Premium Only Content

Usury Unveiled: The Esoteric Engine of Debt, Power, and Human Destiny

(A Master-Level Exploration of Interest-Based Finance, Its Hidden History, and the Struggle for Liberation)

Introduction: The Great Secret of Debt

Money. For centuries, it has been the bloodstream of civilizations, fueling trade, innovation, and ambition. Yet beneath the skin of this monetary system lies a quietly beating heart: usury—the practice of charging interest on loans. Far from an innocuous economic tool, usury has historically functioned as a subtle, relentless form of control. Ancient warnings, religious prohibitions, and even so-called “conspiracy theories” have all whispered that interest-based debt is a cunning lever of power, siphoning collective wealth and energy into a small, commanding elite.

This article aims to surpass conventional histories of usury, diving deeply into esoteric threads, sociopolitical manipulations, spiritual ramifications, and the potential for a grand “cosmic realignment” if humanity breaks free from the matrix of interest and perpetual debt.

1. Usury’s Ancient and Mystical Origins

1.1 Babylon, Temple Loans, and the Roots of Servitude

Modern accounts typically trace usury back to ancient Mesopotamia, where clay tablet records show loans given in grain or silver at set interest rates. The “Code of Hammurabi” tried to curtail predatory rates, aware that cyclical peonage threatened community well-being. But a lesser-known dimension emerges from cuneiform texts referencing temple-based financial rites, where priests or priestesses administered “holy loans.” Could early money-lending have carried more than a simple trade dynamic—perhaps a ritual of subjugation or “spiritual pledging,” using interest as an energetic bond?

Esoteric Angle: Some interpret these temple systems as forging psychic or karmic ties between debtor and lender, inadvertently forming the blueprint of modern centralized banking.

1.2 The Templar Paradox: Usury’s Shifting Moral Compass

Millennia later, the Christian medieval period famously outlawed usury, labeling it a mortal sin. Yet, ironically, groups like the Knights Templar created advanced proto-banks across Europe. They nominally avoided direct interest but collected “fees” suspiciously akin to it. Eventually, the Templars fell to a conspiracy culminating on Friday the 13th, 1307, orchestrated by kings who coveted their wealth and secret finances.

Key Lesson: Even societies condemning interest found workarounds or hypocritical exceptions. The Templars, with rumored “esoteric knowledge” gleaned from the Holy Land, threatened the established “usurer class,” paying a steep price in the form of orchestrated mass arrests and property seizures.

2. The Usury Mechanism: An Energetic Trap or Cosmic Parasite?

2.1 Debt as an Alchemical Bond

From an esoteric vantage, a loan with interest isn’t merely an economic contract but a metaphysical agreement. Some traditions interpret debt as forging a subtle link—a tether—between the debtor’s life force and the creditor’s ledger, fueling an unseen “loosh” or psycho-energetic harvest.

• Enslaving Emotional States: Chronic debt fosters anxiety, guilt, or survival fear, emotions said to be “low-frequency” which might be beneficial to hidden power structures or “astral parasites.”

• Moral or Karmic Twist: The line “forgive us our debts, as we forgive our debtors” in religious texts underlines that spiritual stagnation arises from prolonged debt, perpetuating cyclical bondage.

2.2 Guilt as a Silent Enforcement

A complementary dimension is “financial guilt,” used by family, community, or institutions to corner individuals into compliance. Debt-based societies equate moral virtue with “repaying every penny plus interest,” conflating spiritual righteousness with submission to the system:

1. Shame Factor: People drowning in loans often hide their predicament, thus isolating themselves from potential solidarity or alternative solutions.

2. Never-Ending Obligation: As interest accumulates, payoff drifts further away, entrenching dependence on new credit lines or the “financial hamster wheel.”

