Premium Only Content

USDA Loan - USDA Mortgage - 11 Facts - USDA Loans- USDA Home Loan 2020

USDA Loan - Mortgage - 11 Facts about a USDA Loan- No Money Down - Zero Down Payment Home Loan - USDA Loan - zero down payment - mortgage, home loan, mortgages, FHA Loan, first time home buyer, Loan Requirements, home loans, real estate loan, USDA loan, USDA loan 2020, USDA loans explained, mortgage rates, zero down payment, USDA, USDA loans, USDA loan facts, How does a USDA loan work, No down payments, USDA program, USDA home loan, USDA mortgage, USDA real estate, USDA home loans, Qualify for USDA loan, No money down, home loans for first time buyers, mortgages 101, USDA loans in California

Created by the U.S Department of Agriculture

USDA Loans offer great features 97% of the US landmass is loan eligible!

11 facts about USDA Loans

1) USDA loans require zero down payment!

2) There actually is no minimum credit score requirement on a USDA loan. Most lenders will require a 580 Fico Score, a few will go lower, but most will require a 640 or higher FICO score

3) The is USDA Maximum loan amount is based on the county average income

4) USDA loans are designed to have the lowest interest rates. The rates are at least as low and sometimes even lower than VA and FHA and it still does not require a down payment

5) Up Front Mortgage Insurance is only 1% for a USDA loan as compared to 1.75% for FHA, and 1.4% with a 10% down payment on a VA loan all the way up to 3.6% (all funding fees are waived for disabled vets on VA loans) So a USDA loan has the lowest funding fee of all government loans!

6) On an FHA loan a borrower will pay .85% annual mortgage insurance rate (based on a 3.5% down payment), and for USDA only .35% annual mortgage insurance cost - only about 41% of the FHA mortgage insurance cost!

For example on a $300,000 FHA purchase with a 10,500 down payment, the Mortgage Insurance would cost $205.06 monthly

On a $300,000 USDA purchase with Zero Down Payment, the monthly mortgage insurance is only $87.50 a month

7) This loan has a maximum income of 115% of the Area Median Income. The allowable income adjusts for family size.

You can look up the county limits at https://www.rd.usda.gov/files/RD-GRHL...

8) How do you find out if a property is available? Just visit https://eligibility.sc.egov.usda.gov/...

9) Only available for owner-occupied properties.

10) The buyer must move into the house within 60 days of the close of escrow

11) When the appraised value is higher than the purchase price, the closing costs can be financed with the difference! Only USDA loans allow that!

00:00 start

00:20 fact number 1 – zero down payment

00:24 fact number 2 no minimum credit score

00:48 fact number 3 designed for rural areas

01:04 Fact number 4 Lowest Interest Rates

01:21 Fact number 5 Lowest Funding Fee

01:52 fact Number 6 Very Low PMI Rate

02:28 Fact number 7 Median to lower-income requirement

03:00 Fact Number 8 Owner Occupied Only

03:13 Fact Number 9 Must Move in within 60 days

03:25 Fact Number 10 Must be Pre Approved

03:52 Fact number 11 Closing Costs can sometimes be financed

usda loan

usda loans explained

USDA

USDA loans

USDA home loan

USDA mortgage

USDA real estate

USDA home loans

Qualify for USDA loan

usda home loan explained

USDA MOrtgage explained

USDA mortgage loan

usda loan limit

usda income limit

usda home loan

usda real estate

usda no down payment

usda requirements

Usda Real Estate Loan

USDA Zero Down

USDA area

USDA down payment

USDA loan progam

USDA Real Estate

USDA Limit

USDA guidelines

California USDA

http://www.FireYourLandlord.info for FHA loan application online. Apply online. even FHA Loans bad credit!

FHA Loan guidelines for FHA mortgage loans are the same in California and nationally.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#USDA #USDALoan #USDAmortgage

Like | Share | Comment and Subscribe

Apply online now at http://www.FireYourLandlord.info

5-10 mins to get your process started. FHA loans real estate - whole loan process and Fire Your Landlord!

To learn how much mortgage can you can qualify for. Watch https://www.youtube.com/watch?v=wA8QL...

For an FHA mortgage, or if you have an FHA loan question, call Chris an FHA Loan Officer! Fire Your Landlord with FHA loans to qualify for FHA!

Mortgage loan to buy a home with an FHA Home loan!

Chris Trapani

NMLS# 240870

Cell: 310-350-2546

Fire Your Landlord

800 N. Haven Avenue Suite 240

Ontario, CA 91764

-

6:38

6:38

KMGH

5 years agoIdeal Home Loans- No Mortgage Payments until 2020

20 -

4:39

4:39

KNXV

4 years agoIdeal Home Loans: Finding a mortgage loan that's right for you

14 -

4:32

4:32

KNXV

4 years agoIdeal Home Loans: Get a mortgage loan that is right for you!

19 -

1:03

1:03

Wh@ts Trending with Juice Giorgio

3 years ago20 Facts about 2020 - Fact #10

28 -

0:57

0:57

KMGH

3 years agoMortgage Matters 2/6

32 -

1:01

1:01

MPIWealthExpert

4 years ago15 Year Mortgage Loan or 30 Year Mortgage by Curtis Ray

45 -

13:00

13:00

FireYourLandlord

3 years agoConventional MORTGAGE: What is a Conventional Loan, How Does it Work?

73 -

2:27

2:27

VA Mortgages by BestDanMortgage

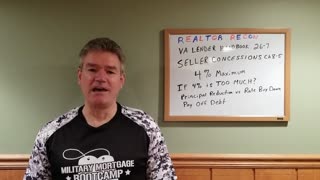

4 years agoVA home loan - 4% Seller concessions

56 -

5:44

5:44

KMGH

5 years agoIdeal Home Loans- New Mortgage Payment Not Due Until Feb. 2020

25 -

5:34

5:34

KMGH

3 years agoGet Low Mortgage Rates & Refinance Before 2021! // Ideal Home Loans

40