Premium Only Content

How the Fed is FAILING You - with Joseph Brown, Founder of Heresy Financial @Heresy Financial

What happens when the money supply is expanding more than ever, the government is more indebted than it's ever been and interest rates are at the lowest they've ever been? Find out with Jason Hartman and the founder of Heresy Financial, Joseph Brown as they discuss this and much more!

We are seeing the largest monetary expansion in US history which has triggered some very high inflation numbers. The last two years have given the government an excuse to start monetizing a ton of government debt by printing money. This is a top down financing tool for redirecting purchasing power, instead of creating new purchasing power, and leads to a misallocation of resources due to the unlimited purchasing power at the top. This misallocation causes the destruction of wealth and will eventually lead to financial repression.

And so, the question is not a matter of if the Federal Reserve will spark a crash, but the question is when and how much before they reverse course.

Follow Joseph Brown, founder of Heresy Financial on Twitter: https://twitter.com/heresyfinancial?s=20

0:00 Introduction

0:34 Welcome Joseph Brown, founder of Heresy Financial

1:22 The Federal Reserve, tapering and rising interest rates

3:30 Injecting cash into the repo market to prevent a systemic financial collapse

4:25 Bureaucrat malevolence or incompetence?

5:55 Quantitative easing infinity, monetizing government debt

7:25 The Federal Reserve is under pressure to get inflation under control

8:20 What will happen when the Fed raises interest rates in 2022?

9:15 Not if, but when will the Fed spark an economic crash?

9:36 Will investors still want to buy real estate with higher interest rates?

12:25 Why the real estate market is different this time

14:25 Every bailout costs more and more

16:15 Long and short term interest rates and the yield curve

18:30 Stimulus checks, universal basic income, and a central bank digital currency

21:23 The Federal Reserve has become more political

22:55 A central bank digital currency is complete financial repression

24:15 Joe Brown's 2022 economic predictions

25:50 Effects of hyperinflation

28:19 People with the power will always make the decision that is most beneficial to them

28:51 Debt-to-GDP ratio and monetized debt

33:05 We have an inflationary monetary system

34:30 Follow Joseph Brown on YouTube and Twitter at Heresy Financial

Follow Jason on Twitter: https://twitter.com/JasonHartmanROI

Learn More: https://www.jasonhartman.com/

Free White Paper on The Hartman Comparison Index™: https://www.hartmanindex.com/white-paper

Listen to the podcast: https://www.jasonhartman.com/podcast/

Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com

Free Class: Easily get up to $250,000 in funding for real estate, business or anything else http://JasonHartman.com/Fund

Free Report on Pandemic Investing: https://www.PandemicInvesting.com

Jason’s TV Clips: https://vimeo.com/549444172

CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect

What do Jason’s clients say? http://JasonHartmanTestimonials.com

Call our Investment Counselors at: 1-800-HARTMAN (US) or visit www.JasonHartman.com

Guided Visualization for Investors: http://jasonhartman.com/visualization

Have questions or topics you want me to do a video on? Let us know in the comments below. If you love real estate investing, SUBSCRIBE!

#jasonhartman #heresyfinancial #realestate #federalreserve #fedtaper #inflation #moneyprinting

-

3:20

3:20

KTNV

3 years agoFinancial Focus with Steve Budin

54 -

2:58

2:58

KTNV

3 years agoFinancial Focus with Steve Budin

29 -

3:04

3:04

KTNV

3 years agoFinancial Focus with Steve Budin

8 -

3:35

3:35

KTNV

3 years agoFinancial Focus with Steve Budin

10 -

3:05

3:05

KTNV

3 years agoFinancial Focus with financial analyst Steve Budin

24 -

2:41

2:41

KTNV

3 years agoFinancial Focus with Steve Budin

13 -

1:08

1:08

SWNS

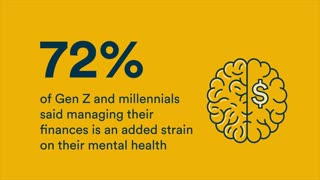

3 years agoFinancial stress may come with age

88 -

1:01:18

1:01:18

Tactical Advisor

15 hours agoBuilding a 308 AR10 Live! | Vault Room Live Stream 016

172K17 -

2:17:02

2:17:02

Tundra Tactical

1 day ago $28.36 earnedTundra Nation Live : Shawn Of S2 Armament Joins The Boys

267K28 -

23:22

23:22

MYLUNCHBREAK CHANNEL PAGE

2 days agoUnder The Necropolis - Pt 5

210K71