Premium Only Content

Must be Done to Access A Lost or Destroyed Policy of Insurance

Lost or Destroyed Policy of Insurance

Insurance claims often arise long after the expiration of a policy that may still be required to provide defense and indemnity to the insured. The proof of such policies has created a new and unique profession called insurance archaeology. If damage first occurred many years after expiration or cancellation of a policy and the policy is lost or destroyed, the insured can still prove its existence and its contents through “an unsigned copy or by oral evidence.”

In Chatham v. Occidental Life Insurance Company of California, 248 Miss. 328, 158 So.2d 735 (1963), the Court quoted with approval the general well established rule that a policy of insurance may be cancelled at any time before loss, by agreement between the parties, and that such cancellation may be by consent of the parties, express or implied from the circumstances independently of the terms of the policy. When the insurance contract was effectively cancelled by agreement of the parties voluntarily and knowingly done when the Lost Policy Cancellation Release was signed and executed. T U.S. Fire Ins. Co. v. Coggins, 195 So.2d 482 (Miss., 1967).

In Fulton Boiler Works, Inc. v. Am. Motorists Ins. Co., 828 F. Supp. 2d 481, 490 (N.D.N.Y. 2011), the Court observed that the "clear and convincing" standard seemed appropriate to establish a lost policy but declined to explicitly adopt a position on the issue at summary judgment. The issue of which standard applies is immaterial because plaintiff could not meet either standard. Other courts have done roughly the same.

According to most state courts that have ruled on the issue, policyholders liable for environmental damage are entitled to insurance coverage not only under the policy that was in effect at the time when damage was first discovered, but also under every policy in effect during the often decades long period when damage was silently occurring. Thus, if environmental damage occurred over a long period of time, a municipality (or any other party deemed liable for pollution) may be entitled to coverage for both defense and indemnity under multiple, even scores of, insurance policies.

When the putative insured failed to establish the terms and conditions of the lost policy by even a preponderance of the evidence it failed to establish coverage. In Servants of Paraclete, Inc. v. Great American Ins. (D.N.M.1994) 857 F.Supp. 822, 828-829 the court found a letter from the insurer acknowledging issuance of policy, testimony of insurer's business analyst about the type of policy issued to the plaintiff, testimony by an underwriter about the usual form of liability policies used at the time the lost policy was issued, written evidence of the exact premium paid, and at least two of the insurer's specimen policies, considered together, sufficient to defeat the insurer's motion for summary judgment]. [Dart Industries v. Commercial Union Ins., 92 Cal.Rptr.2d 174, 77 Cal.App.4th 916 (Cal. App., 2000)]

-

10:17

10:17

Barry Zalma, Inc. on Insurance Law

10 months agoWho's on First - Defense and/or Indemnity

144 -

0:21

0:21

KTNV

4 years agoChecks for insurance policy holders

110 -

1:37

1:37

WTMJMilwaukee

4 years agoAccess Your Living Benefits of Life Insurance

18 -

0:43

0:43

WMAR

5 years agoBaltimore approves insurance policy

21 -

0:39

0:39

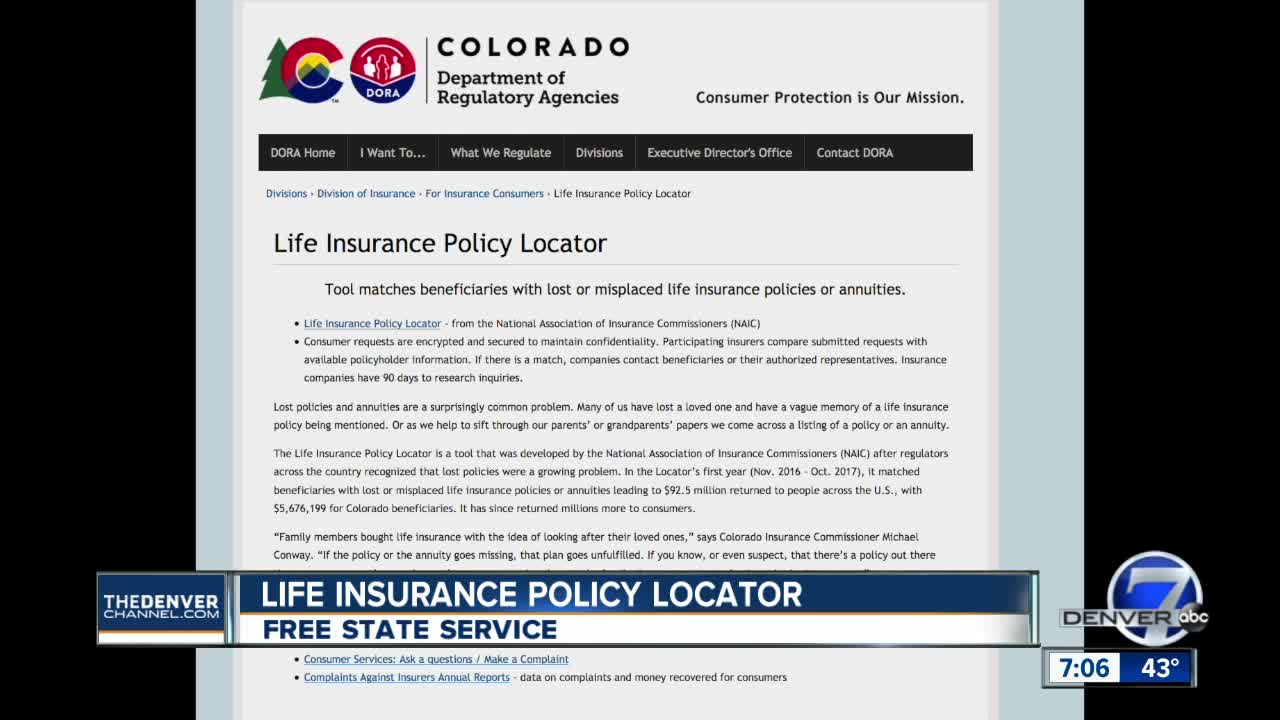

KMGH

5 years agoLife insurance policy locator helps find old life insurance policies

15 -

2:41

2:41

Newsy

4 years agoStudy Says 5.4 Million Americans Lost Health Insurance During Pandemic

360 -

4:18

4:18

TechRaptor Reviews

4 years ago $0.84 earnedDRIFT21 Is A Must Play Drifting Game | Early Access Preview

3.59K -

3:10

3:10

KJRH

4 years agoMask-wearing policy dispute

1021 -

2:56

2:56

KERO

4 years agoFire insurance preparation

53 -

25:19

25:19

Devin Nunes

4 years agoTrump’s Foreign Policy Successes

6.64K18