Premium Only Content

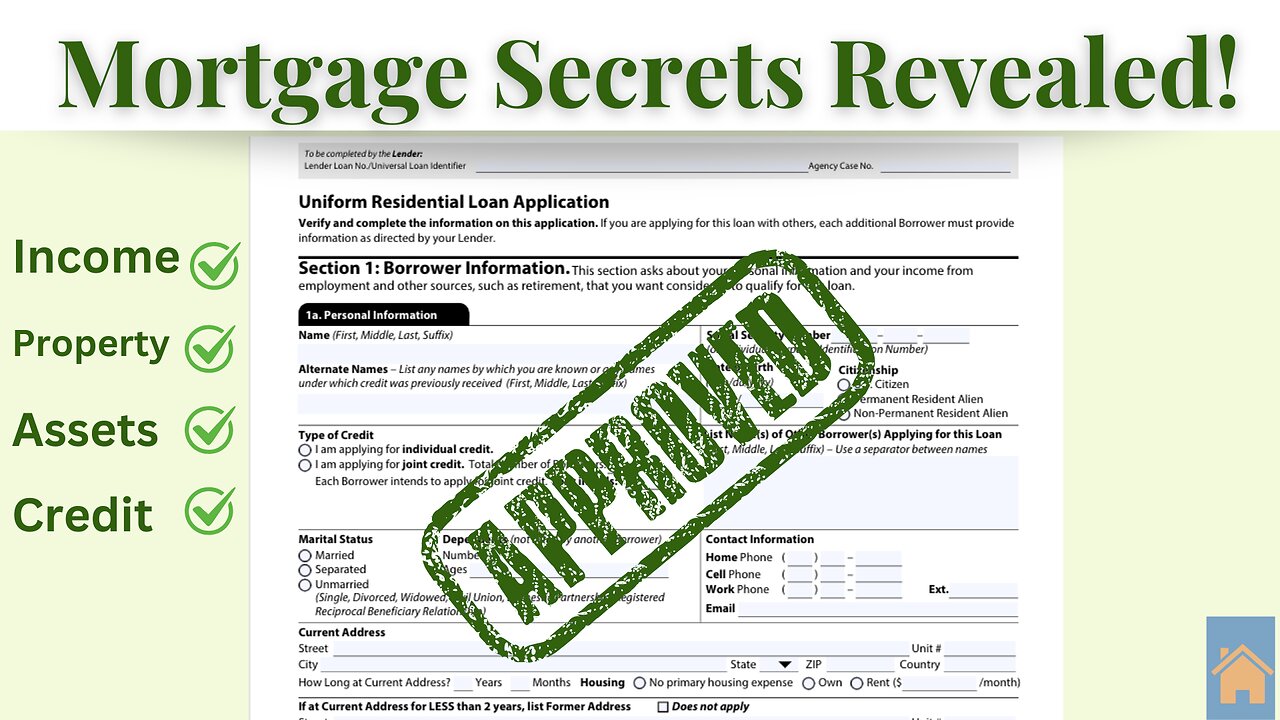

How Lenders Approve Mortgages: Income, Assets, Credit & Property

🔹 What does it take to get approved for a mortgage? In this livestream, we’re breaking down the 1003 Mortgage Application to show exactly how lenders evaluate borrowers.

📌 Topics Covered:

✔️ Income & Debt-to-Income (DTI) – How your earnings and debt affect approval

✔️ Property & Loan-to-Value (LTV) – How much house you can afford and equity requirements

✔️ Assets & Down Payment Options – Exploring gifts of equity, HELOCs, seller concessions, and nontraditional assets

✔️ Credit & Qualification Factors – How your credit score and history impact loan approval

💰 BONUS: Learn how to use your 401(k) without penalties and leverage alternative financing options to cover your down payment and closing costs!

📅 Join us LIVE and bring your questions! Whether you’re a first-time homebuyer or refinancing, this session will help you understand how to qualify for the best mortgage.

🔔 Don’t forget to subscribe for more mortgage tips!

#MortgageApproval

#HomeBuyingTips #Mortgage101 #LoanApplication #FirstTimeHomeBuyer #MortgageProcess #DTI #DTIexplained #LTVratio #HomeLoans

-

28:01

28:01

Side Scrollers Podcast

5 hours agoNEW SERIES! Smash JT Has a Full-On Meltdown | Nerd Duel ft. Lady Desiree & You, Me & The Movies

28.1K2 -

2:13:28

2:13:28

I_Came_With_Fire_Podcast

8 hours agoMEAD & MENTAL HEALTH WITH I CAME WITH FIRE AND VOC!!!

38K4 -

1:10:04

1:10:04

John Crump Live

4 hours ago $2.59 earnedYes I talked To The ATF

30.7K3 -

6:01:28

6:01:28

Amish Zaku

7 hours agoVerDanceKey Warzone - Birthday Fun

33.1K5 -

LIVE

LIVE

NeoX5

5 hours agoKhazan: The Road Less Taken | Part 5-2 | Rumble Studio | Rumble Gaming

269 watching -

LIVE

LIVE

TwinGatz

10 hours ago🔴LIVE - He Is Doing His Best | ARMA Reforger

586 watching -

54:40

54:40

LFA TV

15 hours agoSee God in the Trade War | TRUMPET DAILY 4.7.25 7PM

60.7K13 -

1:18:30

1:18:30

Sarah Westall

8 hours agoNew Study: EMFs Literally Put You into a Brainwave Cage; Reclaiming your Mind w/ Ian & Philipp

71.3K20 -

35:54

35:54

SantaSurfing

8 hours ago4/7/2025 - Trump Tariff impacts - he wants no Capital Gains Tax! Inflation falls to 1.22%!

45.1K30 -

59:17

59:17

We Like Shooting

19 hours ago $2.63 earnedDouble Tap 404 (Gun Podcast)

29.9K1