Premium Only Content

Congress Coming After Your IRA, Income, Estate, Crypto, Child Tax Credits

Bill Wilkins, Certified Financial Planner Practitioner TM of 29 years discusses how your IRA, Income, Corporate Income, Estate, Crypto, Child Tax Credits could be impacted by the Build Back Better Plan being voted on.

Write your Representatives about your concerns:

https://www.house.gov/representatives/find-your-representative

https://www.senate.gov/senators/senators-contact.htm

If you are getting value from our podcasts and would like to support us, You can now buy us a cup of coffee! @ https://www.buymeacoffee.com/PursuingTheBest . And or Please share the video with others who you think might find it valuable.

If you are interested in complimentary financial planning that strives to help you achieve the life you desire sooner than later, please click this link https://www.rightcapital.com/sign-up?referral=5BQAHbDZtiChIDBrOLmUxw&type=client

You can also call us at 513-641-6307

After you enter in the basic profile data above we will get in contact with you to discuss a time to meet. We provide up to 30 minutes of complimentary planning.

Financial Planning Services after the first complimentary session are as follows:

1) Do it yourselfers can continue to use our financial and investment planning software for just $15.99 a month, Cancel anytime. See how adjusting your budget monthly, retirement age, social security start dates, downsizing or upsizing your home, private schooling for kids vs not, pool purchase, landscaping, remodeling etc....impacts your long term lifestyle from daily living to taxes to estate planning etc... Track your investments all in one location. Track your bank account and credit card transactions all in one location. After a year of using the software we do provide an additional 30 minutes of consultation. This does not include asset management or specific investment recommendations.

2) Hourly Consulting Fee beyond upfront complimentary planning. Minimum $200 for a half hour, $100 for each 15 minutes after that (Includes use of our software for 12 months.) This involves no money management.

3) Full Discretionary Asset Management, Financial Planning engagement. Fee is based on asset size. We do everything for you, includes build and monitor your financial plan, investment planning, recommendations and discretionary management, research, meetings with your CPA, Attorney, family, trading, access to our software, money movement back and forth to your bank when needed, beneficiary updates, provide necessary tax reporting forms and more etc.... Fees are based on asset size under management with an overall minimum of $500 per year.

Thank you so much for watching, If you feel like others would benefit from this video please share and subscribe to our channel via the green buttons above. Also Smash the Boxing Glove Icon at the bottom to help the video get noticed!

If you are getting value from our podcasts and would like to support us, You can now buy us a cup of coffee! @ https://www.buymeacoffee.com/PursuingTheBest .

We thank you so much for any support whether it’s Smashing Boxing Glove, Hitting The Like Button, Watching our videos or being a client! 😎

Standard & Poors/Dow Jones References to index reports are sourced from the link below. https://urldefense.com/v3/__https://www.spindices.com/spiva/*/reports/regions__;Iw!!Cz2fjcuE!z8AXD28-PQ_Xr3q4LiseOdIID0XvDdtT0YwkanPK-1S6tcGGYsmC_t3_Zhni_NYc-mM$

The content in any of Wilkins Wealth Management Group's Videos should not be construed as tax, legal, insurance, engineering, construction, health & safety, electrical, construction, financial advice or other and may be outdated or inaccurate, it is your responsibility to verify all information to practice all safety precautions, consult your attorney, your CPA, financial advisor etc... before acting on any information in this video. Please see important disclosures at the end of each video as well.

• Securities and advisory services offered through LPL Financial, a registered investment advisor.

• Third party posts found on this profile do not reflect the views of LPL Financial and have not been reviewed by LPL Financial as to accuracy or completeness.

• The financial professionals associated with Wilkins Wealth Management Group LLC may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state unless you reach out to us first and we get licensed to help you.

• We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Securities and Advisory services offered through LPL Financial. A Registered Investment Advisor. Member FINRA / SIPC. https://www.sipc.org/ https://brokercheck.finra.org/

LPL Financial representatives associated with this website may discuss and/or transact securities business only with residents of the following states: AZ,CA,DE,FL,GA,IL,KY,MS,NC,OH,PA,SC,TN,TX,VA,WA.

• Our Compliance department requires comments to be disabled.

BILL WILKINS CFP®, CEO

*Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of 2016-2017 Five Star Wealth Managers.

Bill Wilkins, President of Wilkins Wealth Management Group, LLC, has over 29 years in the Financial Services Industry. He graduated from the University of Dayton in 1990 with a Bachelor of Science degree in Business Administration and a Major in Finance.

*Bill recently was recognized with the 5 Star Manager Award in Cincinnati Magazine, July 2016. Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience, and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of 2016 Five Star Wealth Managers.

Bill obtained his CERTIFIED FINANCIAL PLANNER™ designation in 1999 from the College for Financial Planning in Denver, CO. Even though Bill has worked for such financial firms as Fidelity and Merrill Lynch, Bill felt he could serve his clients more objectively by joining the #1 Independent Broker/Dealer in the country*, LPL Financial. By utilizing LPL Financial's Platform, Bill has been able to provide completely objective advice and gain access to some of the most comprehensive, nonproprietary investments and insurance products in the industry. Bill resides in Mason, OH with his wife of 26 years, Susan, and two children.

The CERTIFIED FINANCIAL PLANNER™ designation is recognized as the standard of excellence for personal financial planning. Bill is required to renew his certification every 2 years by completing 30 hours of continuing education. As a Certified Financial Planner™ Board Designee, Bill is bound by the CFP Code of Ethics Principles. The second principle, Objectivity, requires honesty and impartiality which, Bill believes can be best achieved through LPL Financial's Independent Advisor Platform.

-

3:17

3:17

WFTS

3 years agoHow to make the most of your child tax credits

8 -

2:18

2:18

WKBW

3 years agoChild Tax Credits: Impact on Families

13 -

1:30

1:30

KGTV

3 years agoChild Tax Credits going out

14 -

2:37

2:37

WKBW

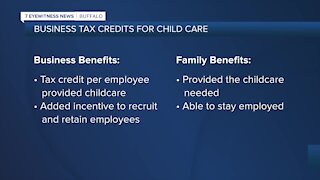

3 years agoChild Tax Credits: The Impact on Businesses

11 -

2:17

2:17

KNXV

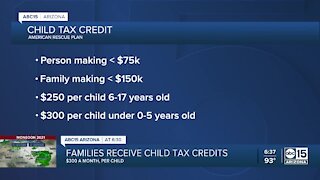

3 years agoFamilies starting to receive child tax credits

24 -

26:52

26:52

Investor Guys Podcast

3 years agoLow Income and Tax Credits

297 -

13:39

13:39

WPTV

3 years agoFacebook Q&A: Child tax credits

7 -

55:56

55:56

Grant Stinchfield

1 hour agoWhat Happened to the Mystery Drones? They Don't Just Disappear, or do They?

1.41K -

LIVE

LIVE

Flyover Conservatives

12 hours agoThe Medical Industry’s Dark Secret—What They Don’t Want Pregnant Women to Know! - Dr. James Thorp | FOC Show

812 watching -

1:01:32

1:01:32

Standpoint with Gabe Groisman

2 days agoThe War on Israel: Yair Netanyahu Tells All

16.6K5