Premium Only Content

4 Reasons to Refinance Your Mortgage - Lower Interest Rate, No PMI

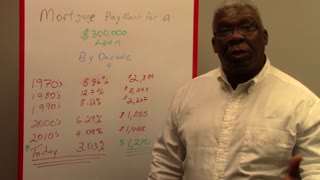

Mortgage Refinance! Refi today with low-interest rates of less than 3%! Learn the 4 reasons to refinance your home loan. Lower your interest rate on your mortgage and lower your monthly payment. Is there any reason to pay more for your home loan than you have to? By refinancing into a lower rate, the savings will vary obviously by your current interest rate to the new rate, and of course, the loan amount. If you are refinancing a $100,000 mortgage you probably won't save as much as someone refinancing a $500,000 mortgage.

00:00 Lower the Rate, Lower the Payment

0:10 Get Rid of PMI

0:22 Reduce Loan Years

0:28 Pay off Debt

0:39 Contact us!

The 2nd reason to refinance, the home buyers often buy with small down payments, When a buyer puts less than 20% down, mortgage insurance is almost always required. This insurance allows home buyers with small down payments to buy, otherwise, they would be required to put down 20%. Over time, home prices have gone up. Over time the home buyer also pays the loan down.

Once the homeowner has 20% equity in the property, a refinance is possible to get rid of the PMI (mortgage insurance) which often costs hundreds of dollars monthly. So when the opportunity arises to get rid of PMI (mortgage insurance) and also lower the interest rate - it results in huge savings! So an FHA to conventional Refinance will very often make sense

The 3rd reason to refinance is Cash out. Sometimes with enough equity getting extra cash is possible to pay off debts or even to do home improvements etc., or for other items that the homeowner deems necessary. Often people pay off a car and credit cards and student loans and save themselves hundreds and often even a thousand dollars a month!

Reason number 4 to refinance is to lower the term (the number of years). As an example, if you still owe 26 years on your mortgage but the interest rate will drop with the refinance, perhaps instead of taking the couple of hundred dollars a month and spending it (usually winding up with nothing to show for it) why not add the savings to the payment (keep making the original payment and perhaps save 6 years (bring it down to 20 years)

Do the math! If you save 6 years of principal and interest payments, how much would you save?

As an experienced mortgage pro, I can evaluate all of your options to see the best options for you so you'll know how much you'll save.

The bigger the drop in interest rate, the bigger the savings also.

The interest rate on any refinance is determined by a few factors. These factors each change the risk to the lender. The lower the risk, the lower the interest rate!

These factors include:

Credit score - You have 3 credit scores - the middle score is used. For example, if your scores are 710, 700, and 680 - then 700 would be your score. If there is more than one borrower the lower middle score would be used. Example:

Spouse has scores of 610, 650, and 670. The spouse's middle score is 650. 650 would be used instead of 700 for the pricing.

Loan to value ratio

if the house is worth 100,000 and the loan is 95,000, that is a 95% loan to value. But if the home is appraised at 100,000 but the loan amount s 70,000 then the loan to value is 70%. Obviously, 70% loan to value is a lower risk to the lender than 95%, therefore the lower the loan to value, the lower the risk, the lower the interest rate.

Use - Is it a rate and term refinance or a cashout? A Cashout is a higher risk than a rate and term (just lowering the interest rate and payment) so cashout has a higher fee.

Type of property - single-family residence is less risky than a condominium or multiple unit properties so it would offer a lower rate.

Use of property - an owner-occupied property is lower risk than a rental property - so the rate is lower.

http://www.FireYourLandlord.info for FHA loan application online. Apply online. even FHA Loans bad credit!

FHA Loan guidelines for FHA mortgage loans are the same in California and nationally.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

#homeloans #homeloan #mortgage

Like | Share | Comment and Subscribe

Apply online now at http://www.FireYourLandlord.info

5-10 mins to get your process started. FHA loans real estate - whole loan process and Fire Your Landlord!

To learn how much mortgage can you can qualify for. Watch https://www.youtube.com/watch?v=wA8QLQysJMg&t=2s

For an FHA mortgage, or if you have an FHA loan question, call Chris an FHA Loan Officer! Fire Your Landlord with FHA loans to qualify for FHA!

Mortgage loan to buy or refinance a home with an FHA, conventional, VA Home loan!

Chris Trapani

NMLS# 240870

Cell: 310-350-2546

Fire Your Landlord®

800 N. Haven Avenue Suite 240

Ontario, CA 91764

-

1:50

1:50

WGBA

4 years agoA great time to refinance your mortgage

160 -

7:06

7:06

The REal Deal - Your Real Estate Answers

4 years agoRefinance Your Home NOW

621 -

4:32

4:32

KNXV

4 years agoIdeal Home Loans can help lower your mortgage and debt payments

6 -

5:34

5:34

KMGH

4 years agoGet Low Mortgage Rates & Refinance Before 2021! // Ideal Home Loans

40 -

2:50

2:50

KSHB

4 years agoRefinancing your mortgage

20 -

2:25

2:25

WMAR

4 years agoTrouble paying your mortgage?

45 -

2:09

2:09

WMAR

4 years agoTrouble paying your mortgage

22 -

1:05

1:05

KTNV

4 years agoTake advantage of lower interest rates

20 -

5:29

5:29

TheKnowledgeBroker

4 years agoLower Interest Rates Is Good News For Buyers

361 -

1:29

1:29

KMGH

4 years agoLeverage Your Mortgage

13