Premium Only Content

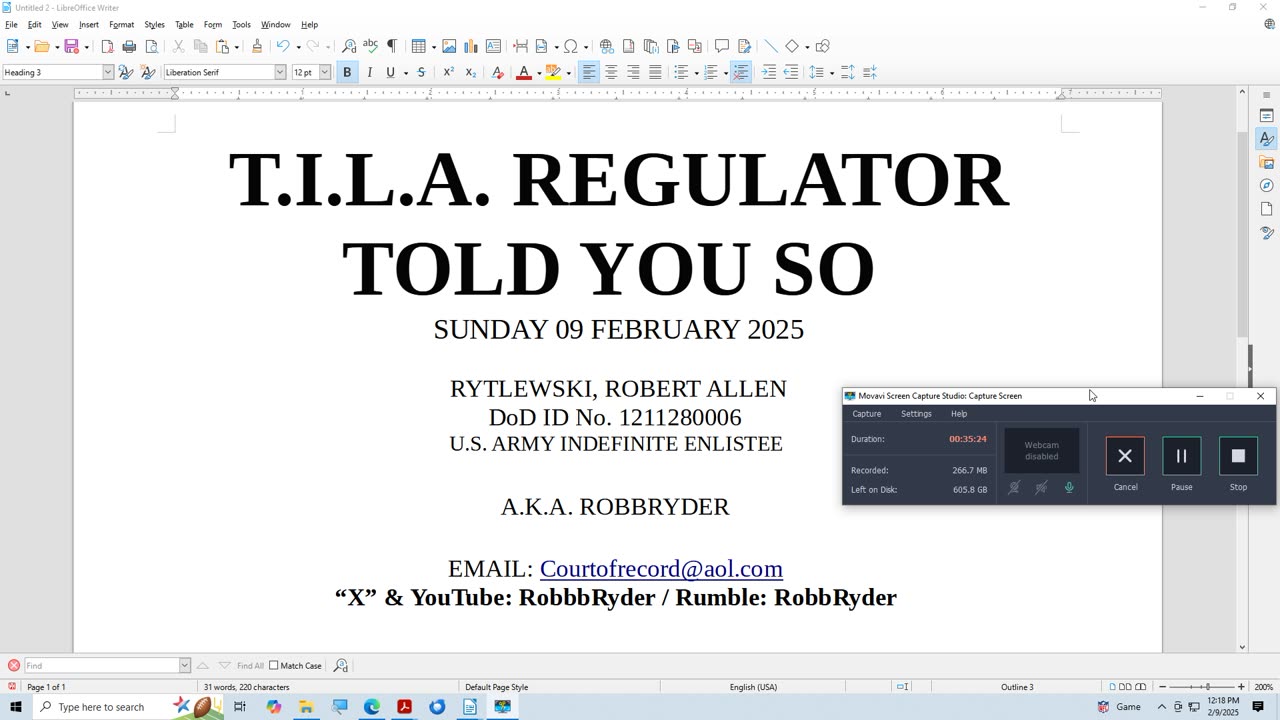

T. I. L. A. REGULATOR -- TOLD YOU SO

In the continuing series of videos pertaining to the "Truth In Lending Act" (T.I.L.A.) we reached the point where an alleged "Regulator" responded to the Complainant.

Specifically, the Missouri Division of Finance (DOF) which claims to regulate banks, credit unions, and lenders operating in Missouri. This Regulator informed the Complainant that it had contacted the Lender and gave the Lender 21 days to reply.

Instead of waiting 3 weeks I asked the Complainant to ask the Regulator to "Do the Math" and verify the Complainant's calculations.

Instead of following the law on calculating APR the Regulator relied on a computer program (calculation tool) from a website, and replied to the Complainant that the program calculated APR was within tolerance allowed by law.

https://www.ffiec.gov/examtools/FFIEC-Calculators/APR/#/accountdata

What the Regulator failed to mention is that the "Law" specified how APR is to be calculated "The annual percentage rate shall be determined in accordance with either the actuarial method or the United States Rule method. Explanations, equations and instructions for determining the annual percentage rate in accordance with the actuarial method are set forth in appendix J to this part" (12 C.F.R. § 1026.22 Determination of annual percentage rate).

This is not what the Regulator did. (Neither have we, but the method I show was provided by AI (GROK), and is close enough for government work.

But there is more.

Neither the Missouri Division of Finance (DOF) nor any other State Regulator is mentioned in T.I.L.A., which specifically mentions that Federal Regulators are responsible for T.I.L.A.

Nevertheless, "IS" is what it is, and so what to do now is the basis of the video.

-

35:56

35:56

Standpoint with Gabe Groisman

1 day agoGlobal Terror: Were Your Tax Dollars Funding It? with Gregg Roman

6.47K5 -

2:33:27

2:33:27

The Quartering

4 hours agoTrump's Most SAVAGE Order Yet, Tesla TERROR Backfires, Woke Snow White BOMBS, RFK Vs Food Dye!

173K146 -

16:38

16:38

Friday Beers

2 hours ago $0.88 earnedDrunk Mario Kart Goes HAYWIRE I Friday Beers Tournament

21.2K4 -

LIVE

LIVE

SternAmerican

1 day agoIntegrity in Action call With Steve Stern and Raj Doraisamy Thursday, March 20th at 2:00PM EST

133 watching -

1:25:01

1:25:01

Sean Unpaved

4 hours agoMarch Madness Bracket Picks: Final Four & Winner; Rapid Fire Round!

12.7K3 -

32:13

32:13

Professor Nez

2 hours ago🚨BOMBSHELL DISCOVERY: Declassified JFK Files Point to U.S. Ally's Involvement in A*sassination!

19.9K27 -

LIVE

LIVE

PudgeTV

1 hour ago🟡Practical Pudge Ep 59 | Tundra Tactical - Building a Guntube Community Under Youtube Censoroship

77 watching -

2:52:39

2:52:39

VINCE

4 hours agoLIVE: The VINCE Radio Show - 03/20/25

124K43 -

48:42

48:42

Ben Shapiro

3 hours agoEp. 2162 - The Case For Derek Chauvin | Episode 2: The Incident

52.3K30 -

1:58:55

1:58:55

The Charlie Kirk Show

4 hours agoAbolishing the Ed Department + What the JFK Files Reveal | Pestritto, Stone | 3.20.25

105K48