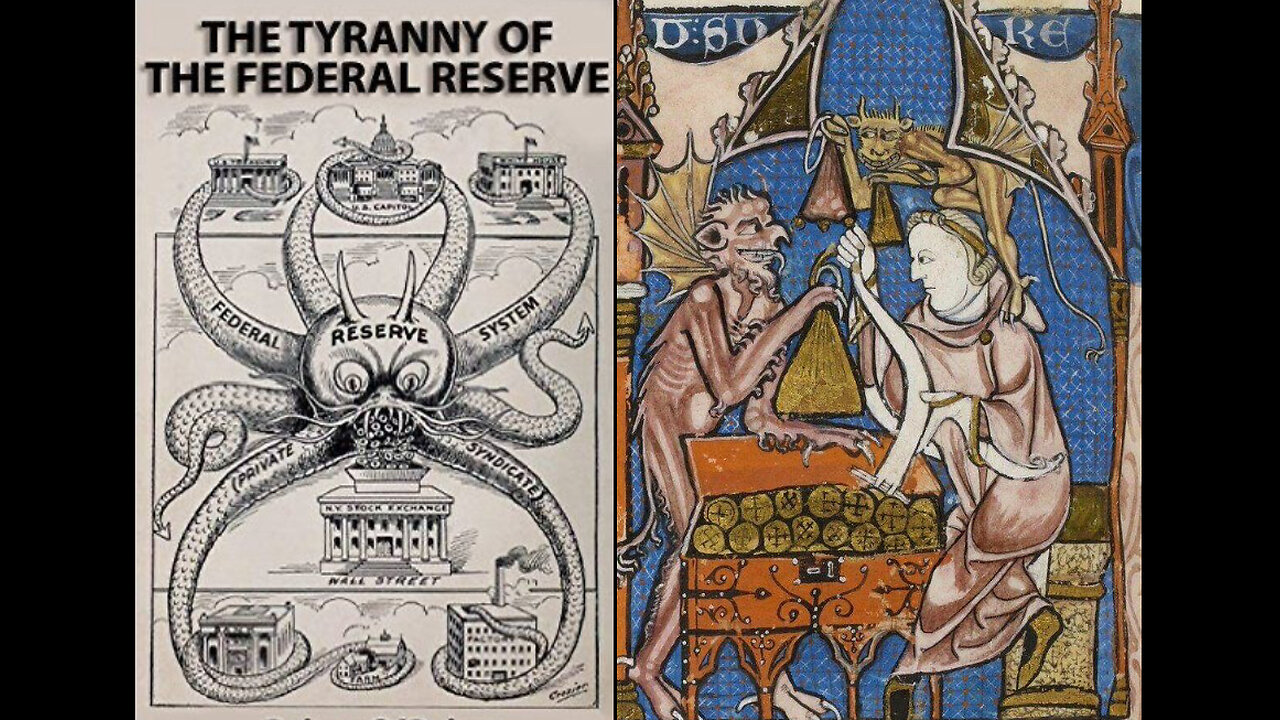

3. The Modern Banking Octopus: From Federal Reserves to IMF

3.1 Central Banks and the Illusion of Choice

Created in 1913, the U.S. Federal Reserve cunningly privatized currency issuance under the guise of stability. In essence, each dollar is loaned into existence, ensuring that every note in circulation corresponds to debt plus interest. Nations worldwide replicate this model:

• Global Web: Through the Bank for International Settlements (BIS) in Switzerland and allied central banks, a near-universal architecture enforces the interest-based system.

• Permanent Scarcity: Because the principal is introduced but not the interest, total debt outstrips available money, guaranteeing perpetual shortfall.

3.2 International Monetary Fund (IMF) & World Bank: Colonialism 2.0

Post–World War II, direct colonialism gave way to “financial colonialism.” Lending packages to developing nations come laced with conditions that privatize resources, hamper local autonomy, and lock countries into cyclical debt.

Esoteric Observers Note: This can be seen as a global net, orchestrated by a hidden “money wizard class,” ensuring each region remains entangled in debt obligations, reinforcing a covert energetic drainage funneling wealth upward.

4. The Digital Age of Usury: CBDCs, AI, and the Coming Enslavement

4.1 Central Bank Digital Currencies (CBDCs) and Automated Control

As countries pilot or plan CBDCs, the idea of a fully digital currency emerges, theoretically bypassing the need for physical cash. But the deeper implication:

1. Programmable Money: Governments can impose negative interest rates, automatic taxation, or restricted spending if your “behavior score” drops.

