Premium Only Content

#OnThisDate February 3, 1913: Income Tax Empowered

https://history-collectors.com/ | Own A Piece Of History

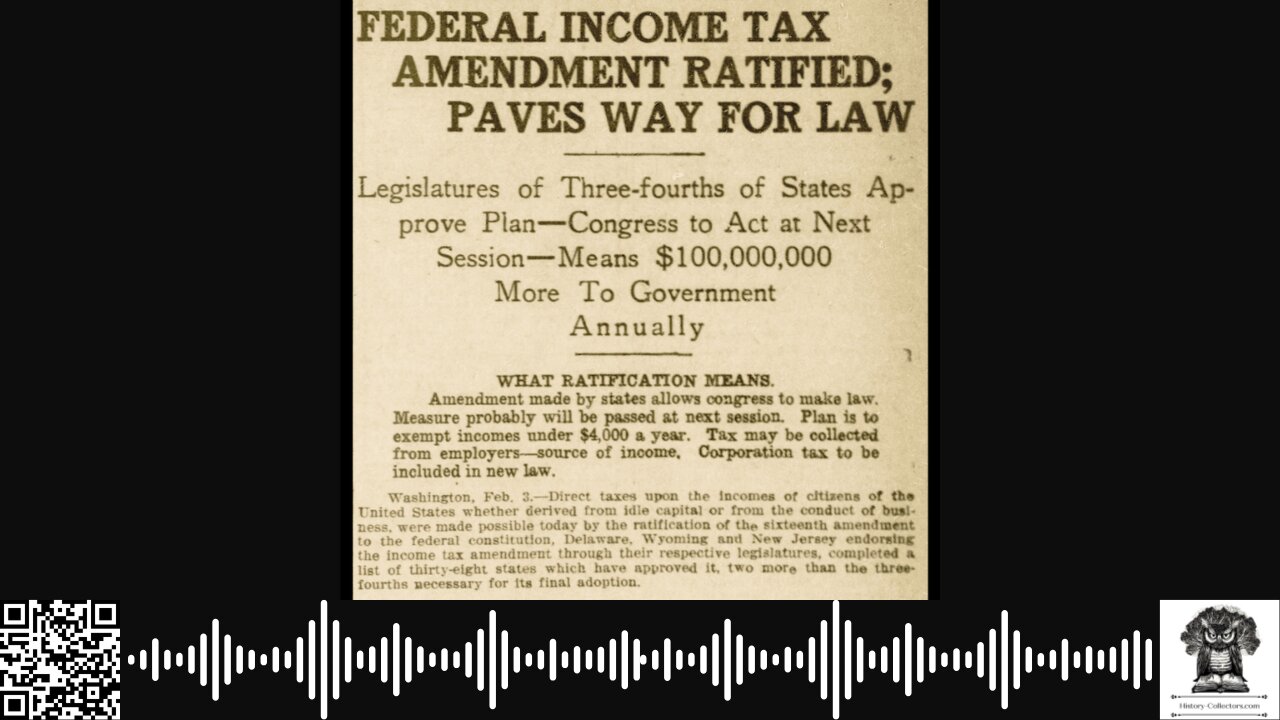

The United States Ratified The Sixteenth Amendment, Granting Congress The Authority To Levy Income Taxes Without Apportioning Them Among The States. This Change Addressed Limitations Imposed By The Supreme Court's 1895 Decision In Pollock V. Farmers' Loan & Trust Co., Which Had Declared Previous Federal Income Taxes Unconstitutional.

During The Civil War, Congress Enacted The Revenue Act Of 1862, Introducing A Temporary Income Tax To Fund War Expenses. This Tax Was Repealed In 1872. In 1894, Congress Attempted To Implement A Peacetime Income Tax Through The Wilson-Gorman Tariff Act. However, The Supreme Court's Ruling In Pollock Deemed Taxes On Income From Property As Direct Taxes, Requiring Apportionment Among The States, Rendering The 1894 Income Tax Unconstitutional.

