Premium Only Content

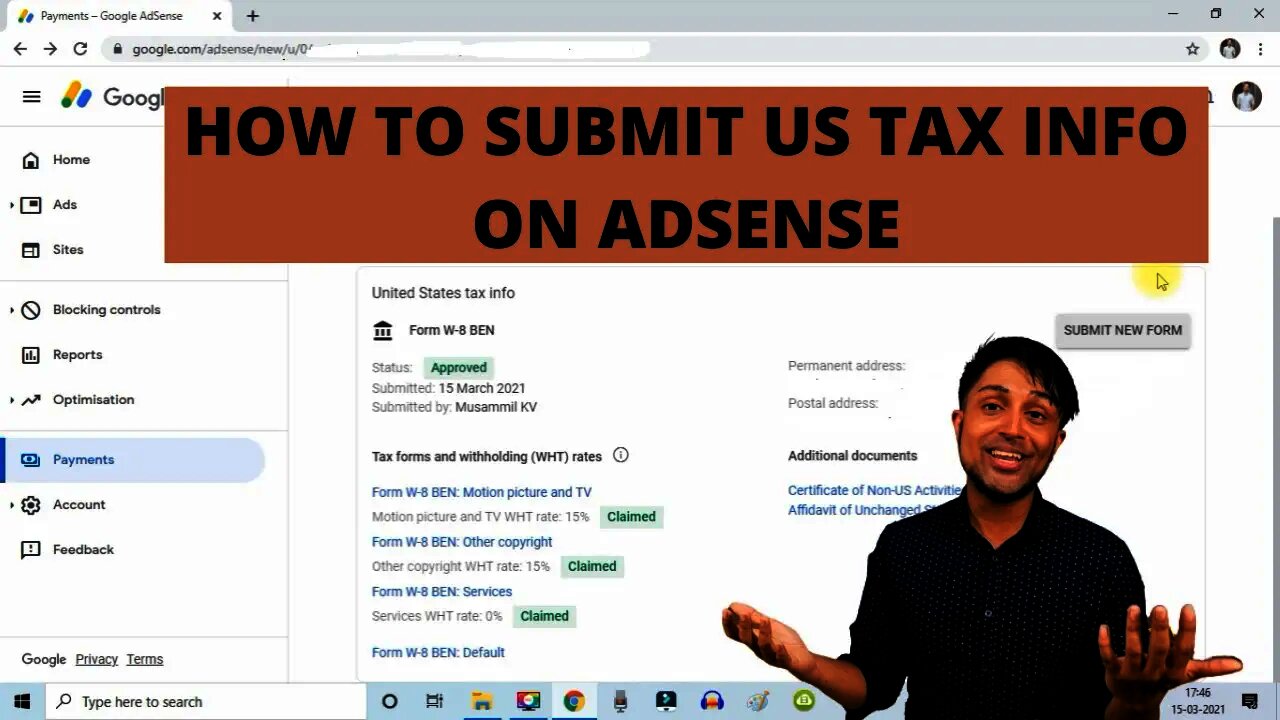

How To Submit U.S. tax info to Google AdSense To Save 24% US TAX For YouTube Creators And Bloggers

FOLLOW ME ON SOCIAL MEDIA :

Instagram : https://www.instagram.com/MuzammilVagoZz

Twitter : https://twitter.com/MuzammilVagoZz

Facebook : https://www.facebook.com/MuzammilVagoZzMVZ

WhatsApp : +917736506757

TikTok : https://www.tiktok.com/@muzammilvagozz

---------------------------------------------------------------------------------------------

You may see a message 'Important: Creators outside of the U.S., prepare to submit your tax information in AdSense to ensure potential taxes on your earnings are accurate' on your YouTube creator studio

YouTube is set to start deducting taxes from creators outside of US on the earnings they generate from viewers in the US. The new policy will begin from as early as June 2021, the Google-owned company said in an email to creators. YouTube has also asked creators to submit their tax information in AdSense “to determine the correct amount of taxes to deduct”. The changes apply to all creators outside of the US, including the ones in India. However, there won't be any similar tax deduction for creators living in the US.

In a support page, YouTube said that its parent company Google has the responsibility under Chapter 3 of the US Internal Revenue Code to collect tax information, withhold taxes, and report to the Internal Revenue Service when a creator earned royalty revenue from viewers in the US. This has resulted in the implementation of the new tax requirements for YouTube earnings.

“If any tax deductions apply, Google will withhold taxes on YouTube earnings from viewers in the US from ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships,” the company in its support page.

YouTube has informed creators about the update and has asked them to provide their tax information in their AdSense account as early as possible. If a creator isn't able to provide the information by May 31, the company said that it might need to deduct up to 24 percent of their total earnings worldwide.

However, if a creator has provided their tax information, there will be a withholding between 0–30 percent on the earnings they generate from viewers in the US. The withholding rates notably depend on whether the country of the creator has a tax treaty relationship with the US. This means that there will be variation in the deduction of taxes for creators in different countries.

so in this video i am going to show you how you can properly fill us ta info on adsense

#ustaxinfo #ustax #youtubecreators #googleadsense #adsense

CHECK OUT MY ALL YOUTUBE CHANNELS

Muzammil VagoZz REACTIONS : https://www.youtube.com/channel/UC3K_3zWRRNswXPNi-CpbfSA

Muzammil VagoZz GAMING : https://www.youtube.com/channel/UCS_LiEzBh6ropYO_EmWoH2A

Muzammil VagoZz TRICKS : https://www.youtube.com/channel/UCsdVeTPrQ4sSZ9hU9EjOuJA

Muzammil VagoZz VLOGS : https://www.youtube.com/channel/UC1Ot47ruk5-7zY3t-rZrMhA

Muzammil VagoZz TALKS :https://www.youtube.com/channel/UCuTu3tni732PBQaVh_Oswkw

-

0:54

0:54

CANUCK TV AND RADIO

3 years agoMY FIRST GOOGLE ADSENSE CHEQUE

52 -

4:15

4:15

FlowaPowa

3 years agoGoogle Forms: How to Submit a PHOTO as an Answer

4 -

3:29

3:29

YouTube Video Ads Academy The Definitive YouTube Ad Course

3 years agoLinking YouTube Channel To Google Ads Account

44 -

UPCOMING

UPCOMING

Leonardaisfunny

1 hour agoH-1b Visas: Infinity Indians

143 -

58:04

58:04

Kimberly Guilfoyle

4 hours agoFBI's Terror Response Failures, Live with Steve Friend & Kyle Seraphin | Ep. 185

65.6K34 -

2:15:01

2:15:01

WeAreChange

4 hours agoMassive Developments In Vegas Investigation! UNREAL DETONATION, Shocking Details Emerge!

66.9K13 -

DVR

DVR

LFA TV

11 hours ago2025 Is Off to a Violent Start | TRUMPET DAILY 1.2.25 7pm

5.71K -

LIVE

LIVE

theDaily302

10 hours agoThe Daily 302- JJ Carrell

480 watching -

2:57

2:57

EvenOut

1 day ago $0.66 earnedTHE TELEPORTING PORTA POTTY TWIN RPANK!

12.3K -

1:02:55

1:02:55

In The Litter Box w/ Jewels & Catturd

23 hours agoAmerica Is Under Attack! | In the Litter Box w/ Jewels & Catturd – Ep. 711 – 1/02/2025

78.5K107