Premium Only Content

The biggest misconception of Life Insurance - How an IUL is an answer to this misconception!

What is The biggest misconception about Life Insurance?

How a IUL is an answer to the biggest misconception about life insurance

Life insurance is just for when you die. Most people think that it’s only about protecting their family if they die and they themselves won’t ever be able to benefit from the policy.

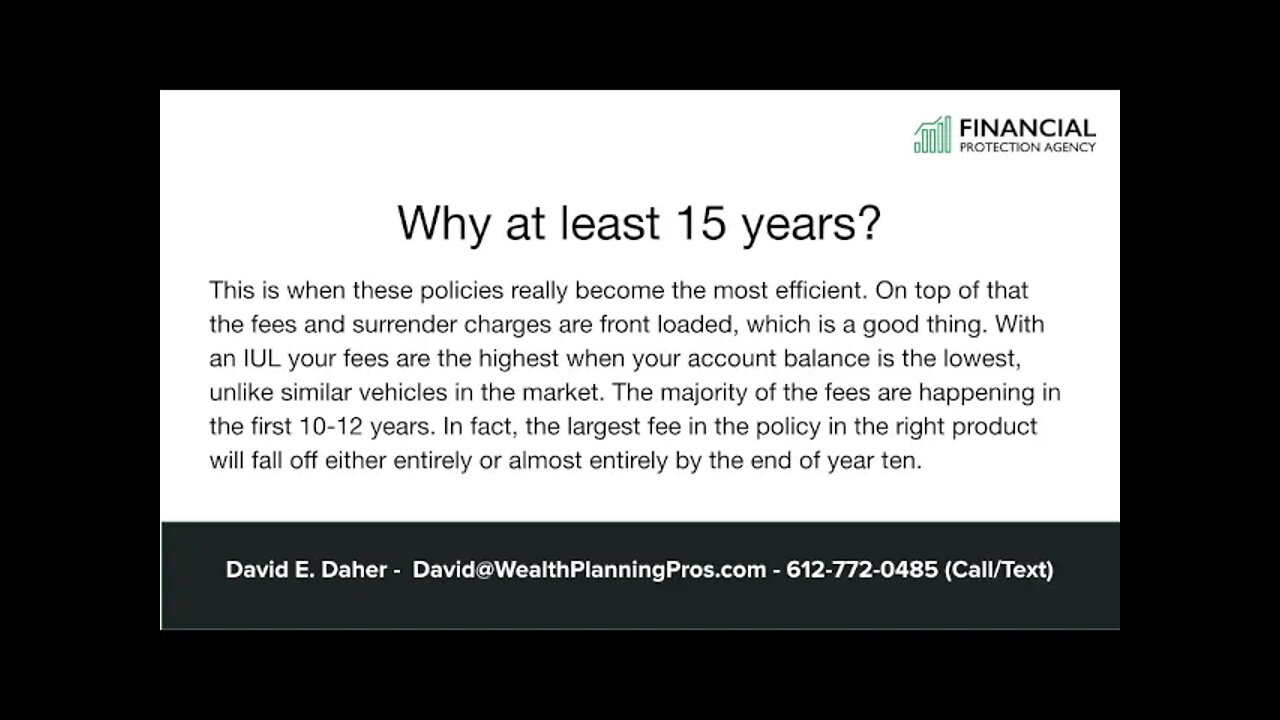

Why an IUL specifically? Because when it comes to accumulating tax free income in both a safe and effective manner, there isn’t a vehicle out there that does this better than a properly structured and maximum funded Index Universal Life Contract. I must add that a huge part of this is making sure the contract is with a well regarded carrier that has low fees, cost free distributions and a history of effective internal rates of return.

0:00 intro

1:15 Why an IUL

1:40 First two things you need to know

2:15 Long term products

2:54 Why at least 15 years

3:39 The advisor must be a specialist

4:06 End

Thanks for tuning into my video and for checking out my channel.

Don’t forget to give me a thumbs up if you like the video or found value in it.

If you haven’t done so already, please subscribe and click the notification bell so you can get my newest videos as soon as they come out.

Book a Time to chat here:

https://calendly.com/wealthplanningpr...

David Daher

Index Universal Life Specialist

Financial Protection Agency, Inc.

612-772-0485 (Call/Text)

David@WealthPlanningPros.com

-

1:14:34

1:14:34

Michael Franzese

14 hours agoWhat's Behind Biden's Shocking Death Row Pardons?

76.6K48 -

9:49

9:49

Tundra Tactical

13 hours ago $21.16 earnedThe Best Tundra Clips from 2024 Part 1.

116K11 -

1:05:19

1:05:19

Sarah Westall

13 hours agoDying to Be Thin: Ozempic & Obesity, Shedding Massive Weight Safely Using GLP-1 Receptors, Dr. Kazer

104K26 -

54:38

54:38

LFA TV

1 day agoThe Resistance Is Gone | Trumpet Daily 12.26.24 7PM EST

70.5K12 -

58:14

58:14

theDaily302

22 hours agoThe Daily 302- Tim Ballard

67.4K13 -

13:22

13:22

Stephen Gardner

15 hours ago🔥You'll NEVER Believe what Trump wants NOW!!

115K341 -

54:56

54:56

Digital Social Hour

1 day ago $11.95 earnedDOGE, Deep State, Drones & Charlie Kirk | Donald Trump Jr.

65.7K6 -

DVR

DVR

The Trish Regan Show

17 hours agoTrump‘s FCC Targets Disney CEO Bob Iger Over ABC News Alleged Misconduct

69.7K43 -

1:48:19

1:48:19

The Quartering

17 hours agoElon Calls White People Dumb, Vivek Calls American's Lazy & Why Modern Christmas Movies Suck!

150K114 -

2:08:42

2:08:42

The Dilley Show

18 hours ago $37.51 earnedH1B Visa Debate, Culture and More! w/Author Brenden Dilley 12/26/2024

128K44