In Response To The Pollock Decision, Congress Proposed The Sixteenth Amendment On July 2, 1909. The Amendment Sought To Clarify Congress's Power To Tax Incomes Without Apportionment. Over The Next Few Years, State Legislatures Debated Its Adoption. By February 3, 1913, The Necessary Three-Fourths Of States Had Ratified The Amendment, Officially Incorporating It Into The Constitution.

Following Ratification, Congress Enacted The Revenue Act Of 1913, Reintroducing A Federal Income Tax. The Act Imposed A One Percent Tax On Personal Incomes Above Three Thousand Dollars And A Six Percent Tax On Incomes Exceeding Five Hundred Thousand Dollars. This Legislation Marked The Beginning Of A Consistent Federal Income Tax System, Providing A Significant Revenue Source For The Government.

The Sixteenth Amendment's Ratification Represented A Transformative Moment In American Fiscal Policy. It Enabled The Federal Government To Generate Revenue Directly From Citizens' Incomes, Reducing Reliance On Tariffs And Excise Taxes. This Shift Allowed For Expanded Federal Programs And Services, Shaping The Modern Relationship Between The Government And Its Citizens.

The Ratification Of The Sixteenth Amendment On February 3, 1913, Was A Landmark Event That Redefined Federal Taxation Authority. By Empowering Congress To Levy Income Taxes Without Apportionment, It Addressed Previous Constitutional Challenges And Established A Foundation For The Contemporary Fiscal Landscape Of The United States.

--------------------------------------------------------------------------------------------

Whether You're Commuting, Working Out, Or Just Relaxing, These Recordings Give You The Freedom To Absorb Knowledge At Your Own Pace, Wherever You Are.

Tune In To Focus Deeply On The Content Without Visual Distractions, And Easily Control Playback To Review Complex Topics As Needed.

Perfect For Auditory Learners Or Anyone Looking To Maximize Their Time — Click Play All To Listen Now And Transform Your Time Into A Productive Learning Session!

For Enthusiasts Of Historical Ephemera, Visit History-Collectors.com To Find Collectibles That Might Complement Your Collection.

You Can Own A Piece Of History.

Before You Go, A Simple Way To Support The Efforts Of This Channel Is To Like, Subscribe, Comment And Share.

Follow: https://rumble.com/c/c-6336896

-

4:17

4:17

History-Collectors.com

4 days ago#OnThisDate January 31, 1958: America’s Space Breakthrough

7 -

LIVE

LIVE

Bare Knuckle Fighting Championship

3 hours agoThe Bare Knuckle Show with Brian Soscia

246 watching -

LIVE

LIVE

The Shannon Joy Show

3 hours ago🔥SHOCK Report - The COVID Dossier! A Coordinated Global Military Operation: Live EXCLUSIVE W/ Sasha Latypova & Debbie Lerman.🔥

496 watching -

1:57:04

1:57:04

Steven Crowder

4 hours ago🔴 USAID Exposed: Everything You Need to Know Featuring Mike Benz

301K166 -

LIVE

LIVE

LFA TV

17 hours agoCLEANING HOUSE!! | LIVE FROM AMERICA 2.4.25 11am

5,548 watching -

DVR

DVR

Bannons War Room

1 year agoWarRoom Live

111M -

2:07:20

2:07:20

Matt Kohrs

12 hours agoTrump Pump Returns, Palantir (PLTR) Dominates & Breaking News || The MK Show

68.5K4 -

12:11

12:11

EvenOut

13 hours ago $1.53 earnedTaking Pictures of Strangers, Then Appearing With Their Printed Photo Twin Prank

31.9K7 -

32:11

32:11

BonginoReport

6 hours agoWinning: Trump Forces Canada and Mexico Into Total Surrender (Ep.132) - 02/04/2025

149K111 -

51:51

51:51

Randi Hipper

3 hours agoBITCOIN PRICE FACES VOLATILITY AS ALTCOIN TAKE A HIT! LATEST MARKET UPDATE

33.9K2