Premium Only Content

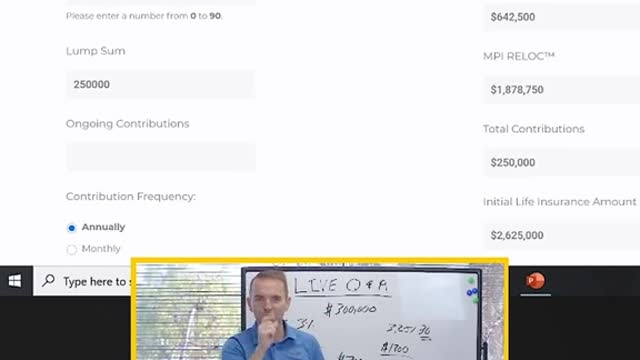

Lump Sum Results With MPI™ by Curtis Ray

A common suggestion by the #financial world is to have an #emergencyfund up to 6 months of your #salary saved up in cash or a liquid #savingsaccount. Is it a good idea to have an emergency fund? Of course. In a #savings account? There is a much better way! Its called a #Compound Account with #Liquidity. •

As an example, your hard-earned #money in a savings account loses around 3% value each year due to Inflation! So if you had $15,000 in your emergency savings account, the buying power of your money would drop to $14,550 after 1 year and after 20 years, as low as $8,000. Inflation would erode almost half of your money’s value sitting in a savings account. However, having your $15,000 in an MPI Compound Account, that has liquidity similar to a savings account to act as your Emergency Fund, and continue to Compound simultaneously, after the same 20 years of inflation, would still have real value of up to $70,000. Know the Rules of #Compounding!

-

0:54

0:54

MPIWealthExpert

4 years agoAchieve Retirement With MPI™ by Curtis Ray

47 -

0:46

0:46

MPIWealthExpert

4 years ago $0.01 earnedRoth IRA vs MPI™ by Curtis Ray

78 -

1:00

1:00

MPIWealthExpert

4 years agoLowest Fees Highest Compounding Results by Curtis Ray

38 -

0:50

0:50

MPIWealthExpert

4 years agoVanguard vs. MPI™ Retirement Plan by Curtis Ray

94 -

0:59

0:59

MPIWealthExpert

4 years agoTraditional 401k vs. MPI™ Secure Compound Interest by Curtis Ray

94 -

0:23

0:23

MPIWealthExpert

4 years agoInfinite Banking Concept with Curtis Ray

66 -

5:37

5:37

KTNV

4 years agoLook Younger with Lasting Results

39 -

0:58

0:58

irenehammond

4 years agoDo it with Intention - Exponential Results

22 -

1:13

1:13

The Kevin Jackson Network News

4 years agoCurtis McDonald reunited with his family

631 -

3:09

3:09

WMAR

4 years agoDelays occurring with COVID-19 test results

83