Premium Only Content

So, You're Nostalgic for the 1950s?

Out-of-wedlock birth rate

https://www.youtube.com/watch?v=p5pWdKMB4mE (11:05-15:39 see also links under “Out-of-wedlock births”)

Federal Spending Per Capita, adjusted for inflation

https://www.youtube.com/watch?v=Usc42LN3w4E

National Debt, Federal Debt Per Capita, adjusted for inflation

https://www.youtube.com/watch?v=aUjiuu5-4-A

Individual Transfer Payments (inflation-adjusted dollars & as a % of all federal outlays)

https://www.whitehouse.gov/omb/budget/Historicals/ (Table 11.1)

Federal Spending; Mandatory Spending as a % of all federal outlays

https://www.whitehouse.gov/omb/budget/Historicals/ (Tables 8.2 & 8.6)

Means-tested entitlements as a % of all federal spending

https://www.whitehouse.gov/omb/budget/Historicals/ (Table 8.2)

https://www.whitehouse.gov/sites/default/files/omb/budget/fy2016/assets/hist_intro.pdf

Labor Force Participation Rate

https://www.youtube.com/watch?v=no9Rwi6CNuI (7:49-11:38)

http://data.bls.gov/timeseries/LNS11300061

http://beta.bls.gov/dataViewer/view/timeseries/LNS11300164Q

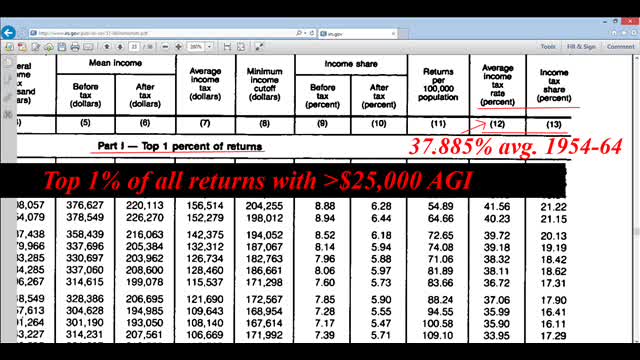

The rich didn’t pay those astronomical personal income tax rates of the 1950s

https://fullerfiles.wordpress.com/2014/08/01/debunking-the-liberal-logic-on-taxes-in-the-1950s/

http://beingclassicallyliberal.liberty.me/2014/05/27/no-we-never-had-over-70-tax-rates-on-the-rich/

http://www.fas.org/sgp/crs/misc/R42111.pdf

http://www.irs.gov/pub/irs-soi/51-86inintxshatr.pdf

Homeownership rate data/HUD Spending

http://www.census.gov/housing/hvs/data/histtabs.html

http://www.census.gov/housing/hvs/data/histtab14.xls

http://research.stlouisfed.org/fred2/series/USHOWN/

http://www.census.gov/hhes/www/housing/census/historic/owner.html

http://www.downsizinggovernment.org/charts/

Federal Receipts by source, % of

https://www.whitehouse.gov/omb/budget/Historicals/ (Table 2.2)

Federal Personal Income Tax Rates, Federal Corporate Income Tax Rates & FICA/HI (Social Security & Medicare) Tax Rates

http://taxfoundation.org/article/social-security-and-medicare-tax-rates-calendar-years-1937-2009

http://taxfoundation.org/article/federal-corporate-income-tax-rates-income-years-1909-2012

1) Out of wedlock birth rate

2) Federal Debt Per Capita

3) Federal Spending Per Capita

4) Federal Transfer Payments to Individuals

5) Means-Tested Spending

6) So-called Mandatory Spending

7) Labor Force Participation Rates

8) Homeownership Data

9) Sources of Federal Tax Revenue

10) Personal Income Tax Rates (taking a special look at years where those rates were changed)

11) Various Personal Income Tax Data (dispelling certain Progressive myths concerning personal income tax rates of the 1950s)

-

3:47

3:47

GeeDee44

4 years ago $0.20 earnedYou're Beautiful, and You're Beautiful

438 -

0:55

0:55

STLNutritionDoc

4 years agoSo you're not a sales person

45 -

3:33

3:33

Isabella12

3 years ago $0.01 earnedWhen you're an Addams

99 -

2:05

2:05

Jack Ellis

4 years ago $0.02 earnedYou're Sixteen

99 -

2:33

2:33

AmericanWorkMule

4 years agoWhen you're smiling honey pie

24 -

8:24

8:24

Calming Music

4 years agoCalming Music - You're loved

12 -

5:09

5:09

Christian Recording Artist, Eric Horner

4 years agoWhat If You're Wrong

112 -

26:56

26:56

MYLUNCHBREAK CHANNEL PAGE

1 day agoUnder The Necropolis - Pt 6

195K50 -

6:03

6:03

Tactical Advisor

1 day agoEverything New From Panzer Arms 2025

30.1K1 -

1:15:59

1:15:59

CarlCrusher

21 hours agoUFOs & Paranormal Phenomena are Not Imaginary | Dr Jim Segala MUPAS Phase 2

35K2