Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

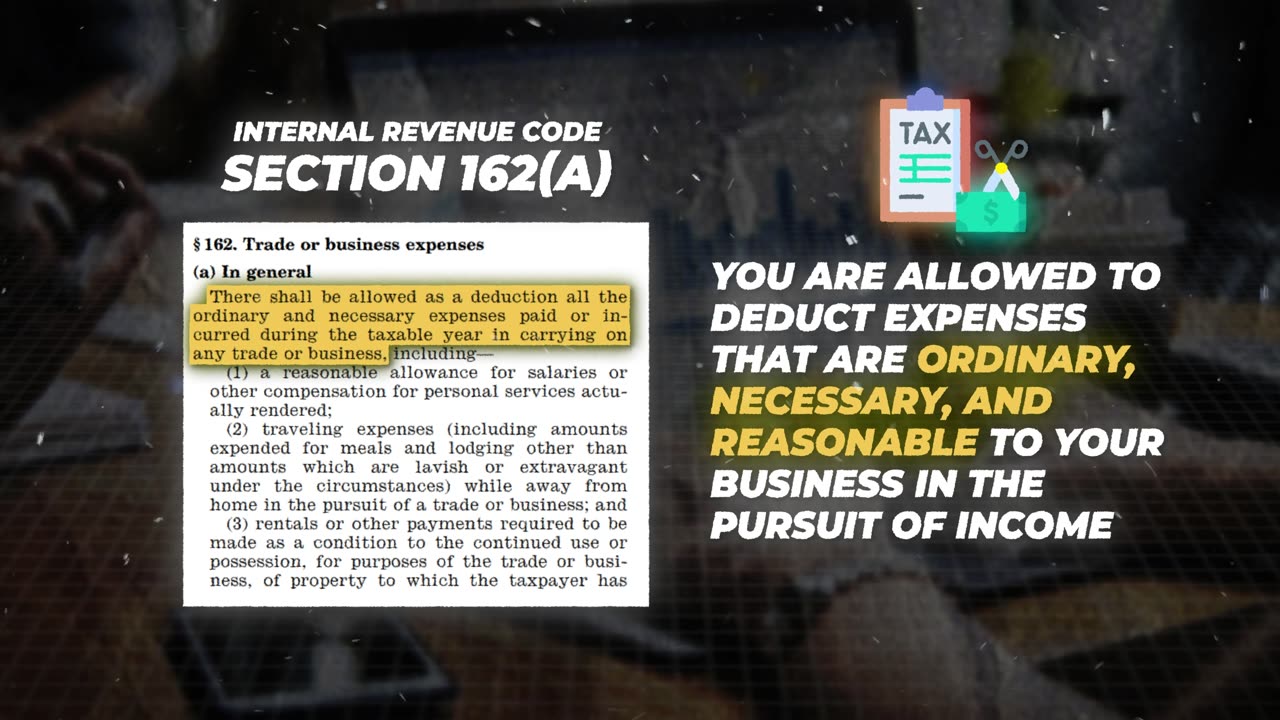

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

9:10

9:10

Karlton Dennis

18 days agoElon Musk and DOGE Take SLEDGEHAMMER to Federal Spending!

201 -

1:21:11

1:21:11

Mike Rowe

11 days agoWhat Carlos Learned After Spending Seven Weeks Without Screens | The Way I Heard It with Mike Rowe

13.3K18 -

30:32

30:32

The Why Files

9 days agoOperation Prato | Alien Vampires of the Amazon

27.9K44 -

33:23

33:23

Adam Carolla

2 hours ago $3.99 earnedBorder Patrol Agent in Hot Water & Whoopi’s Dumbest Take Yet | The Adam Carolla | #news

11.4K5 -

2:41:35

2:41:35

TimcastIRL

6 hours agoUSAID Orders Staff To SHRED & BURN ALL Documents, Deep State COVER UP w/Bubba Clem| Timcast IRL

173K70 -

1:45:39

1:45:39

Kim Iversen

9 hours agoTrump Attacks Thomas Massie—But MAGA Isn’t Having It! Is Trump Picking the Wrong Fight?

53.9K111 -

56:31

56:31

Glenn Greenwald

8 hours agoUNLOCKED EPISODE: On Europe’s Emergency Defense Summit, the Future of Independent Media, Speech Crackdowns and More

115K53 -

43:48

43:48

BonginoReport

9 hours agoMainstream Media Plots The Next Plandemic! (Ep.02) - 03/11/2025

150K282 -

1:13:13

1:13:13

Michael Franzese

9 hours agoMegyn Kelly’s UNFILTERED Take on The Ukraine War, Trump & Modern Masculinity

113K42 -

1:43:21

1:43:21

Redacted News

10 hours agoBREAKING! UKRAINE AGREES TO CEASEFIRE WITH RUSSIA... BUT THERE'S A BIG CATCH | Redacted News

194K328