Premium Only Content

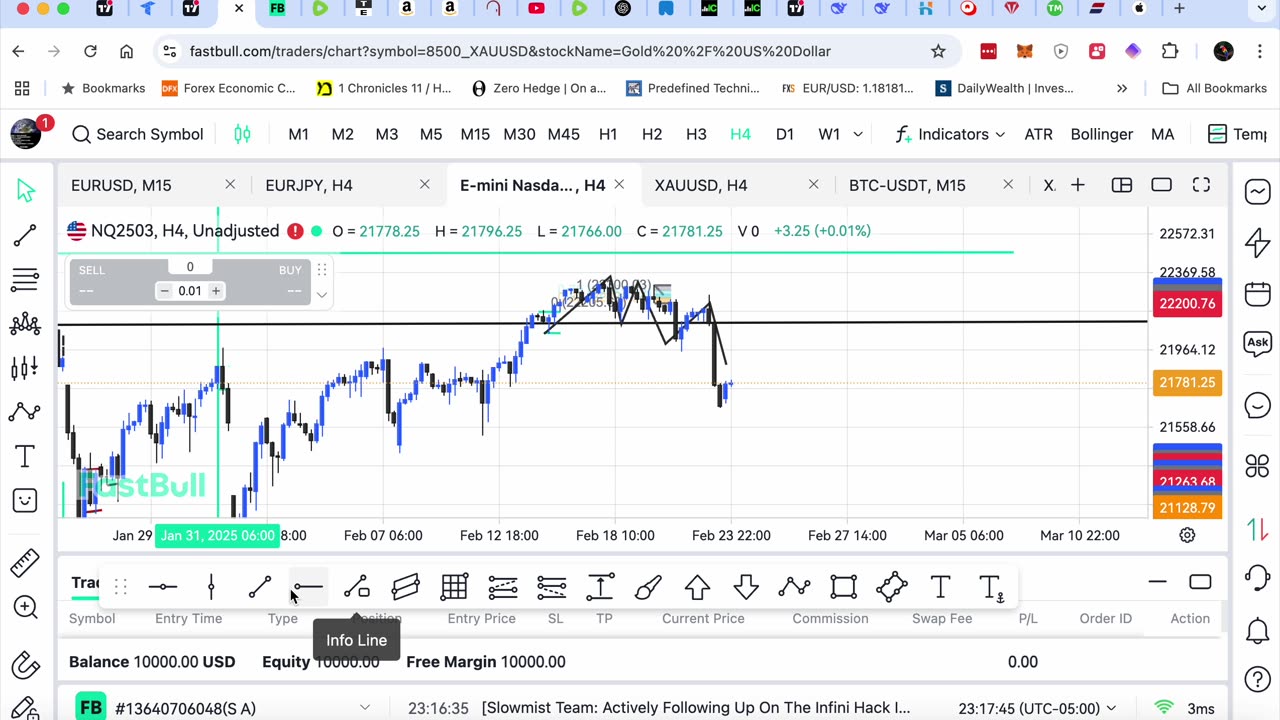

Market Review Feb 23, 2025

Gold prices remain volatile as investors weigh inflation concerns against a stronger dollar. With the Fed's rate hike stance, gold is making new highs as safe-haven demand fuels the upside.

The Nasdaq continues its tech-driven rally, fueled by AI optimism and strong earnings from giants like NVIDIA. However, rising bond yields and Fed uncertainty may pressure growth stocks in the short term. President Trump tarriffs are putting a downward pressure on the stocks in the short term.

The Dow Jones holds steady, supported by robust industrial and healthcare sectors. As economic data signals mixed signals, the index remains range-bound, with investors eyeing upcoming Fed decisions.

EUR/USD after a big drop is now rising steadily amid a weak dollar and ECB's rate cutting stance to fuel the economy. Eurozone economic weakness and geopolitical risks keep the pair below key levels, but a dovish Fed pivot could reverse the trend.

Crypto markets are taking a beating as Bitcoin tests $95K amid ETF inflows. Altcoins like Ethereum and Solana follow suit, but regulatory concerns and profit-taking have triggered short-term pullbacks.

#Oil - Energy concerns had earlier fueled the price of oil but since Mr Trump has begun to deregulate and open more wells oil has started to drop and we could see oil going back down to the $60 barrel if Russia and Ukraine war is stopped oil will see its biggest drop.

-

15:13

15:13

Clownfish TV

19 hours agoBluesky Trusts the Science? Scientists FLEEING X for Bluesky!

6.86K7 -

29:50

29:50

The Finance Hub

14 hours ago $3.96 earnedBREAKING: TULSI GABBARD JUST DROPPED A MAJOR BOMBSHELL!!!

16.4K19 -

11:32

11:32

ariellescarcella

16 hours ago"Being A Lady Boy Is Exciting!" (This Dude Has A Kid)

11.1K5 -

1:03:33

1:03:33

The Dan Bongino Show

1 day agoSunday Special with Mike Benz, Michael Knowles, Rep. Tim Burchett and Rep. Andy Harris - 02/23/25

355K1.13K -

1:36:21

1:36:21

Sarah Westall

12 hours agoViolence Erupting in the Panama Canal, Identifying Enemy Infiltration, Psyops Ongoing w/ Michael Yon

95K50 -

1:56:25

1:56:25

Nerdrotic

15 hours ago $19.43 earnedThe Red Pyramid's Hidden Secrets | Forbidden Frontier #091

75.1K15 -

2:08:53

2:08:53

vivafrei

23 hours agoEp. 252: Liberals DISQUALIFY Candidate from Race! DOGE Wins & Loses; Rumble Sues BRAZIL! & MORE!

180K270 -

1:15:12

1:15:12

Josh Pate's College Football Show

14 hours ago $24.73 earnedCFB’s Top 12 Programs | TV Executives & Our Sport | USC Changes Coming | Early Championship Picks

120K3 -

Vigilant News Network

18 hours agoUK Government BUSTED in Secret Plot to Extract Your Data | Media Blackout

122K28 -

1:03:32

1:03:32

Winston Marshall

3 days ago"War On Children!" The DEMISE Of The West Starts With Schools - Katharine Birbalsingh

137K68