Premium Only Content

Atlas Line Review Why I Dont Over Trade For The Best Results

https://daytradetowin.com/trading-software

Day Trading Results using the Atlas Line Software

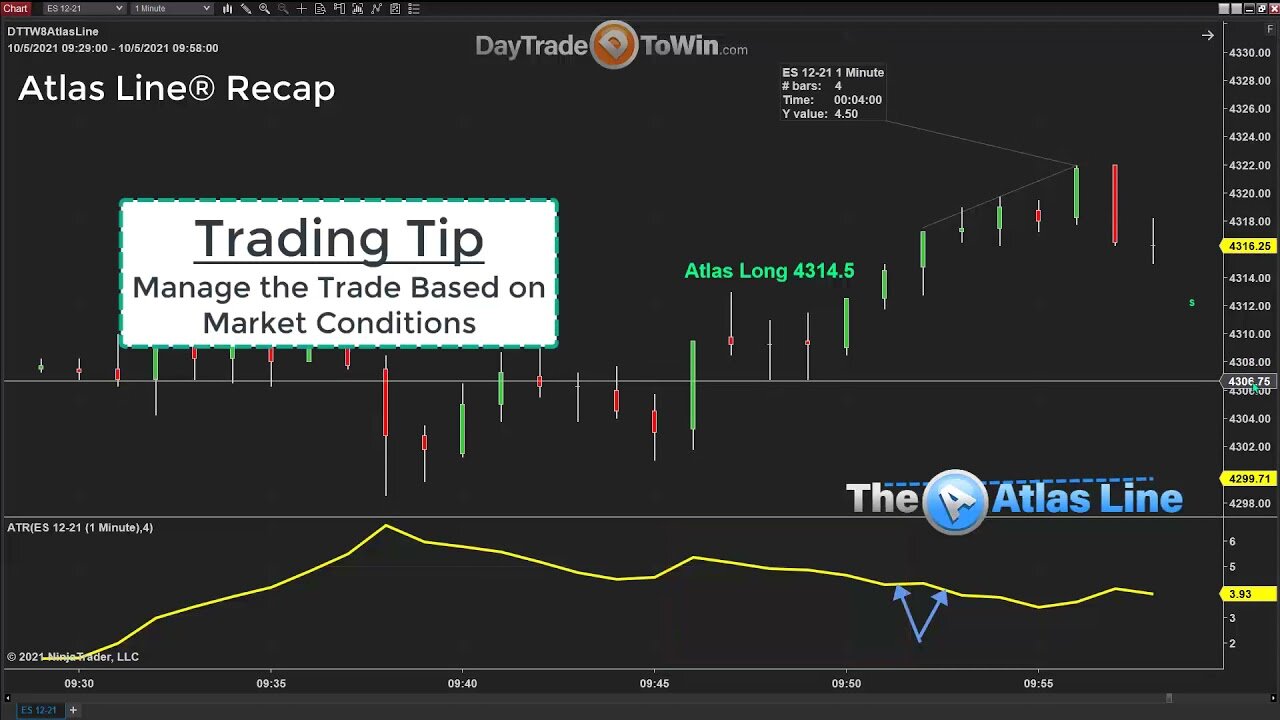

Let's review the signals on the Atlas Line trading software exclusively offered by daytradetowin.com Let's see what happened today during this trending day. Mentorship Class starting https://daytradetowin.com/day-trading-mentorship-coach

The mentorship class includes all the courses and software. So you may want to look into that, especially if you're a new trader, you may want to join the next upcoming class and we do install and provide all the setup and information for you before you begin. So today we're looking at a few signals, right? As the day begins, and there's a lot of short signals and it would make sense that the Atlas line, as well as you can see, had a lot of short signals here early in the morning, there was a long signal here that did not work.

This was a losing trade, but the rest of the signals on the Atlas line to go short were very good, just hitting short, short, short the entire day. And it would make sense that you would want to scalp that as well. So going short today on the Trade Scalper, there are a number of signals here. There's one, two, three, four, five signals all go short and you have this one signal here to go long, which is a winning trade. It's a good log signal. Let me just expand this out here.

As you can see this trade was good, but the one thing you do have to be careful with is the volatility, which we do have a lot of volatility. So if you look back here and you see, for example, on a one minute chart, the signal at about noon Eastern standard, Eastern time, 12 o'clock 12, 12, 15 to go short here at 30, 98 50.

So this signal was a good signal, but it concerns me that there is a huge amount of volatility that is setting up. So I just want to be careful before jumping into a trade that I understand that the volatility has a lot to do with how much our stop or profit our trade management, because you can't trade the same way when the market is slow in comparison to when the market is more volatile or fast. So be aware of the volatility and it's okay to skip trade.

You don't have to take every single tray that comes your way, especially when it's riskier. So just be careful with that. And so as we continue here throughout the day, there are a lot of short trades. There's one long trade here, as you could see. And then here we go. Again, short, short, short, short, all the way into the end of the day until about two 30, where the market begins to give long opportunities.

And the Trade Scalper is a great way to take a small piece of each move as it occurs. So this 38, 30, 81 75 to go long, this 30, 90 to go long. You don't have to hold onto a trade. Take a few points, especially if the ATR here is at three or four and you're out.

So out of all these signals, there's probably two trades that failed and the rest looking at about 20 trades or so that were successful. Now in looking at the Atlas line here for today, you can see that there are a lot of short signals and we have this one long signal here. This was today. Let's take a look at yesterday Thursday just to give a comparison of multiple days in a row. This is a great short setup here, right at about nine 59 45, nine 50 a to go short. And then the rest of the signals here are long, long opportunities. For those of you looking to join the upcoming class Monday, June 22nd, all the information is available at daytradetowin.com until next time, good trading.

https://daytradetowin.com/get-started-trading

https://daytradetowin.com/get-started

https://daytradetowin.com/trading-systems-courses

Price action at its best! Risk Disclosure: https://daytradetowin.com/risk

-

3:22

3:22

DayTradeToWin

2 years agoAtlas Line short trade first trade of 2016

7 -

4:45

4:45

DayTradeToWin

2 years agoDay trading and scalping the Emini S&P500 Atlas line and Trade Scalper review of trades

11 -

4:08

4:08

DayTradeToWin

2 years agoTrading Results Recap Atlas Line Software on Multiple Markets✔️

14 -

5:07

5:07

DayTradeToWin

2 years agoTrading Results ✔️and Review Market Orders with Day Trade To Win Software

11 -

4:52

4:52

DayTradeToWin

2 years agoGreat Long Trade August 2018 Using Atlas Line and ATO 2

16 -

3:29

3:29

DayTradeToWin

2 years agoTrading Review - How to add the Atlas Line and ATO 2 on your chart

24 -

6:20

6:20

DayTradeToWin

2 years agoTrading Recap Long and Short Entries - Atlas Line Indicator 2-day Review

16 -

4:29

4:29

DayTradeToWin

2 years ago $0.01 earnedDay Trading Results on Friday - Scalp Trading + Atlas Line Software

32 -

9:04

9:04

DayTradeToWin

2 years agoAtlas Line and Trade Scalper E-mini S&P - Trading with Two Charts

9 -

54:22

54:22

LFA TV

1 day agoThe End of the Trans-Atlantic Alliance | TRUMPET DAILY 2.17.25 7PM

57.4K7