Premium Only Content

Income Averaging For IRS Offer In Compromise - How It Works, Using It To Your Advantage

Here we go through #IRS Offer In Compromise income and expense averaging. This guide is based on the information located here: https://www.irs.gov/irm/part5/irm_05-008-005r

Things change or might be inconsistent, especially for self-employed taxpayers.

This topic often is not covered in many tax relief consultations, because quite simply many tax relief salespeople (often referred to as Tax Consultants, but are typically not licensed) don't know about it, but it's crucial to your success in many OICs.

You can find our completely free tax help guide here: https://trp.tax/taxhelp/

Our guide on how to do your own OIC here: https://trp.tax/tax-guide/how-to-do-your-own-offer-in-compromise/

Comparing Bankruptcy vs Offer In Compromise: https://trp.tax/tax-guide/bankruptcy-or-offer-in-compromise/

You can get help from one of our expert tax attorneys by calling us at (888) 515-4829 or scheduling a consultation at https://trp.tax/start/

-

9:13

9:13

TaxResolutionProfessionals

3 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

6:43

6:43

TaxResolutionProfessionals

3 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

4:16

4:16

TaxResolutionProfessionals

3 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

28 -

10:59

10:59

Generate Income Online Using Facebook Ads

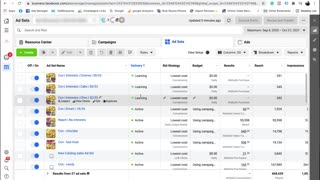

3 years agoHow To Generate Income Online Using Facebook Ads | Video #48 Understand Your Stats

46 -

12:10

12:10

Generate Income Online Using Facebook Ads

3 years agoHow To Generate Income Online Using Facebook Ads | Video #26 Naming Your Campaigns

71 -

1:27:43

1:27:43

Graham Allen

6 hours agoJoe Rogan Warns The World About WWIII! Make Military Great Again! + Elon Is Buying MSNBC?!

105K137 -

1:20:46

1:20:46

Caleb Hammer

3 hours agoEntitled Gen-Z Girl Uses Payday Loans To Party | Financial Audit

27.8K5 -

2:02:54

2:02:54

LFA TV

14 hours agoBUSTED! UKRAINE $$ LAUNDERING! | LIVE FROM AMERICA 11.25.24 11am EST

57.2K18 -

LIVE

LIVE

LumpyPotatoX2

1 day agoGrayZone Warfare: NightOp - #RumbleGaming

278 watching -

2:24:06

2:24:06

Matt Kohrs

15 hours agoStocks Pump Higher (RUM, MSTR & TSLA) || The MK Show

49.6K2