Premium Only Content

Finance Help: Calculation of individual costs and WACC Chevron Corporation (CVX) has

Question content area top

Part 1

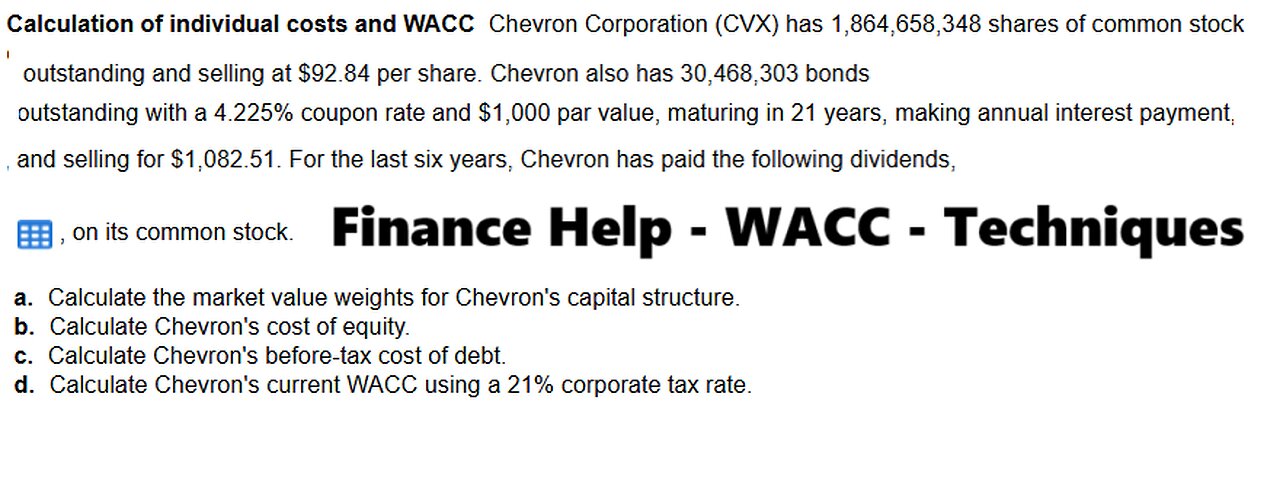

Calculation of individual costs and WACC Chevron Corporation (CVX) has 1 comma 864 comma 658 comma 348 shares of common stock outstanding and selling at $92.84 per share. Chevron also has 30 comma 468 comma 303 bonds outstanding with a 4.225% coupon rate and $ 1 comma 000 par value, maturing in 21 years, making annual interest payment, and selling for $1 comma 082.51. For the last six years, Chevron has paid the following dividends, LOADING..., on its common stock.

a. Calculate the market value weights for Chevron's capital structure.

b. Calculate Chevron's cost of equity.

c. Calculate Chevron's before-tax cost of debt.

d. Calculate Chevron's current WACC using a 21% corporate tax rate.

#FinanceHelp

#WACC

#WeightedAverageCostofCapital

-

![[LIVE] Bully | GTA: Vice City | First Playthrough | 8 | Rampage and The Spirit of The Season](https://1a-1791.com/video/fwe1/85/s8/1/W/e/n/4/Wen4x.0kob-small-LIVE-Bully-GTA-Vice-City-Fi.jpg) 3:15:35

3:15:35

Joke65

4 hours ago[LIVE] Bully | GTA: Vice City | First Playthrough | 8 | Rampage and The Spirit of The Season

15.8K -

3:27:04

3:27:04

Laura Loomer

6 hours agoEP103: Dems Promote Violent Anti-Trump Protests Nationwide

25.8K8 -

LIVE

LIVE

Fairy Mysterious Adventures

4 hours agoStardew with the Rumble crew #16

1,227 watching -

1:28:42

1:28:42

Kim Iversen

9 hours agoThe War on Terror Was a Scam? Is Osama Bin Laden Really Dead? SEAL Who Killed Him Breaks It Down.

44.2K98 -

1:09:44

1:09:44

Slightly Offensive

6 hours ago $7.18 earnedALMOST SERIOUS: How Mass Legal Immigration DESTROYED Australia | Guest: Maria Zeee

49.4K14 -

2:38:38

2:38:38

TimcastIRL

6 hours agoTrump Orders DOJ To FIRE EVERY Biden Attorney, Calls For CLEAN HOUSE w/Siaka Massaquoi | Timcast IRL

120K73 -

1:29:31

1:29:31

Glenn Greenwald

9 hours agoGermany's Repressive Speech Crackdown Intensifies; U.S. & Russia Meet in Saudi Arabia and Open Cooperation; Plus: An Amazing Hate Crime in Florida is Buried | SYSTEM UPDATE #408

89.2K54 -

DLDAfterDark

3 hours ago $1.06 earnedDLD Live! What's Your Typical EDC/Civilian Load Out? Guns & Ammo & EDC?

13.9K1 -

1:30:48

1:30:48

Redacted News

10 hours agoBREAKING! TRUMP AND PUTIN NEARING PEACE BUT EUROPEAN WARMONGERS TRYING TO STOP IT | REDACTED

178K250 -

52:40

52:40

Candace Show Podcast

10 hours agoSaturday Night Lively: What Were They Thinking? | Candace Ep 148

151K151