Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Offer In Compromise Time Frame - Here's How Long An IRS Offer In Compromise Takes, Most Of The Time

3 years ago

3

It can change quite a bit, but on average from our cases:

Wage Earners with simpler financials: 5-9 months

Self-employed Individuals: 7 months to 1.5 years

Now, these time frames might go up or down, but the IRS technically needs to respond within 2 years. Yes, there are some cases that go really close to that 2-year mark and if an appeal is required, maybe even longer.

That's a reason to look out at the billing practices of the tax firm you hire. Sometimes endless monthly fees can drag on while the IRS is just sitting on your case. During that time, nobody is doing any work on it from the tax firm's end.

Loading comments...

-

9:13

9:13

TaxResolutionProfessionals

3 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

6:43

6:43

TaxResolutionProfessionals

3 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

4:16

4:16

TaxResolutionProfessionals

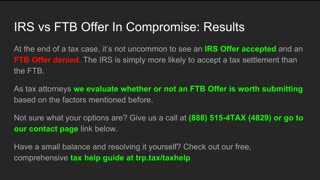

3 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

1:33

1:33

TaxResolutionProfessionals

3 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

31 -

10:56

10:56

LifeAdventuresWithCam

3 years agoPerfection takes time

22 -

20:56

20:56

marcushouse

9 hours ago $2.33 earnedStarship Flight Test 9 Vehicles FINALLY Prepare, and Huge Starbase Upgrades – It's All Happening!

39.1K17 -

23:48

23:48

CatfishedOnline

23 hours agoVictim's Life is Threatened After He Gets in Too Deep With a Crypto Scammer

36.4K6 -

8:40

8:40

Shea Whitney

10 hours ago $2.02 earned12 Fashion Mistakes Making You Look OLD & OUTDATED!

29.5K11 -

29:18

29:18

TampaAerialMedia

11 hours ago $0.82 earnedUpdate SARASOTA, FL 2025 - St Armands, Lido, & Longboat Key

19.6K2 -

15:52

15:52

ARFCOM Reviews

1 day ago $0.74 earnedNew Entry Level RDS | Primary Arms MD 21 GLx/SLx

18.3K3