Premium Only Content

Daily Stock Analysis– Mortgage-backed REITs, high dividends, and potential perils

REITs or real estate investment trusts have been around since 1960. REITs allow investors to invest in real estate without direct ownership. This investment vehicle can be simple or incredibly complicated. Many people are attracted to the high current dividends. There can also be an illusion of safety because the mortgages used in some REITs are back by the US Government. In today's show, I discuss the opportunities REITs offer. Plus, I discuss the downside too. Investors can learn a lot from the market crash in mortgage-backed REITs that began with the Coronavirus market crash between February and March of 2020. Some mREITs have not rebounded. That is what I am talking about today on the Daily Stock Analysis.

Today's discussion includes Annaly Capital Management, Starwood Property Trust, AGNC Investment Corp., Two Harbors Investment, and PennyMac Mortgage Investment Trust.

Listen, learn, subscribe to join in the conversation. Leave a comment and let me know what you think. #investing #realestate #housing

The sponsor of today's program is Richards Financial Planning. Have you ever heard anyone say, "I regret sorting out my finances"? That's because no one ever says that! You Can Control Your Financial Future. A Financial Plan Can Ease Your Frustration. Visit https://richardsfinancialplanning.com/ to learn more.

One last point from our second sponsor, Advice4LifeInsurance.com. If you need life insurance, you can find the best life insurance at the lowest price in less than five minutes. Visit their website at https://www.advice4lifeinsurance.com

This information is for educational purposes only. Not an offer to buy or sell any stock or an offer of advice.

There are limits to the information provided. At the end of the video, please read the disclosure. Or at the end of the podcast, please listen to the disclosure for Richards Financial Planning, LLC.

References from today's show:

Mortgage Firm Struggles to Meet Margin Calls as Market Turmoil Continues https://www.wsj.com/articles/mortgage-firm-struggles-to-meet-margin-calls-as-market-turmoil-continues-11584975633

Mortgage REITs Come Under Stress That Even the Fed Might Not Be Able to Ease

https://www.barrons.com/articles/target-stock-is-climbing-after-it-reported-another-banner-quarter-for-earnings-51614694528

Basics of Fannie Mae Single-Family MBS https://capitalmarkets.fanniemae.com/media/4271/display

Freddie Mac—Federal Home Loan Mortgage Corp. (FHLMC) https://www.investopedia.com/terms/f/freddiemac.asp

The Inverse Relationship Between Interest Rates and Bond Prices https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/

Two Harbors Investments Corp. Fourth Quarter 2020 Earnings Call https://s24.q4cdn.com/261832436/files/doc_financials/2020/q4/TWO-Q4-2020-Earnings-Call-Presentation-Final.pdf

How Risky Is AGNC Investment Corp.'s Dividend? https://www.fool.com/investing/2021/02/17/how-risky-is-agnc-investment-corps-dividend/#:~:text=AGNC%20cut%20its%20monthly%20payout%20from%20$0.15%20per,conference%20call%20that%20the%20dividend%20cut%20was%20%22unnecessary.%22

Capital Destruction, Inc. A look at mortgage REITs. https://www.morningstar.com/articles/641458/capital-destruction-inc

Two Harbors Investment Sees Unusually Large Options Volume https://www.marketbeat.com/instant-alerts/nyse-two-options-data-report-2021-02/

Commercial Properties' Ability to Repay Mortgages Was Overstated, Study Finds https://www.wsj.com/articles/commercial-properties-ability-to-repay-mortgages-was-overstated-study-finds-11597152211

-

2:18

2:18

OLDSCHOOLSTOCKPICKER

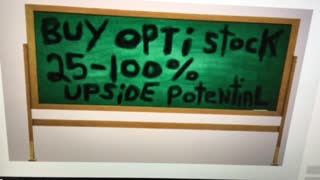

3 years agoOPTI STOCK 25%--50% UPSIDE POTENTIAL

731 -

2:42

2:42

OLDSCHOOLSTOCKPICKER

3 years agoOPTI STOCK 25%--100% UPSIDE POTENTIAL

77 -

2:51

2:51

ChartAction

3 years ago $0.05 earnedPLTR Stock Analysis Watching the Daily 9 Moving Average

150 -

13:06

13:06

Kurt's Religion and Politics

3 years ago $0.01 earned20210201 The Stock Market - The Daily Summation

24 -

4:06

4:06

VideosByVicky

4 years ago $0.01 earnedStock Trading Diary Day 21 – Setting daily goals

61 -

24:13

24:13

Energy News Beat Podcast

3 years ago $0.01 earnedEnergy News Beat 1/19/2020 - Stock Market Daily Update

84 -

12:20

12:20

Kurt's Religion and Politics

4 years ago20201027 High Earners - The Daily Summation

13 -

1:12

1:12

CoachCalloway.com

3 years agoPotential or Limitations?

69 -

10:02

10:02

MichaelBisping

12 hours agoBISPING: "Was FURY ROBBED?!" | Oleksandr Usyk vs Tyson Fury 2 INSTANT REACTION

2383 -

8:08

8:08

Guns & Gadgets 2nd Amendment News

2 days ago16 States Join Forces To Sue Firearm Manufacturers Out of Business - 1st Target = GLOCK

50.9K48