Premium Only Content

Centerra Gold | Paul Tomory and Jimmy Connor

This interview was recorded Jan 18'25....Paul Tomory, CEO of Centerra Gold, has focused on maximizing the value of their global assets.

Efforts involve technical, operational, and commercial enhancements to highlight the true worth of their portfolio.

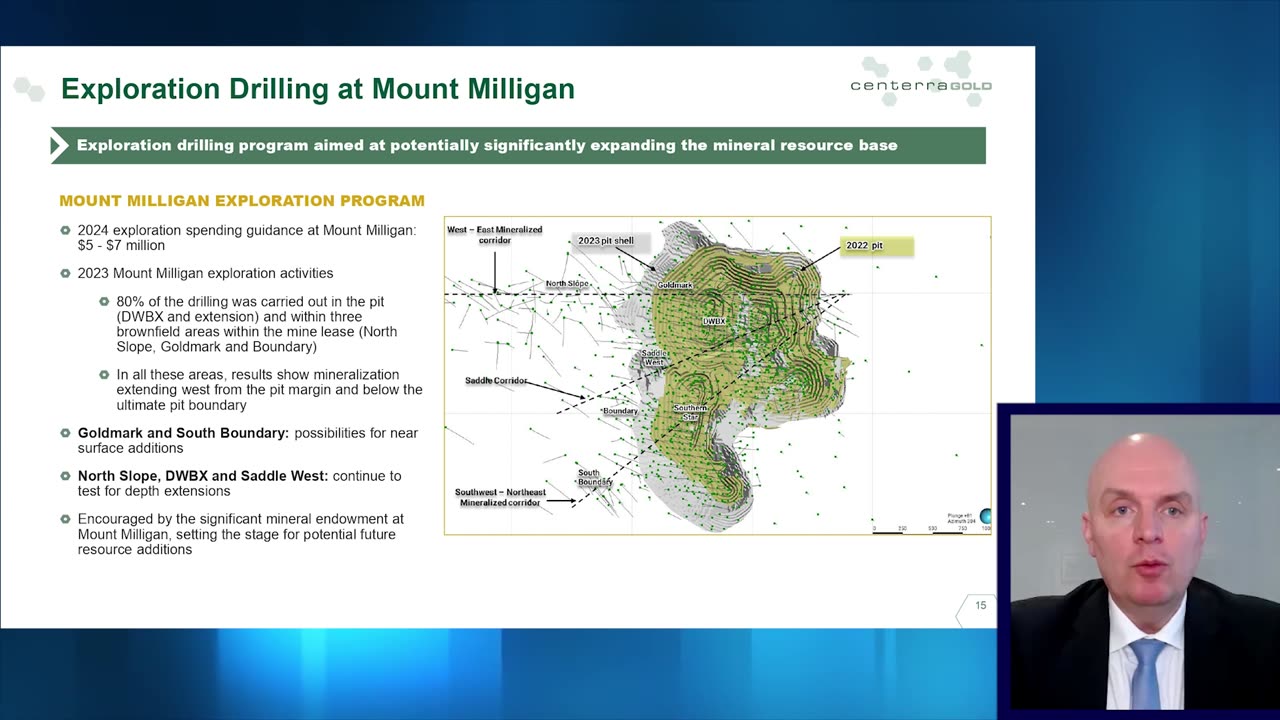

Mount Milligan Asset:

Located in British Columbia, it is a flagship copper-gold mine with a life extending to 2035.

Centerra has renegotiated terms with Royal Gold, enabling studies and exploration for extending the mine life by another decade.

Operational improvements, such as cost optimization and process enhancements, are ongoing.

Oxide Mine in Turkey:

Reopened after resolving environmental issues and now generates significant cash flow.

Mine life is expected until 2029, with limited exploration potential nearby.

Centerra is exploring Greenfield opportunities in Turkey and sees it as a strategic operating region.

Thompson Creek and Molybdenum Assets:

Restarting the Thompson Creek mine in Idaho with $400M investment, funded mostly through cash flow.

Includes a strategic review to potentially sell or partner on these non-core molybdenum assets valued at $472M NPV.

