Premium Only Content

MARCH 2, 2022 IMPORTANT NEW BULLETIN!!! IRS ISSUES FAQS FOR TAX YEAR 2021.

MARCH 2, 2022 IMPORTANT NEW BULLETIN!!! IRS ISSUES FAQS FOR TAX YEAR 2021.

The Internal Revenue Service today issued frequently asked questions (FAQs) for the 2021 Earned Income Tax Credit to educate eligible taxpayers on how to properly claim the credit when they prepare and file their 2021 tax return.

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families in the form of a credit to either reduce the taxes owed or an added payment to increase a tax refund. The amount of the credit may change if the taxpayer has children, dependents, are disabled or meet other criteria.

These FAQs detail what the EITC is, how it was expanded for 2021, which taxpayers are eligible, and how to claim it.

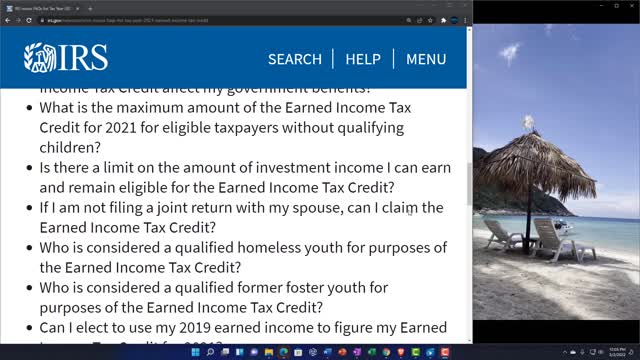

The 17 new FAQs are:

What is the Earned Income Tax Credit?

What is earned income?

What are the earned income limits for taxpayers without qualifying children?

How old must I be to claim the Earned Income Tax Credit if I do not have qualifying children?

Do I need to have a Social Security number (SSN) to be eligible to claim the Earned Income Tax Credit?

Do my qualifying children need to have SSNs in order for me to claim the Earned Income Tax Credit?

What are the age requirements for claiming the Earned Income Tax Credit if I have a qualifying child?

What are the earned income limits for individuals with a qualifying child?

Will any refund that I receive because I claimed the Earned Income Tax Credit affect my government benefits?

What is the maximum amount of the Earned Income Tax Credit for 2021 for eligible taxpayers without qualifying children?

Is there a limit on the amount of investment income I can earn and remain eligible for the Earned Income Tax Credit?

If I am not filing a joint return with my spouse, can I claim the Earned Income Tax Credit?

Who is considered a qualified homeless youth for purposes of the Earned Income Tax Credit?

Who is considered a qualified former foster youth for purposes of the Earned Income Tax Credit?

Can I elect to use my 2019 earned income to figure my Earned Income Tax Credit for 2021?

Can a student claim the Earned Income Tax Credit for 2021?

What is a specified student for purposes of the Earned Income Tax Credit?

File for free and use direct deposit

Taxpayers with income is $73,000 or less can file their federal tax returns electronically for free through the IRS Free File Program. The fastest way to receive a tax refund is to file electronically and have it direct deposited into a financial account. Refunds can be directly deposited into bank accounts, prepaid debit cards or mobile apps as long as a routing and account number is provided.

More information about reliance is available.

-

1:05:34

1:05:34

In The Litter Box w/ Jewels & Catturd

22 hours agoReturn to Sender | In the Litter Box w/ Jewels & Catturd – Ep. 740 – 2/12/2025

36.1K20 -

1:32:17

1:32:17

The Quartering

3 hours agoDOGE Storms the Department of Education, Trump FIRES USAID head, and Teacher freed from Russia

72.1K37 -

59:57

59:57

The White House

4 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Feb. 12, 2025

188K200 -

LIVE

LIVE

John Crump Live

4 hours agoBreaking Down The J6 Pardons With The J6 Pardon Project

98 watching -

1:09:47

1:09:47

Tucker Carlson

4 hours agoKen Paxton: How Soros Protects Drug Cartels, Being Blacklisted by Fox News, and the Laken Riley Act

133K105 -

LIVE

LIVE

Film Threat

8 hours agoCAPTAIN AMERICA: BRAVE NEW WORLD REVIEW (NON-SPOILER) | Hollywood on the Rocks

159 watching -

![[Ep 607] Constitutional Crisis! There Is No Proof! AAARRRGG! – Leftist Lunacy & Why It Will Fail](https://1a-1791.com/video/fwe2/bb/s8/1/3/0/u/O/30uOx.0kob-small-Ep-607-Constitutional-Crisi.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

2 hours ago[Ep 607] Constitutional Crisis! There Is No Proof! AAARRRGG! – Leftist Lunacy & Why It Will Fail

321 watching -

3:19:53

3:19:53

Right Side Broadcasting Network

6 hours agoLIVE REPLAY: White House Press Secretary Karoline Leavitt Holds a Press Briefing - 2/12/25

176K67 -

11:08

11:08

China Uncensored

2 hours agoChina Will Betray You

41.4K11 -

17:38

17:38

Silver Dragons

4 hours agoTRUMP ENDS THE PENNY - Coin Dealer on the END OF CASH! Is This Just the Start?!?

23.1K6