Premium Only Content

Tips for Veterans Buying a Home with VA Loan

Tips for Veterans Buying a Home with VA Loan

For veterans or service members looking to buy a home with a Veterans Affairs loan, there are some extra steps to take and home condition requirements that aren’t needed with other types of loans.

The home must be safe, clean, in good condition and move-in ready, partly because the U.S. Department of Veterans Affairs doesn’t want to back a loan where the military member’s finances are at risk because they have to make unexpected home repairs.

The extra work can be worthwhile. VA loans are 0.25 to 0.50 percent lower than conventional loans, don’t require a down payment or mortgage insurance, and have more flexible and forgiving requirements. Closing costs are limited and lenders fees are limited to 1 percent of the loan amount.

The government guarantees at least a quarter of the loan amount on a VA mortgage, which is why a down payment and mortgage insurance aren’t needed.

For buyers who qualify, here are some things to be aware of when buying a home with a VA loan:

Look for a move-in ready home. Homes that are structurally sound, safe and sanitary are more likely to pass the VA appraisal. The property must have adequate heating, roofing and safety features, and major issues must be repaired before the loan can close. If the VA expert has to return to reinspect something that needs to be fixed, the borrower will have to pay more inspection fees.

Be ready for an inspection. A home inspection is a normal part of buying a house, but a VA inspector will make sure the property is in good, working order. But a lot of the things they’ll be looking at are cosmetic, which a regular lender wouldn’t be concerned with. Though a VA inspection can sound like a professional home inspection, it isn’t and buyers can hire their own inspectors after the VA one if they’d like.

And more inspections. The VA also requires some inspections that other lenders don’t. A VA loan will require a pest inspection, along with a look at the septic tank, if there is one, and the water well if the property isn’t on a city water line.

Quicker timeline. VA loans have tighter timelines than other types of loans, which is why hiring a real estate agent and loan officer who have experience with VA loans can make the process smoother. Active-duty service members can have short buying windows if they’re ordered to move to another base.

The information in this video is for informational us only. Please contact me or another Real Estate professional for you exact criteria.

If you have a question please that you think would make a great Quick tip please submit your question via text to 352- 242 7711 or email your question to oliver@redmanpg.com

-

3:18

3:18

Sold By Oliver Thorpe

3 years agoTips for Veterans Buying a Home with VA Loan

62 -

4:35

4:35

KNXV

3 years agoTIPS: Buying and selling a home with Opendoor

12 -

4:35

4:35

KNXV

3 years agoBuying and selling a home with Opendoor this fall

8 -

1:56

1:56

WKBW

3 years agoVeterans use photography to cope with returning home

3 -

3:36

3:36

The Ramsey Show Highlights

3 years agoWhy Buying A Home With Your Friend Is A Bad Idea!

1.23K10 -

6:10

6:10

KERO

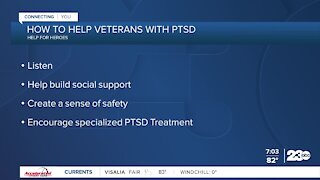

3 years agoVeterans struggle with mental health

82 -

10:50

10:50

Erica Parker Now

3 years ago3 Stages of the Loan Process: Stage 1 The Preapproval Process | Home Buying Tips 2021

44 -

3:57

3:57

Selling Boston & the Burbs by Jeffrey Chubb

3 years ago1st Step when Buying a Home

57 -

3:15

3:15

WKBW

3 years agoProgram for veterans to connect with service dogs

6 -

0:41

0:41

KTNV

3 years agoHome buying tips for current sellers market

12