Premium Only Content

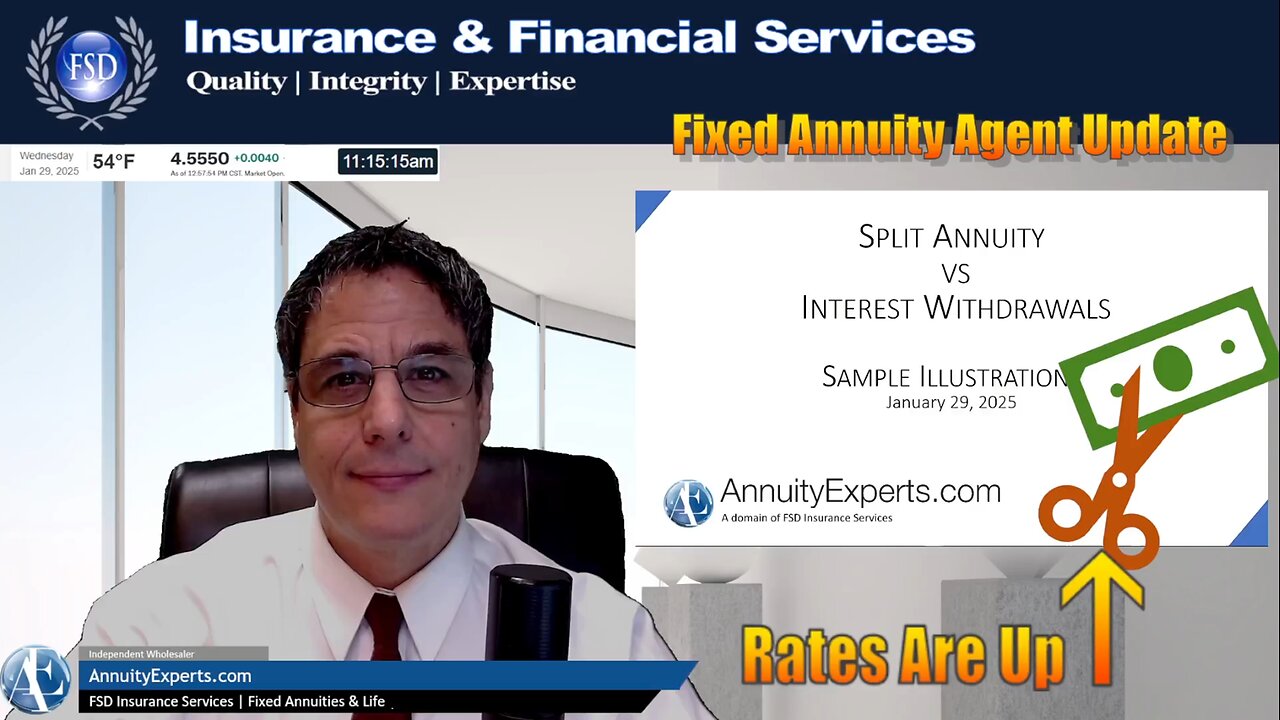

$500,000 - Split Annuity vs Interest Only withdrawals

$500,000 - Split Annuity vs Interest Only withdrawals

A breakdown of annuity income concepts and results.

✅ SPLIT BREAKDOWN

MYGA Premium = $346,008.00

SPIA Premium = $153,992.00

MYGA Rate = 5.40% for 7 Years (grows to $500K)

SPIA Income: $2,118.04 for 84 payments then ends

(86.6% tax excluded)

$1,834.22 Non Taxable

$283.82 Taxable @ 30% tax = $85.15

$2,118.04 - $85.15 = $2,032.89 after tax

✅ INTEREST ONLY BREAKDOWN

MYGA Premium = $500,000

MYGA Rate = 5.40% for 7 Years

Interest Income:

31 day month = $211.67 ($1,580.96 after tax)

30 day month = $204.84 ($1,529.96 after tax)

28 day month = $191.19 ($1,427.96 after tax)

X - https://x.com/MrFixedAnnuity

YouTube - https://www.youtube.com/@annuityexperts

LinkedIn - https://www.linkedin.com/in/jeff-affronti-a1551834/

Instagram - https://www.instagram.com/annuityexperts/

Rumble - https://rumble.com/c/c-1096761

Facebook - https://www.facebook.com/annuityexperts

annuities, annuity commission, annuity experts, annuity interest rates, annuity marketing, California annuities, client oriented, combo split annuity, deferred annuity, fixed annuity, fsd financial, Guaranteed Lifetime Income, immediate annuity, insurance, life insurance agents, life only, jeff affronti, multi-year guarantee annuity, Qualified Longevity Annuity Contracts, QLAC, MYG annuity, myga rates, partial 1035 exchange, retirement income, retirement planning, savings rates, spia quote, surrender charges, tax deferral, walk away annuity, tax exclusion ratio, joint life annuity, inflation protected income, COLA, cost of living adjustments, deferred annuity

IMPORTANT INFORMATION

This material is for informational, educational & entertainment purposes.

It is not a recommendation to buy, sell, hold or rollover any asset.

It does not take into account the specific financial situation, investment objectives, or insurance need of an individual person.

Withdrawals may be subject to ordinary income taxes and, if made prior to age 59½, may be subject to a 10% IRS penalty.

Surrender charges may also apply for early or excess withdrawals.

All guarantees are backed by the claims-paying ability of the issuer.

Products are available only in all states where approved.

Please note that most SPIA quote rates are valid for 7 days.

For the latest ratings, access https://web.ambest.com/home

-

LIVE

LIVE

Mally_Mouse

1 hour agoSaturday Shenanigans!! - Let's Play: Mario Party Jamboree

660 watching -

LIVE

LIVE

Patriots With Grit

5 hours agoWill Americans Rise Up? | Jeff Calhoun

726 watching -

14:55

14:55

Exploring With Nug

5 hours ago $4.52 earnedWe Found Semi Truck Containers While Searching for Missing Man!

25.3K4 -

27:57

27:57

MYLUNCHBREAK CHANNEL PAGE

13 hours agoOff Limits to the Public - Pt 3

47.7K49 -

38:07

38:07

Michael Franzese

6 hours agoLeaving Organized Crime and Uncovering Mob in Politics: Tudor Dixon and Michael Franzese

41.2K12 -

2:42:54

2:42:54

Jewels Jones Live ®

1 day agoAMERICA IS BACK | A Political Rendezvous - Ep. 111

39.1K38 -

LIVE

LIVE

Due Dissidence

1 day agoLIVE: Workers Strike Back Conference ft. Chris Hedges, Jill Stein, Kshama Sawant, and More!

1,078 watching -

8:36:37

8:36:37

Right Side Broadcasting Network

5 days agoLIVE REPLAY: CPAC 2025 Day Three with President Donald J. Trump - 2/22/25

389K90 -

1:05:34

1:05:34

The Big Mig™

14 hours agoConfirmed Kash Patel New FBI Director, Bring On The Pain |EP483

72.5K21 -

53:59

53:59

Tactical Advisor

10 hours agoThe Vault Room Podcast 009 | Everyone Getting $5000?!

63.2K11