Premium Only Content

Forget the Rate, Focus on the Payment!

Forget the Rate, Focus on the Payment!

We've all been there. You're buying a car, a house, or even just financing a new appliance. The salesperson throws numbers at you: "This great interest rate!" or "Look at this low APR!" While interest rates are important, they often overshadow the real number you should be paying attention to: your monthly payment.

Why is the payment so crucial? Because it's what directly impacts your daily budget. Here's why you should shift your focus:

1. Cash Flow is King:

Your monthly payment determines how much money leaves your bank account each month. A low interest rate doesn't matter if the resulting payment stretches your budget too thin.

Consider two scenarios:

A low interest rate with a long loan term, resulting in a manageable payment.

A slightly higher interest rate with a shorter loan term, resulting in a higher payment but quicker debt payoff.

The first scenario might seem appealing, but the second could save you significant money in the long run, and also gets rid of the debt faster.

Ultimately, can you comfortably afford the payment every single month? That's the question you need to answer.

2. Total Cost of Ownership:

While a low interest rate can reduce the overall interest paid, a longer loan term can negate those savings.

Use online loan calculators to see the total amount you'll pay over the life of the loan, including both principal and interest. This will reveal the true cost.

For example, a lower interest rate over 30 years can result in a higher total payment, than a slightly higher interest rate over 15 years.

The total cost of ownership is the total amount of money you will spend.

3. Flexibility and Financial Freedom:

A lower payment can provide more flexibility in your budget, allowing you to save for other goals, invest, or handle unexpected expenses.

Paying off debt faster, even with slightly higher payments, frees up your future cash flow.

The quicker you pay off debt, the less interest will accrue.

4. Negotiation Power:

Instead of solely focusing on the interest rate, negotiate the monthly payment. Tell the lender or salesperson the maximum amount you can afford.

This approach can often lead to better deals, even if the interest rate isn't the absolute lowest.

By focusing on payment, you are focusing on a concrete number, and not an abstract percentage.

How to Focus on the Payment:

Know your budget: Before shopping, determine how much you can realistically afford to pay each month.

Use online calculators: Input different loan amounts, interest rates, and terms to see how they impact your monthly payment.

Negotiate the payment: Don't be afraid to tell lenders or salespeople your desired monthly payment.

Consider shorter loan terms: If possible, opt for a shorter loan term to pay off debt faster and save on interest.

Don't be afraid to walk away: If the payment isn't right, don't feel pressured to sign.

In Conclusion:

While interest rates are a factor, your monthly payment is the key to financial well-being. By focusing on the payment, you can ensure that your borrowing decisions align with your budget and long-term financial goals. Don't let a "low" interest rate distract you from the true cost of borrowing.

-

12:23

12:23

Adam Does Movies

3 hours ago $0.69 earnedSnow White (2025) Movie Review - Disney Does It Again!

9.34K7 -

1:33:43

1:33:43

Tucker Carlson

2 hours agoSteve Witkoff’s Critical Role in Negotiating Global Peace, and the Warmongers Trying to Stop Him

66.1K65 -

15:56

15:56

T-SPLY

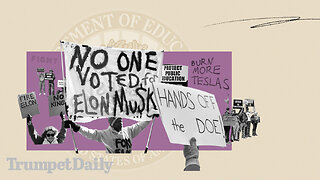

6 hours agoDemocrats Are Now Lying About The Department Of Education Shutdown

65.3K40 -

DVR

DVR

Edge of Wonder

5 hours agoJFK Files Update: The Secret $100K Bounty

11.7K2 -

57:42

57:42

Sarah Westall

2 hours agoJFK Document Dump – What’s New, What’s Not – JFK & National Security Expert Larry Hancock

27.7K2 -

1:36:52

1:36:52

Bare Knuckle Fighting Championship

1 day agoCountdown to BKFC FIGHT NIGHT PHILLY & FREE FIGHTS

13.5K1 -

55:01

55:01

LFA TV

1 day agoTrump Derangement Syndrome Is Turning Violent | TRUMPET DAILY 3.21.25 7PM

17K4 -

LIVE

LIVE

2 MIKES LIVE

5 hours ago2 MIKES LIVE #195 Music Night Special with Kevin Carter!

49 watching -

2:01:20

2:01:20

vivafrei

9 hours agoOwen Shroyer SWATTED! The Tate Brothers Sue for DEFAMATION! Fentanyl Busts in Canada & MORE!

139K69 -

Nerdrotic

5 hours ago $21.38 earnedSnow White Is An ABOMINATION | Assassin's Creed BACKLASH - Friday Night Tights 346 Critical Drinker

85.2K25