Premium Only Content

EARNING RELEASE: COCA-COLA, MCDONALD'S, AMD, QUALCOMM, AMAZON, LILLY, PFIZER

Claim your Moomoo welcome rewards https://j.moomoo.com/01Iik6

Gate.io Crypto exchange, Web3, NFT, Defi

https://www.gate.io/ref/X1NDAVk?ref_type=102

OKX Crypto exchange and Wallet

https://okx.com/join/9458250

Bridget, enjoy the crypto trading joiner together.

https://bit.ly/3Bx99Mn

Enjoy the sharing ideas and earning

https://rumble.com/register/themarkets

Check out https://linktr.ee/thecapmarkets for complete coverage along with all the latest financial news and data!

#invest #longterm #stock #money #bitcoin #financialfreedom #ipo

-----

Analyzing the most anticipated earnings releases for the week of February 3, 2025, here’s a strategy tailored for both traders and investors based on potential market reactions and long-term fundamentals.

---

1. Trading Strategy (Short-Term - High Volatility Plays)

Goal: Capture earnings-driven price swings for quick gains.

Key Trading Considerations:

Implied Volatility (IV) & Options:

Stocks like AMD, Alphabet, Amazon, Tesla, and PayPal usually experience high IV before earnings, making them attractive for straddle or strangle options strategies.

Consider selling volatility post-earnings if IV collapses significantly.

Earnings Momentum & Sentiment:

Strong past performance + positive guidance = potential breakout (e.g., NVIDIA, Meta, Tesla in prior earnings cycles).

Recent underperformance + weak guidance = potential breakdown (e.g., Snap, Peloton).

After-Hours Gaps & Pre-Market Moves:

Monitor post-earnings price action—many high-beta stocks make their biggest moves outside of regular trading hours.

Stocks like Qualcomm (QCOM), AMD, and Uber can move 5–10% on earnings day.

Key Trades to Consider:

Bullish Plays:

PayPal (PYPL): If earnings show strong growth, the stock could rally after a tough year.

AMD (AMD): If data center and AI chips drive revenue, a post-earnings rally could follow.

Alphabet (GOOGL): Watch for AI and ad revenue growth—strong earnings could push it to new highs.

Amazon (AMZN): If AWS revenue outperforms, expect a strong move higher.

Bearish or Cautious Plays:

Snap Inc. (SNAP): If advertising struggles, expect post-earnings downside.

Peloton (PTON): A weak consumer demand outlook could push shares lower.

Newell Brands (NWL): If earnings show ongoing inventory issues, further downside is possible.

---

2. Investing Strategy (Long-Term - Fundamental Growth Focus)

Goal: Build long-term positions in strong businesses while avoiding weak performers.

