Premium Only Content

Comunale v. Traders & General Ins. Co

See the full video and full text of the case of the California supreme court in Comunale v. Traders & General Ins. Co. (1958) 50 Cal.2d 654, 328 P.2d 198, held the insurer liable for amounts over the policy limit because of its wrongful refusal to settle the underlying action. The opinion distinguishes the consequences of a wrongful refusal to settle and a wrongful refusal to defend, pointing out that as to the latter, the liability of the insurer is ordinarily limited to the amount of the policy plus attorneys' fees and costs.

Mr. and Mrs. Comunale were struck in a marked pedestrian crosswalk by a truck driven by Percy Sloan. Mr. Comunale was seriously injured, and his wife suffered minor injuries. Sloan was insured by defendant Traders & General Insurance Company under a policy that contained limits of liability in the sum of $10,000 for each person injured and $20,000 for each accident. He notified Traders of the accident and was told that the policy did not provide coverage because he was driving a truck that did not belong to him. When the Comunales filed suit against Sloan, Traders refused to defend the action, and Sloan employed competent counsel to represent him. On the second day of the trial Sloan informed Traders that the Comunales would compromise the case for $4,000, that he did not have enough money to effect the settlement, and that it was highly probable the jury would return a verdict in excess of the policy limits. Traders was obligated to defend any personal injury suit covered by the policy, but it was given the right to make such settlement as it might deem expedient. Sloan demanded that Traders assume the defense and settlement of the case. Traders refused, and the trial proceeded to judgment in favor of Mr. Comunale for $25,000 and Mrs. Comunale for $1,250.

The decisive factor in fixing the extent of Traders' liability is not the refusal to defend; it is the refusal to accept an offer of settlement within the policy limits. Where there is no opportunity to compromise the claim and the only wrongful act of the insurer is the refusal to defend, the liability of the insurer is ordinarily limited to the amount of the policy plus attorneys' fees and costs.

Comunale v. Traders & General Ins. Co., 328 P.2d 198, 50 Cal.2d 654, 68 A.L.R.2d 883 (Cal. 1958)

The Video covers the full text of the California Supreme Court decision.

ZALMA OPINION

This is the first case that created the tort of bad faith and allowed a person to obtain both contract and tort damages as a result of a bad faith refusal to defend and or settle a claim within policy limits. It us imperative that everyone interested in insurance claims know the full text of the case that started the creation of the tort of bad faith.

© 2021 – Barry Zalma

Barry Zalma, Esq., CFE, now limits his practice to service as an insurance consultant specializing in insurance coverage, insurance claims handling, insurance bad faith and insurance fraud almost equally for insurers and policyholders.

He also serves as an arbitrator or mediator for insurance related disputes. He practiced law in California for more than 44 years as an insurance coverage and claims handling lawyer and more than 54 years in the insurance business.

He is available at http://www.zalma.com and zalma@zalma.com. Mr. Zalma is the first recipient of the first annual Claims Magazine/ACE Legend Award. Over the last 53 years Barry Zalma has dedicated his life to insurance, insurance claims and the need to defeat insurance fraud. He has created the following library of books and other materials to make it possible for insurers and their claims staff to become insurance claims professionals.

Go to the podcast Zalma On Insurance at https://anchor.fm/barry-zalma; Follow Mr. Zalma on Twitter at https://twitter.com/bzalma; Go to Barry Zalma videos at Rumble.com at https://rumble.com/c/c-262921; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – https://zalma.com/blog/insurance-claims-library/ The last two issues of ZIFL are available at https://zalma.com/zalmas-insurance-fraud-letter-2/ podcast now available at https://podcasts.apple.com/us/podcast/zalma-on-insurance/id1509583809?uo=4

-

7:40

7:40

Barry Zalma, Inc. on Insurance Law

9 months agoLoss of Inventory by Bankruptcy

131 -

2:54

2:54

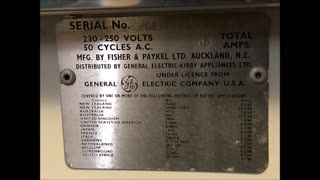

The Home Appliance Channel

3 years agoGeneral Electric Clothes Dryer

44 -

2:15

2:15

The Home Appliance Channel

3 years ago $0.01 earnedGeneral Electric Vintage Reflector Toaster

54 -

1:57:39

1:57:39

Glenn Greenwald

10 hours agoDems & Media Still Blaming Everyone But Themselves, Especially Voters; Trump Bans Pompeo & Haley, Appoints Stefanik: What Does This Reveal About Next Admin? | SYSTEM UPDATE #364

182K112 -

30:27

30:27

Stephen Gardner

7 hours ago🔥No FREAKING way! Trump makes BEST Decision of Presidency!

113K322 -

1:15:22

1:15:22

Donald Trump Jr.

13 hours agoDelivering the Day One Agenda: No More Neocons, Plus Interview with Charlie Kirk | TRIGGERED Ep.190

198K431 -

1:25:15

1:25:15

Flyover Conservatives

13 hours agoNailed It! Man Who Predicted all 56 Races Perfectly Explains Why Trump Won 2024! - Capt. Seth Keshel; Trump Wins: What’s Next for the U.S. Economy and Markets? - Dr. Kirk Elliott | FOC Show

52.6K4 -

54:55

54:55

LFA TV

1 day agoTrump Cleans House | Trumpet Daily 11.11.24 9PM EST

39.6K6 -

1:51:17

1:51:17

We Like Shooting

17 hours ago $8.74 earnedWe Like Shooting 584 (Gun Podcast)

35.6K2 -

1:44:03

1:44:03

State of the Second Podcast

5 days agoColt INVENTED What? Historic Firearms Brought To Life (ft. Candrsenal)

29.9K3