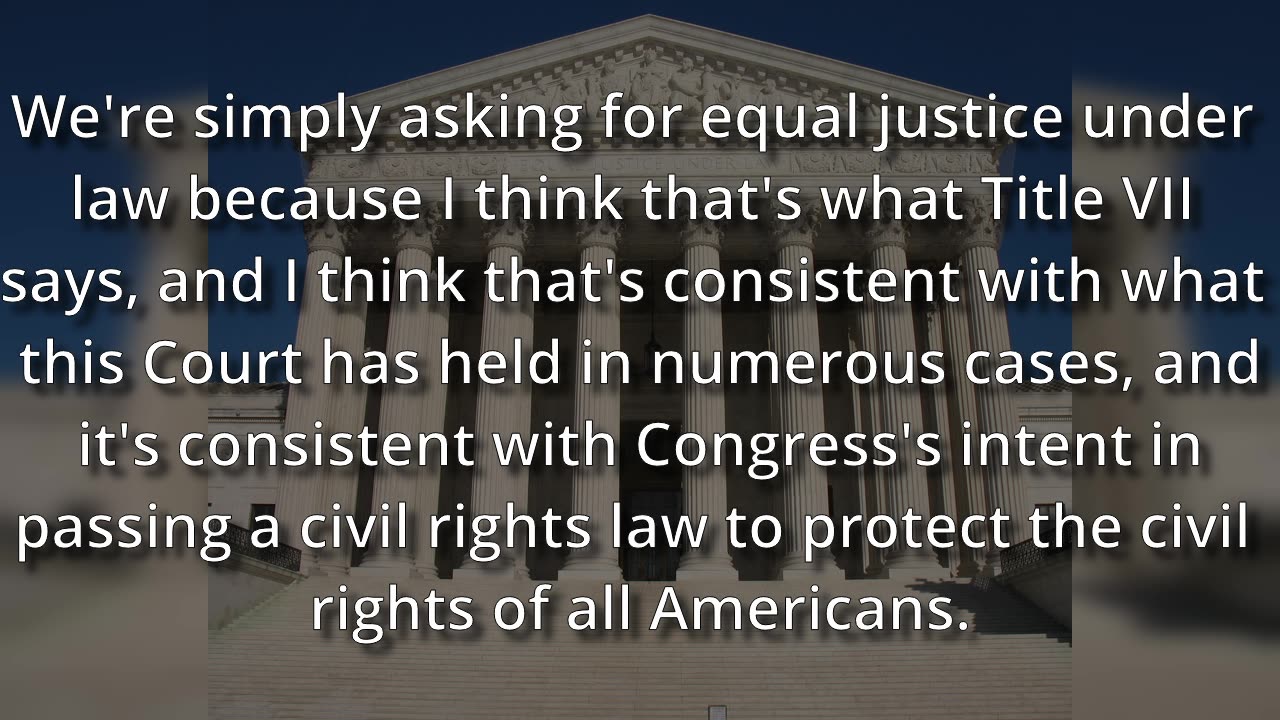

We all recognize that property can be foreclosed on for failure to pay a tax debt. What happens when the value of the foreclosure is greater than the debt owed? A case out of Michigan, recently appealed to the Sixth Circuit, seeks redress for just such situations. Eight citizens of Oakland County Michigan are suing the county for, among other things, taking property worth far more than the tax debt owed, then not reimbursing them the difference. Is this an illegal taking, or a deprivation of property without due process? Or could it simply be a scheme to defraud both the homeowners and taxpayers of Oakland County?

Loading comments...

-

1:29

1:29

The Constitution Study

8 days agoHeterosexual Discrimination - Mr. Wang's Rebuttal

601 -

2:31:02

2:31:02

vivafrei

19 hours agoEp. 258: Taibbi Sues for Defamation! Trump Tariff Madness! Russell Brand, Greenpeace Verdict & MORE!

156K236 -

2:27:12

2:27:12

Nerdrotic

11 hours ago $40.58 earnedCIA JFK Assassination Documents | Forbidden Frontier 097

112K66 -

4:02:43

4:02:43

Alex Zedra

8 hours agoLIVE! Verdansk all night <3

46.2K14 -

1:22:13

1:22:13

Sarah Westall

11 hours agoTruth about Gila Monster Snake Venom & the Miracle of Peptides for Human Health w/ Dr. Diane Kazer

94.6K27 -

2:18:43

2:18:43

Tundra Tactical

9 hours ago $4.98 earned$3200 ZEV HEARTBREAKER Contest!!!

49.4K2 -

6:24:39

6:24:39

EuphioniaStudio

8 hours ago $6.48 earnedIt's BAAAASED, MARIO! | Mario Party 4

48.3K6 -

2:48:34

2:48:34

Adam Does Movies

18 hours ago $7.99 earnedAll The Big Movie Announcements From CinemaCon 2025- LIVE!

64.9K -

1:07:30

1:07:30

Josh Pate's College Football Show

11 hours ago $6.45 earnedBig CFB Changes Coming | USC + Texas + Alabama In 2025 | Truth About Officiating | I Am Engaged

64.8K1 -

4:43:40

4:43:40

Biscotti-B23

14 hours ago $6.46 earned🔴 LIVE VIEWERS VS MEMBERS BEEF 🔥 FINDING A NEW MAIN ⚔ BLEACH REBIRTH OF SOULS

54.7K2