Premium Only Content

Why you SHOULD NOT File ALL Your Unfiled IRS Tax Returns - The Answers

Here are the main reasons you should not file all unfiled tax returns:

1 - The IRS already did it for you and the results are good. If you were single and a W2, likely the result is the same. They might have filed a lower balance than you really owed. They might have a high balance, but you owe on other tax years and plan on filing an Offer in Compromise anyway.

2 - They are not looking for it. Some old IRS returns the IRS has skipped and does not care about them anymore.

3 - Statute of Limitations. The IRS did the tax return for you, and the debt will expire soon.

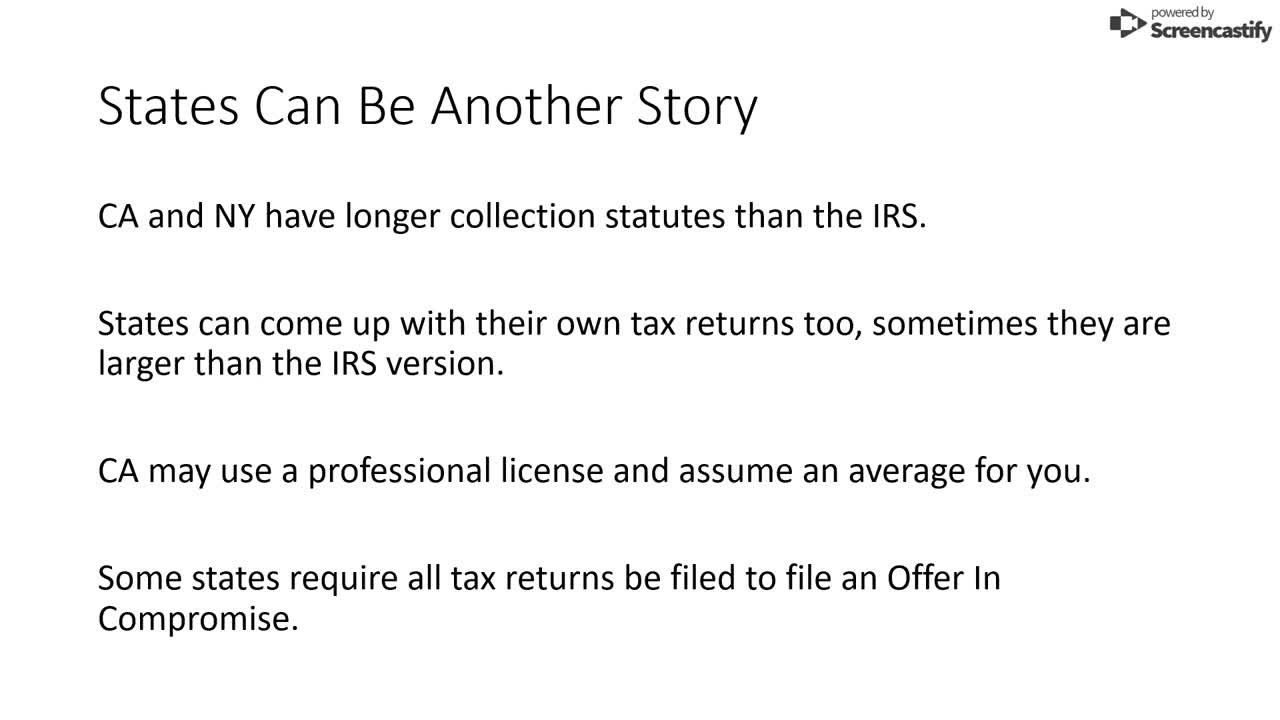

The above does not always apply to states. States come up with their own returns that may differ and have different statutes of limitations. Some require you to file all tax returns to get an Offer in Compromise.

For the written version of this guide, see here:

https://trp.tax/unfiled-tax-help/

See our complete do it yourself tax help guide at https://trp.tax/tax-help/

This information is not legal advice, just our attempt to give out as much free data as possible to help those that cannot afford a tax attorney and anyone to better understand the process. Consult with a tax attorney for your best options and legal advice.

If you owe more than $20,000 to the IRS or state, give us a call at (888) 515-4829 (4TAX) or visit us at https://trp.tax/contact-us/

We offer a free 15-minute consultation with one of our experienced tax attorneys.

-

0:56

0:56

Inspirational and motivation for today

3 years agoWhy you should not trust your understanding alone

61 -

0:49

0:49

Inspirational and motivation for today

3 years agoWhy your feelings should not be in charge

92 -

6:47

6:47

CigarObsession

3 years agoHow Often Should You Rotate Your Cigars?

87 -

0:40

0:40

leraning

3 years agoHow often should you change your password?

49 -

38:07

38:07

Michael Franzese

11 hours agoLeaving Organized Crime and Uncovering Mob in Politics: Tudor Dixon and Michael Franzese

91.6K15 -

2:42:54

2:42:54

Jewels Jones Live ®

2 days agoAMERICA IS BACK | A Political Rendezvous - Ep. 111

73.1K48 -

8:47:33

8:47:33

Due Dissidence

1 day agoLIVE: Workers Strike Back Conference ft. Chris Hedges, Jill Stein, Kshama Sawant, and More!

113K57 -

8:36:37

8:36:37

Right Side Broadcasting Network

5 days agoLIVE REPLAY: CPAC 2025 Day Three with President Donald J. Trump - 2/22/25

455K101 -

1:05:34

1:05:34

The Big Mig™

19 hours agoConfirmed Kash Patel New FBI Director, Bring On The Pain |EP483

108K31 -

53:59

53:59

Tactical Advisor

15 hours agoThe Vault Room Podcast 009 | Everyone Getting $5000?!

85.6K12