Goldfield and Kemess Projects:

Kemess (British Columbia): Focus on developing a large copper-gold deposit with existing infrastructure. A study is expected by the end of 2025.

Goldfield (Nevada): Transitioning to an oxide-only heap leach project, with resource estimates due shortly.

Exploration and Growth:

Greenfield exploration initiatives in Turkey, Nevada, British Columbia, and Ontario.

Actively seeking acquisitions in gold and potentially copper, emphasizing stable jurisdictions.

Balance Sheet Strength:

$600M cash reserves with plans for ongoing dividends, buybacks, exploration, and strategic investments.

Centerra aims to deploy cash into high-value gold assets for growth.

Valuation and Market Position:

Centerra believes it trades at a significant discount to its intrinsic value.

Monetizing or divesting molybdenum assets is viewed as a key strategy to align market valuation.

Mid-Term Milestones:

Key studies and resource updates:

Goldfield resource update (Q1 2025).

Mount Milligan study mid-year.

Kemess study by year-end.

Progress reports on Thompson Creek construction and other operational milestones.

Strategic Outlook:

Strong focus on increasing gold production and improving operational performance.

Commitment to disciplined growth and maintaining a robust financial position.

WAIVER & DISCLAIMER

If you register for this webinar/interview you agree to the following: This webinar is provided for information purposes only. All opinions expressed by the individuals in this webinar/interview are solely the individuals’ opinions and neither reflect the opinions, nor are made on behalf of, Bloor Street Capital Inc. Presenters will not be providing legal or financial advice to any webinar participants or any person watching a recorded version of the webinar. The investing ideas and strategies discussed on this webinar/interview are not recommendations to buy or sell any security and are not intended to provide any investment advise of any kind, but are made available solely for educational and informational purposes. Investments or strategies mentioned in this webinar/interview may not be suitable for your particular investment objectives, financial situation, or needs. You should be aware of the real risk of loss in following any investment strategy discussed in this webinar/interview. All webinar participants or viewers of a recorded version of this webinar should obtain independent legal and financial advice. All webinar participants accept and grant permission to Bloor Street Capital Inc. and its representatives in connection with such recording. The information contained in this webinar/interview is current as of January, 2025 the date of this webinar/interview, unless otherwise indicated, and is provided for information purposes only. Bloor Street Capital was paid a fee for this Interview.

-

1:39:03

1:39:03

Roseanne Barr

6 hours ago $2.99 earnedAdam Carolla! | The Roseanne Barr Podcast #87

80.1K15 -

1:29:04

1:29:04

Glenn Greenwald

6 hours agoTrump, Vance & Musk Announce a Radically New Foreign Policy Framework; Prof. Norman Finkelstein on Gaza's Future, the Cease-Fire Deal & Fallout from the U.S./Israeli War | SYSTEM UPDATE #407

77.8K61 -

4:15:00

4:15:00

Nerdrotic

8 hours ago $4.85 earnedCaptain Falcon America REVIEW, Disney Ending DEI? Rings of Power RETURNS | Friday Night Tights #341

152K22 -

9:34:03

9:34:03

FusedAegisTV

15 hours agoMario Galaxy, Batman, Real Talk/Politics, & MORE - V-Day 💗 Friday Variety Stream!

16.9K1 -

1:10:49

1:10:49

Vigilant News Network

4 hours agoRFK Jr. Drops a Stunning Announcement | The Daily Dose

38.5K26 -

49:49

49:49

Candace Show Podcast

7 hours agoEXCLUSIVE: Blake & Ryan’s Desperate Legal Strategy Exposed! | Candace Ep 147

156K122 -

1:32:20

1:32:20

2 MIKES LIVE

5 hours ago2 MIKES LIVE #180 with guest Kyle Rittenhouse!

33.8K2 -

9:40

9:40

Tactical Advisor

10 hours agoBest Home Defense Shotgun Build | Genesis Gen 12

31.2K -

56:44

56:44

VSiNLive

6 hours ago $3.22 earnedFollow the Money with Mitch Moss & Pauly Howard | Hour 1

59.2K1 -

1:05:48

1:05:48

The Amber May Show

10 hours ago $2.22 earnedBig Balls | You Know It's Bad When Legacy Media Reports On Big Balls | Sam Anthony

30.7K6