Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

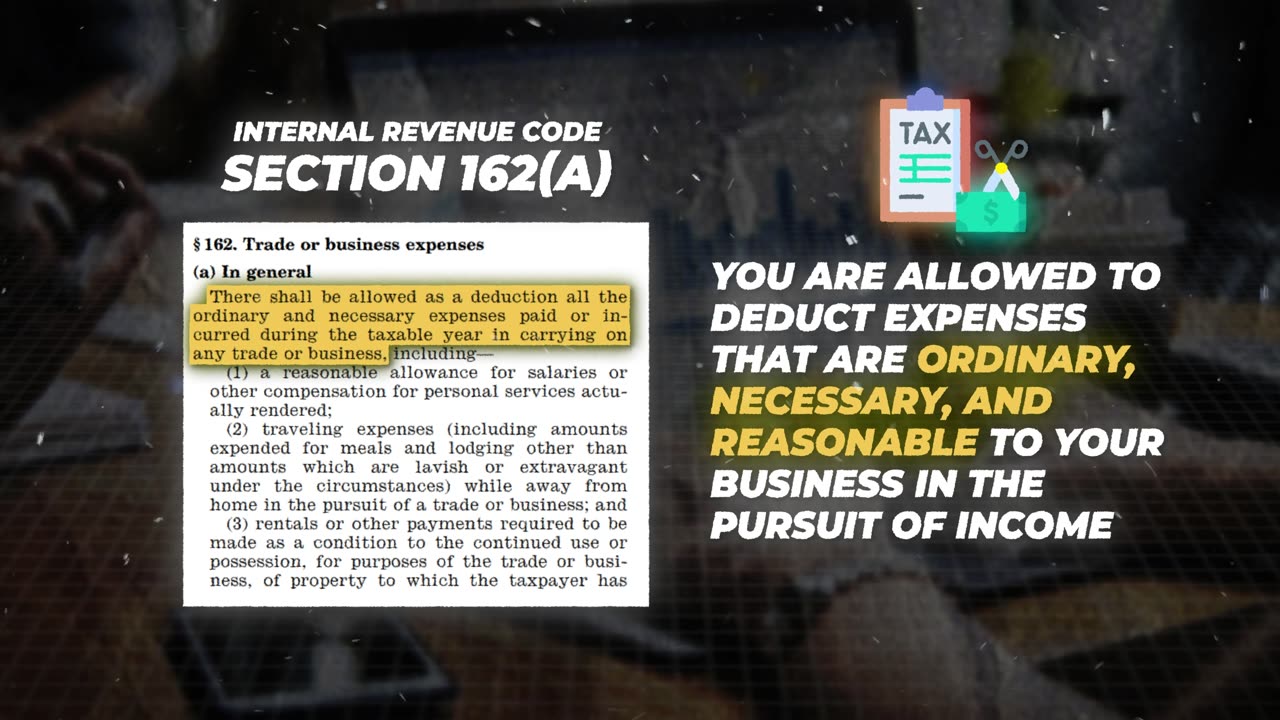

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

LIVE

LIVE

Donald Trump Jr.

2 hours agoZelensky Overplays His Hand, More Trump Wins, Plus Interview with Joe Bastardi | Triggered Ep.221

5,828 watching -

LIVE

LIVE

The Jimmy Dore Show

6 minutes agoPutin Offers U.S. a BETTER DEAL on Rare Earth Metals! Flu Shots Are a Proven Scam! w/ Mikki Willis

1,537 watching -

42:47

42:47

Kimberly Guilfoyle

3 hours agoThe Trump effect: More Major Investment, Plus America First at Home & Abroad. Live w/Ned Ryun & Brett Tolman | Ep. 201

25.2K11 -

1:29:23

1:29:23

Redacted News

2 hours agoWW3 ALERT! Europe pushes for war against Russia as Trump pushes peace and cutting off Zelensky

49.1K131 -

LIVE

LIVE

Dr Disrespect

7 hours ago🔴LIVE - DR DISRESPECT - PUBG - 5 CHICKEN DINNERS CHALLENGE!

2,698 watching -

57:56

57:56

Candace Show Podcast

6 hours agoHarvey Speaks: The Project Runway Production | Ep 1

38.9K20 -

LIVE

LIVE

CatfishedOnline

2 hours agoRacist Lady Shocked After Sending Money to a Nigeria Romance Scammer

95 watching -

56:45

56:45

VSiNLive

2 hours agoFollow the Money with Mitch Moss & Pauly Howard | Hour 1

15.6K -

2:28:18

2:28:18

Nerdrotic

5 hours ago $3.08 earnedOscars Aftermath | Super Chat Square Up - Nerdrotic Nooner 469

30.3K13 -

1:09:41

1:09:41

Sean Unpaved

6 hours ago $3.05 earnedUnpaved

32.6K3