Premium Only Content

The great reset will be the great default

Apologies for the sound Austrian economists. I have learnt from the experience...

There is no way in hell this pumped up debt fuelled bubble has got much longer before the defaults are cascading their way through every market, at every level, throughout the world.

The creative destruction of the market will clear the mal investment while the central planners totally lose control.

They may hit you with a social credit score on their central bank digital token. But you will ignore their worthless currency and trade another way.

The central planners at the world economic forum are no different from the polit bureau in the Soviet Union. They made everyone so poor the people said enough is enough. Your system has failed.

One example of the ridiculousness of central planning in the Soviet era had the polit bureau telling the chandelier company how many tonnes of chandeliers to make every year. The very people who gave the directive to produce chandeliers by their weight, found out the hard way when the chandeliers started falling out of the ceiling and killing them at the oligarch dinner table.

Today’s central planner’s collapse will not repeat exactly as the collapses’ of the past. But it will rhyme, it will rhyme with the fall of Rome, it will rhyme with the fall of the Soviet Union, the 1929 stock market crash, and many other empire crumbling examples in history.

The defaults will bring us back to earth. The clearing of the burden of debt will allow money to trade freely as a real commodity again.

Money will be whatever you want it to be. It will be whatever you trust. It will be what others will accept.

Not far down the track, for your labour, you will only accept the real commodity that you know any other market participant will accept. This commodity will be the best store of value on earth.

The best store of value in the last 5-6000 years, the best store of value that has been, for all of human history, is gold.

The free market will take us to a tri metallic system of day to day trading and wealth preservation. In the tri metallic system all goods and services will most likely be traded for one of the three metals, depending on the size of the transaction.

The three metals will be gold, silver, and copper. Yes copper. We will use copper for small trades, like buying groceries, silver for larger trades like vehicles, and gold as savings, or purchases of land for example.

This great reset the modern socialists think they have planned, will be the great default. The great default can be happen honestly, like a confession, when you let the party know that you owe money to that you cannot pay, go bankrupt, and clear the debt. Or it can happen dis honestly, by creating more currency to pay the debt. Another word for it is counterfeiting. History suggests the counterfeiters will counterfeit until the currency is worthless, it’s still a default, just a dis honest default, like continuing to lie when you are caught out.

That is not to say in the future there will be no credit, but credit will come from savings. Not central bank bond purchases of government debt, and fractional reserve loans to real estate speculators. Credit will be available to entrepreneurs wanting to add value to the market through production. For it is production that drives an economy. Not spending, as so many wrong headed economists and polit bureau pundits will have you believe.

As we get closer to the point of currency collapse, the pensioners in the Western world that thought the govt was going to look after them in their retirement, will see the lie when the currency they are payed in will not buy their groceries, or pay their power bill. The fraud will be realized, and alternatives sought.

By the time we get to that stage, most of us will not bother working for digital dollars or central bank digital currencies, we will refuse to accept the fake money. We will no longer pay tax, which is at present a shell game where the central bank, government and commercial banks issue the currency from nothing in the first place, and take a percentage off the average worker or employer (who are workers also) to trick them into thinking the currency is money. From the CEO to the trolley collector at the supermarket, everyone will be awake to the fraud.

