Premium Only Content

P&L Loans - Loans For Self Employed Borrowers

What are P&L Only Loans?

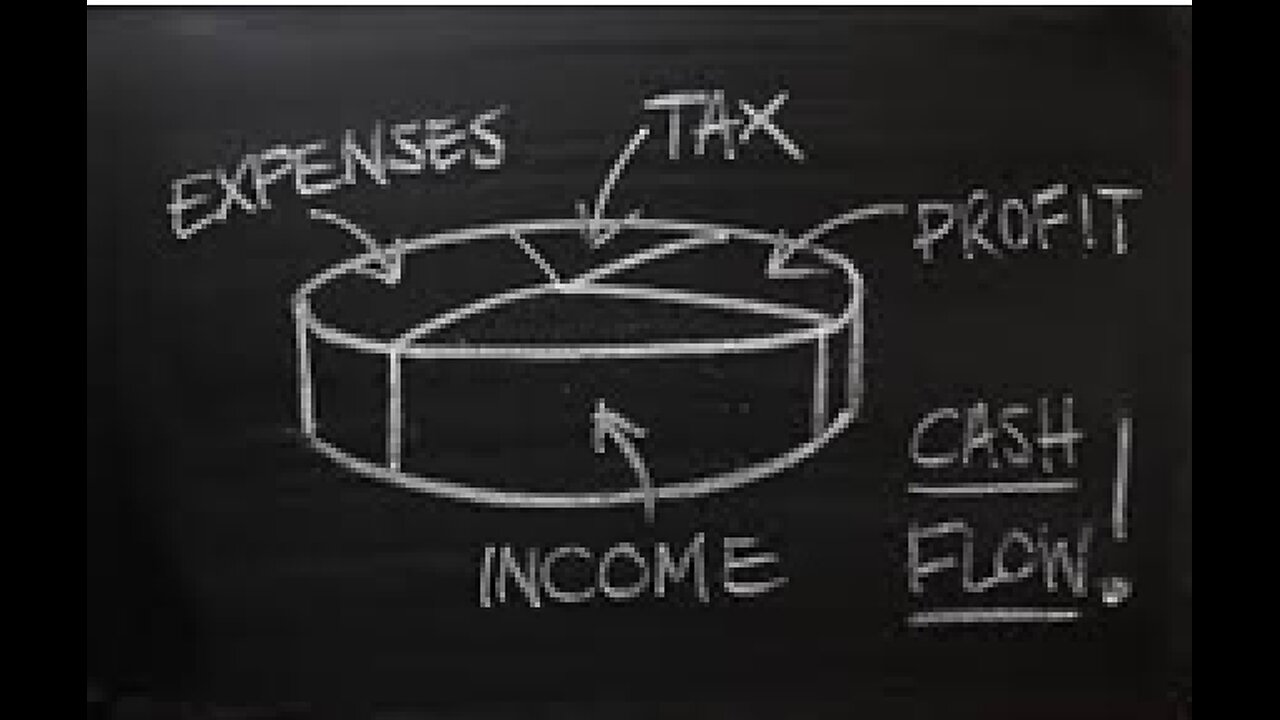

As the name suggests, P&L Only Loans primarily rely on a business's Profit and Loss (P&L) statements for loan approval. This means lenders place significant emphasis on the financial health and profitability of the business, often with less focus on extensive documentation that traditional loans require.

How They Work:

Emphasis on Profitability: Lenders analyze the P&L statements to assess the business's revenue, expenses, and overall profitability.

Simplified Documentation: Compared to traditional loans, P&L Only Loans typically require less documentation, streamlining the application process.

Focus on Cash Flow: Lenders are particularly interested in the business's ability to generate consistent cash flow, which demonstrates its capacity to repay the loan.

Who Benefits from P&L Only Loans?

Self-Employed Individuals: Entrepreneurs and freelancers with fluctuating income may find these loans more accessible.

Small Business Owners: Businesses with strong P&L statements but limited documentation may benefit from this streamlined approach.

Real Estate Investors: Investors seeking quick financing for property purchases or renovations may find P&L Only Loans attractive.

Businesses needing fast capital: Due to less documentation, these loans often close faster.

Key Advantages:

Faster Approval Process: Reduced documentation translates to quicker loan approvals.

Flexibility: P&L Only Loans offer flexibility for borrowers with unconventional income streams.

Accessibility: These loans can be more accessible for businesses that may not qualify for traditional financing.

-

2:13:54

2:13:54

Adam Carolla

14 hours agoRoger Stone on FBI Raid, Trae Crowder on Southern Life & Don Lemon recalls being sexually harassed

38.9K4 -

1:35:54

1:35:54

Mike Rowe

14 days agoHigh School Dropout Turned Harvard Professor Shares What’s Wrong with Education | The Way I Heard It

36.5K21 -

1:23:13

1:23:13

Glenn Greenwald

7 hours agoWhat JFK Documents Reveal About CIA; New Info About Mahmoud Khalil’s Views and Character; PLUS: Glenn’s Fox Appearance on Free Speech, Khalil Case | SYSTEM UPDATE #426

108K69 -

DVR

DVR

Bannons War Room

1 month agoWarRoom Live

7.5M1.5K -

47:02

47:02

BonginoReport

8 hours agoWoman Berated Over MAHA Hat in Gym Incident Speaks Out! (Ep.08) - 03/19/2025

162K168 -

24:16

24:16

Producer Michael

7 hours ago$7,000,000 EMERALD OVER 200 YEARS OLD!

38.8K5 -

2:04:04

2:04:04

Melonie Mac

6 hours agoGo Boom Live Ep 41!

44.3K16 -

57:45

57:45

Mally_Mouse

5 hours agoLet's Hang!! - Just Chillin' & Chattin

40.6K2 -

1:31:49

1:31:49

Kim Iversen

10 hours agoCIA Fingerprints All Over JFK’s Assassination: Dirty Secrets & Shocking Israeli Connections??

128K175 -

2:03:50

2:03:50

vivafrei

13 hours agoElon CONFIRMS Biden Played Politics with Astronauts; JFK Files Dud? Trump Attacks Poilievre & MORE!

211K152