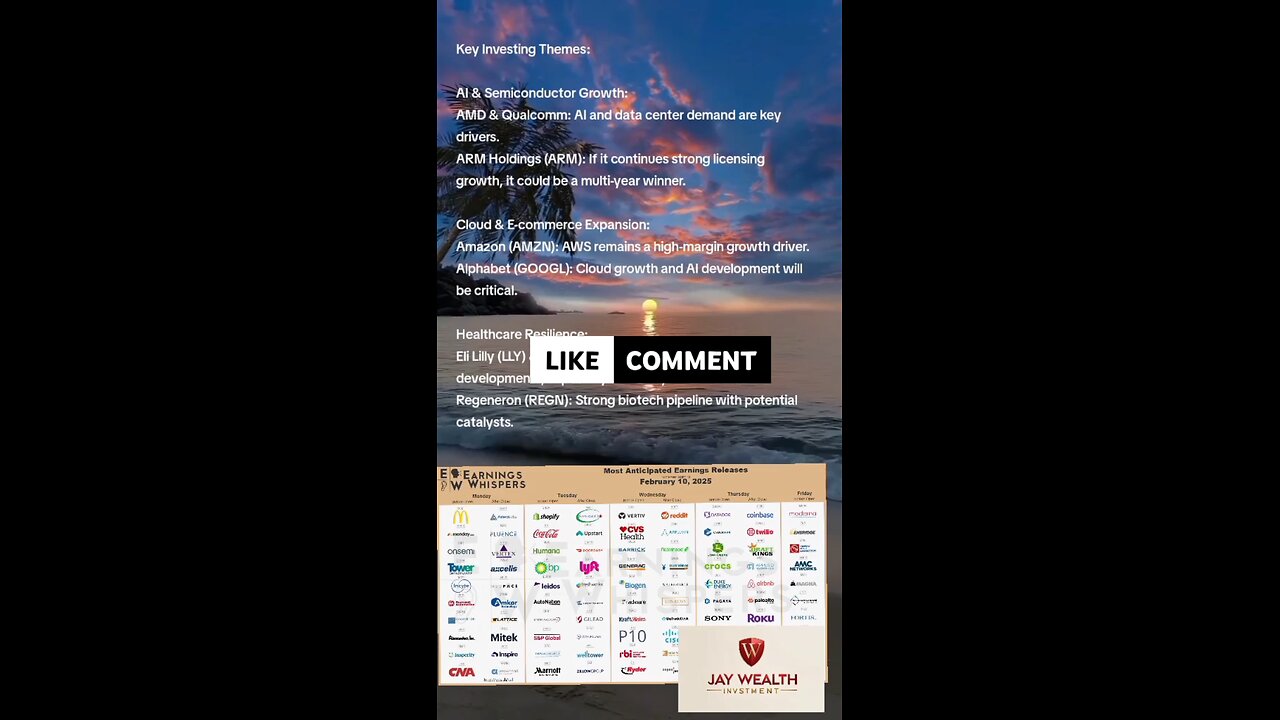

Key Investing Themes:

AI & Semiconductor Growth:

AMD & Qualcomm: AI and data center demand are key drivers.

ARM Holdings (ARM): If it continues strong licensing growth, it could be a multi-year winner.

Cloud & E-commerce Expansion:

Amazon (AMZN): AWS remains a high-margin growth driver.

Alphabet (GOOGL): Cloud growth and AI development will be critical.

Healthcare Resilience:

Eli Lilly (LLY) & Pfizer (PFE): Watch for new drug developments, especially in obesity and diabetes.

Regeneron (REGN): Strong biotech pipeline with potential catalysts.

Consumer Spending & Brands:

Chipotle (CMG) & PepsiCo (PEP): If they show resilience in pricing power, they remain great long-term holdings.

Hershey (HSY) & Estee Lauder (EL): Good defensive plays if the economy slows.

Key Investing Moves:

Buy & Hold:

Long-term growth: AMD, Amazon, Alphabet, Eli Lilly.

Dividend stability: PepsiCo, Hershey, Johnson Controls.

Avoid or Reduce Exposure:

High debt & struggling brands: Peloton, Newell Brands.

Weak advertising businesses: Snap Inc., Pinterest (PINS) if ad revenue is slowing.

---

Final Recommendations

Would you like specific trade setups (e.g., options strategies) for any stock?

-

2:05:49

2:05:49

Badlands Media

1 day agoDevolution Power Hour Ep. 336

71.1K19 -

14:11

14:11

DeVory Darkins

10 hours ago $12.95 earnedFetterman SLAMS Democrats during shocking MSNBC Interview

34.7K46 -

8:42

8:42

Chris Williamson

1 year agoThe Harsh Reality Of Our Collapsing Birthrate - Jordan Peterson

16.7K9 -

4:33:31

4:33:31

Alex Zedra

7 hours agoLIVE! Playing Split Ficition!

36.6K5 -

2:51:38

2:51:38

TimcastIRL

8 hours agoGovernment SHUTDOWN IMMINENT, Democrats Vow To BLOCK Trump CR w/The Native Patriot | Timcast IRL

166K93 -

3:38:57

3:38:57

Digital Social Hour

1 day ago $15.04 earnedAndrew Tate EXPOSES the Truth About Legal Battles, Politics & Masculinity | Andrew Tate DSH #1231

45.5K21 -

2:26:29

2:26:29

Laura Loomer

8 hours agoEP108: Dems Embrace Domestic Terrorism To "Get Trump"

54.5K18 -

3:01:51

3:01:51

Right Side Broadcasting Network

10 hours agoWATCH: NASA’s SpaceX Crew-10 Launch

105K39 -

2:06:17

2:06:17

Glenn Greenwald

9 hours agoJudge Orders Hearing on Columbia Student Deportation Case; Is the Ukraine Ceasefire Plan Serious? Trump Attacks Thomas Massie for His Budget Vote | SYSTEM UPDATE #422

120K161 -

47:16

47:16

BonginoReport

12 hours agoTrump-Elon Bromance Triggers The Libs (Ep.03) - 03/12/2025

153K279