Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

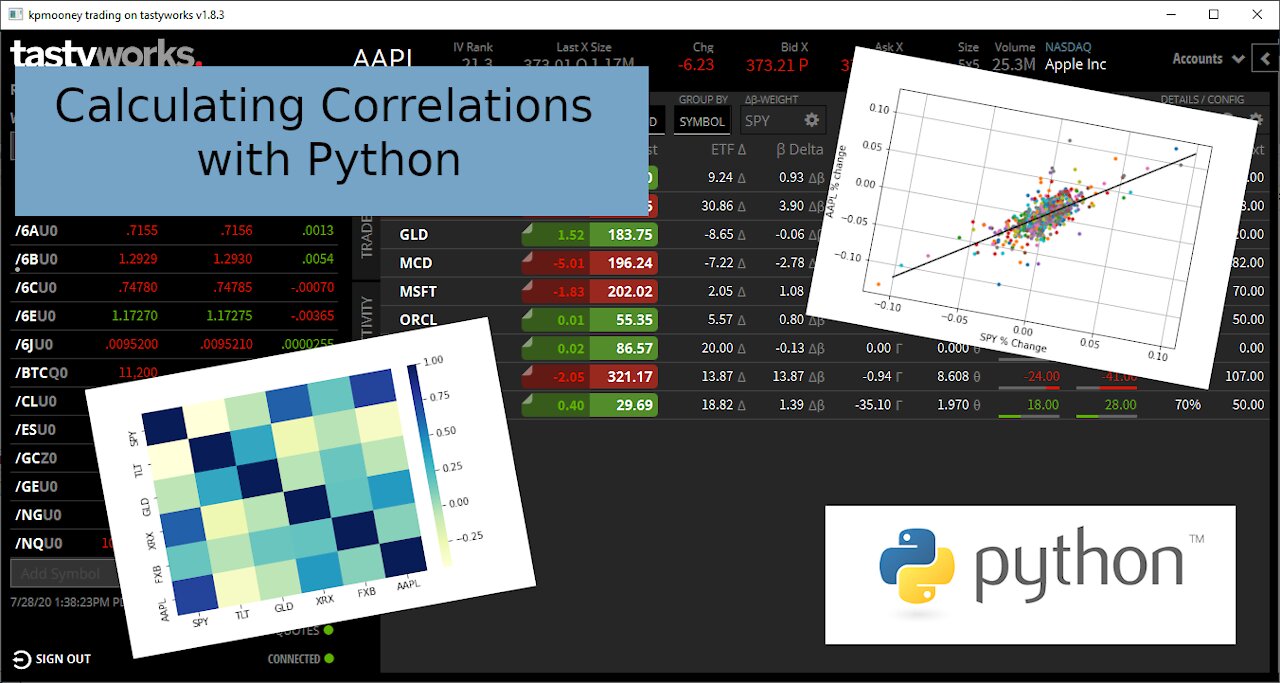

Calculating the Correlations Between Stocks Using Python

3 years ago

53

In the previous video, we looked at beta-weighting our deltas to a particular index, the SPY in that case. In addition to beta-weighting, it is also important to look at the correlations between underlyings to get a sense of how valid that beta number is. It is also useful to see if we are overweighting our portfolios to a specific underlying or sector. In this video, I will show a simple way to calculate the correlation between stocks using Python.

Beta-weighted Deltas: https://youtu.be/PNnOCKHJh8U

Github: https://github.com/kpmooney/numerical_methods_youtube/tree/master/correlation

Tip Jar: http://paypal.me/kpmooney

Loading comments...

-

21:36

21:36

kpmooney

4 years agoCalculating Implied Volatility from an Option Price Using Python

104 -

11:24

11:24

kpmooney

4 years agoCalculating the Implied Volatility of a Put Option Using Python

9 -

7:52

7:52

monsterMatt

4 years agoPython Importing and Using Classes

175 -

12:34

12:34

kpmooney

3 years ago $0.01 earnedCalculating Probability of Making 50% of Max Profit on a Short Strangle Using Python

45 -

26:10

26:10

kpmooney

3 years agoCalculating Option Greeks Using a Spreadsheet (or Python)

26 -

2:22

2:22

Age of Discovery

3 years ago $0.01 earnedUsing Python and Notepad++ for Reality Programming

172 -

4:56

4:56

monsterMatt

4 years agoImporting and Using Custom Classes in Python

111 -

15:12

15:12

kpmooney

3 years agoCalculating Simple Statistics with Python and Pandas: Stock Market Data

51 -

10:12

10:12

kpmooney

3 years agoCandlestick Charts and Technical Studies Using Python and mplfinance

28 -

18:24

18:24

kpmooney

4 years agoProbability of a Touch in Finance using Python Monte Carlo Methods

37