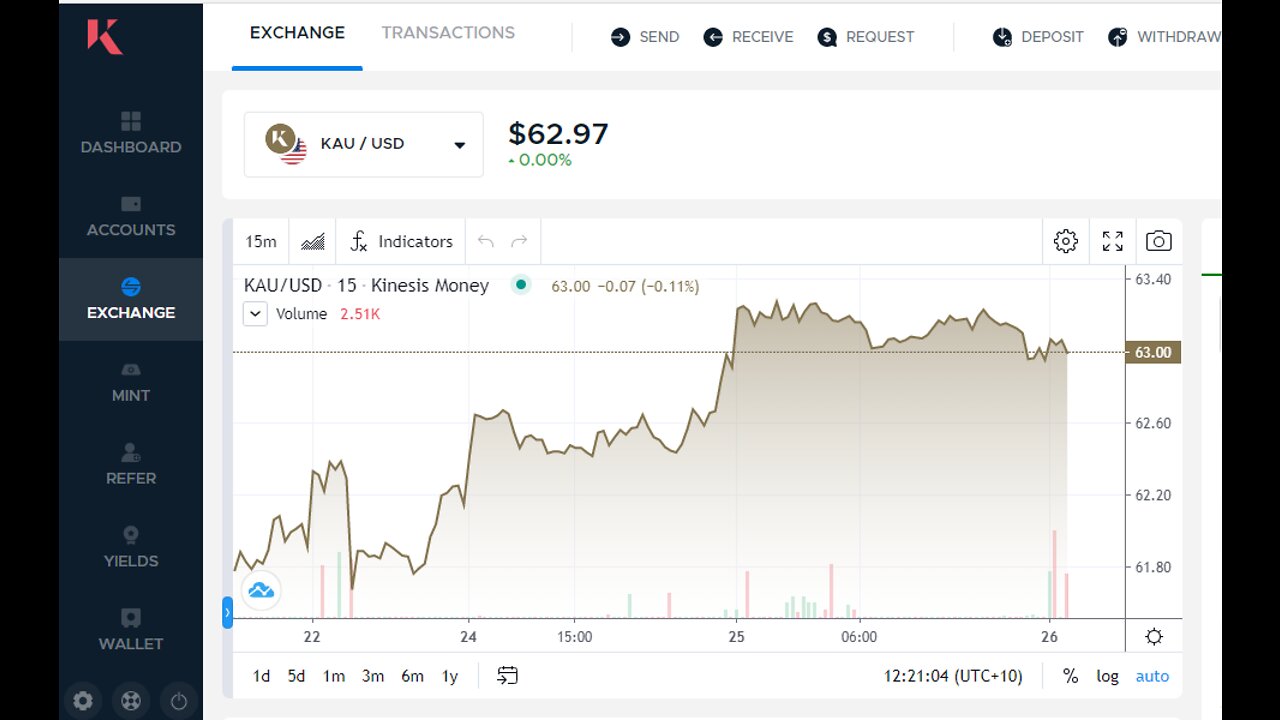

Part of my solution is after making sure at least half my net worth is saved in physical precious metals( in case of a serious collapse when there may be no power or internet, and I am cooking kangaroo on an open fire). I am now saving in kau. Kau and kag are the alternative to the worthless central bank digital token the central planners will try to force upon you.

One kau is a digital token on the blockchain that is a representation of 1 gram of gold stored in a vault. One kag corresponds to 1 ounce of silver in a vault.

Because I live in Australia, every time I purchase a kau, there is a corresponding audited gram of gold stored in a vault in Sydney. Depending on where you are reading this article, the vault may be in Hong Kong, Singapore, New York, London, Dubai, Zurich or Lichtenstein.

The real benefit of owning especially kau is the yield. Every transaction in the new money system attracts a .22 -.45% fee, there is a small cost when it comes to transacting in real commodities like money. Some of this transaction fee is then paid out to to existing kau holders, currently at a rate of 6%. Paid in gold.

The account will essentually attract a rate of interest paid in money that holds its value against all other commodities and currencies. It offers protection from inflation and pays a 6% yield in inflation proof gold. Not in dollars or any other currency.

The new money system is called Kinesis Money. The Gold and silver in the vaults are audited twice a year by Inspectorate, specialist precious metal inspectors, and the results are published on the Kinesis web site.

I believe Kinesis Money will be one of the digital blockchain answers to the great default. One of Kinesis Money’s founders and directors, Andrew Maguire was a whistle blower that called out the hedge funds and commercial banks for selling millions of ounces of paper silver in the dead of night to drive the price down, so they could buy physical at a discount the following day. Great work if you can get it we used to say.

If you want to learn more about Kinesis, there are plenty of videos and articles on their web site www.kinesis.money to explain the system and how it works.

If you want to ask me some questions about my experience in setting up an account with Kinesis, please leave a comment, or call +61 447 809 808

Thanks for reading if you made it this far,

The Amateur Austrian

-

LIVE

LIVE

ROSE UNPLUGGED

21 hours agoAn Air of Optimism for 2025: Can You Feel It?

62 watching -

LIVE

LIVE

The Charlie Kirk Show

1 hour agoThe 2025 Speaker Election + DEI FBI + Britain's Grooming Gangs | Gaetz, Gilliam, Marshall | 1.3.2025

11,489 watching -

Grant Stinchfield

3 hours agoThe Left's Will Evil Plot to Prevent Trump from Taking Office Exposed!

3.43K8 -

52:32

52:32

The Dan Bongino Show

3 hours agoProducer's Picks: Bongino's Best Segments - 01/03/25

95.4K315 -

56:49

56:49

VSiNLive

3 hours agoA Numbers Game with Gill Alexander | Hour 1

22.1K1 -

LIVE

LIVE

Film Threat

16 hours ago2025 MOVIES TO LOOK FORWARD TO + JANUARY'S BEST FILMS | Film Threat Livecast

347 watching -

LIVE

LIVE

The Shannon Joy Show

3 hours ago🔥🔥Friday Freestyle LIVE With Shannon Joy! Ask Me Anything On The Open Live Chat!🔥🔥

371 watching -

1:05:01

1:05:01

The Big Mig™

17 hours agoGlobal Finance Forum Powered By Genesis Gold Group

5.42K4 -

1:31:22

1:31:22

Caleb Hammer

3 hours agoEgo-Maniac Thinks She Can Manifest Problems Away | Financial Audit

20.9K1 -

2:02:38

2:02:38

LFA TV

6 hours agoSPEAKER VOTE LIVE! | LIVE FROM AMERICA 1.3.25

33.5K25