Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

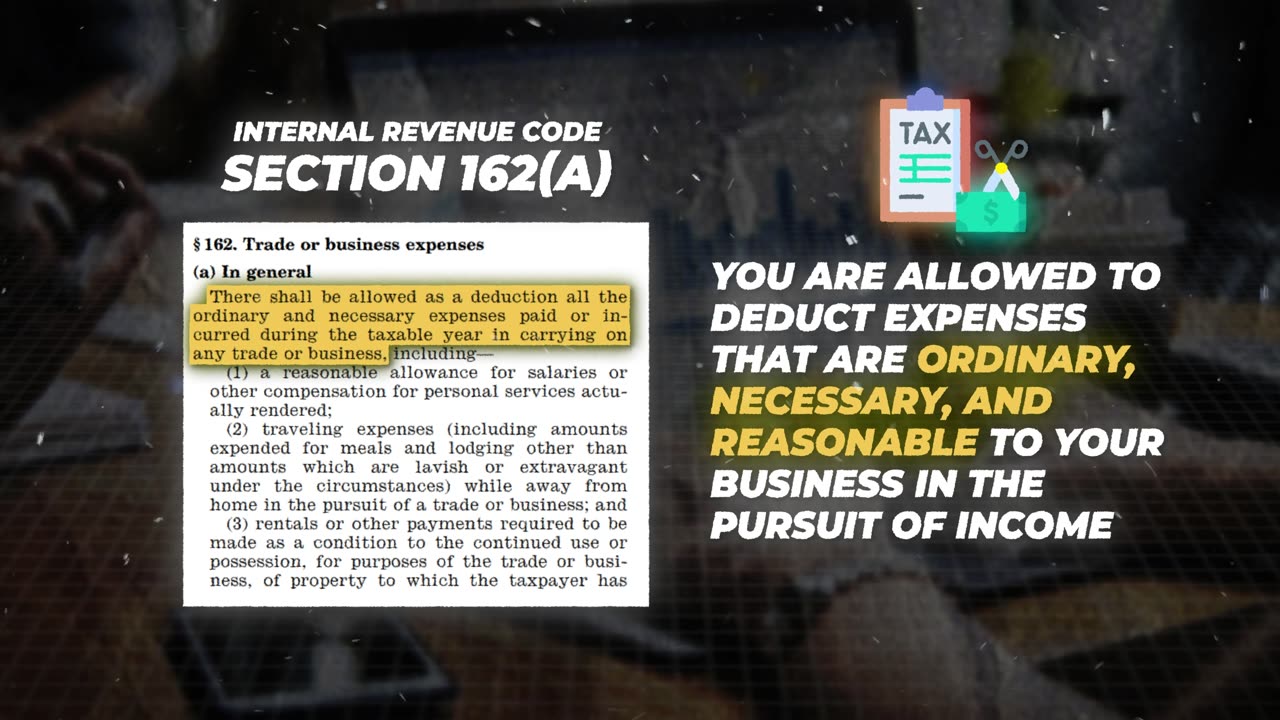

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

9:50

9:50

Karlton Dennis

3 days agoWhy Isn't Everyone Using the MEGA BACKDOOR ROTH?

141 -

LIVE

LIVE

JULIE GREEN MINISTRIES

1 hour agoLIVE WITH JULIE

33,990 watching -

5:24

5:24

SKAP ATTACK

1 day ago $2.12 earnedLuka Humiliates Mavericks in Dallas Return

8.56K7 -

45:42

45:42

Dad Dojo Podcast

1 day agoEP27: How To Warn Your Kids About Online Dangers

20 -

19:25

19:25

Neil McCoy-Ward

19 hours ago🔥 The EU Makes SHOCK Announcement! (Sinister Plans Revealed To..

15K33 -

24:56

24:56

CatfishedOnline

23 hours agoMan Insists His Internet Relationship Isn't A Romance Scam!

11.8K2 -

28:37

28:37

Ohio State Football and Recruiting at Buckeye Huddle

12 hours agoBold Predictions for the 2025 Ohio State Spring Game

15.1K3 -

21:25

21:25

JasminLaine

14 hours agoMark Carney Gets Visibly ANGRY at Reporter—Poilievre BURIES Him! Then He Goes Into HIDING

8.36K13 -

16:56

16:56

Clownfish TV

1 day agoDisney's DEATH by Tariffs? They DEPEND on China!

15.2K9 -

11:30

11:30

IsaacButterfield

1 day ago $0.74 earnedThis Hate Speech Law Is RACIST To White People.

10.5K23