2. Surveillance Mechanism: AI algorithms track every purchase, merging financial activity with social credit systems. The usury relationship intensifies—owing the system becomes near-inescapable as digital tokens can vanish or freeze at a central authority’s whim.

4.2 AI-Managed Lending

AI might soon determine interest rates or “creditworthiness,” applying real-time data about personal habits, location, or social associations. This “next-level usury” cements total dependence:

• Dynamic Interest: If an AI sees your “risk” factors spike, it might auto-adjust your interest rate upward, further entrenching the cycle of debt.

• Algorithmic Nudges: The system might gate your spending for “carbon footprint” reasons or restrict “non-essential” purchases—blurring the line between moral governance and financial policing.

5. Cracks in the System: Paths to Breaking the Debt Spell

5.1 Decentralized Finance (DeFi) and Crypto

Despite controversies, cryptocurrencies challenge the central bank stranglehold:

1. Interest-Free Transactions: Peer-to-peer exchanges can skip institutional lenders, avoiding interest-based pitfalls.

2. Sound Money: Bitcoin’s supply cap ensures deflationary tendencies, undermining the “infinite debt” model.

3. Self-Custody: Owning your keys is a micro-liberation from the old usury script.

5.2 Revival of Ancient Lending Morals & Community Finance

Jubilee or periodic debt forgiveness once protected societies from crippling servitude. Could modern co-ops or local credit circles reintroduce interest-free or minimal-interest frameworks?

• Islamic Banking: Offers profit-sharing models, presumably interest-free, aligning with older moral codes.

• Mutual Credit: Some local networks allow trade without interest, each transaction anchored by a community ledger—usury is absent.

5.3 Spiritual Shift: Recasting Debt as an Energetic Choice

A deeper evolution might involve:

• Personal Awareness: Recognizing that perpetual debt is not “inevitable” but a mental construct shaped by modern finance.

• Value Realignment: If entire communities question “usury-based growth,” they might reorganize priorities—downscaling material mania and cultivating local sufficiency.

Conclusion: Confronting the Hidden Majesties and Dangers of Usury

Usury is far more than a numerical percentage assigned to a loan. Beneath that innocuous transaction lurks a centuries-old apparatus fueling wars, toppling governments, and shaping spiritual states of being. From ancient Sumerian temples to the monolithic central banks of today, the thread is consistent: interest-based finance fosters a slow, methodical siphoning of human vitality and wealth into a global oligarchy. The digital horizon—AI-driven central bank digital currencies—looms as the final iteration of total economic subjugation.

Yet, glimmers of an alternative path remain: decentralized financial innovations, moral codes that reject exploitative lending, and a reawakening to the spiritual dimension of currency. If society acknowledges the magnitude of usury’s hidden history and cosmic cost, it can challenge the engine of debt-based control. Freed from its cyclical illusions, humanity might chart an era where wealth creation and spiritual progress align—an age absent the quiet tyranny of interest.

Final Note: The question stands whether we, as a collective, will passively drift into a hyper-digitized usury cage or awaken to the possibility of forging new financial forms, recapturing sovereignty, and transcending a system that has corralled civilizations for millennia. The choice is ours to make—when we unmask usury, we unmask a deeper cosmic game.

-

4:18

4:18

FragmentsOfTruth

3 days agoThe Blood-Brain Barrier & Vaccines: Are We Poisoning Developing Minds?

1702 -

LIVE

LIVE

Akademiks

2 hours agoKendrick Lamar SPEAKS for first time SINCE BEEF in new Interview. Drake preppin new album. YE WYLING

3,055 watching -

2:12:17

2:12:17

Tucker Carlson

3 hours agoMike Benz Takes Us Down the USAID Rabbit Hole (It’s Worse Than You Think)

95.9K92 -

1:47:17

1:47:17

Roseanne Barr

7 hours ago $14.10 earnedThe Most Offensive Comic, Leonarda Jonie | The Roseanne Barr Podcast #86

69.7K63 -

LIVE

LIVE

Joker Effect

3 hours agoRumble Community Night. Reviewing Rumble partnership program, it's streamers and community discussion.

1,623 watching -

2:29:56

2:29:56

Laura Loomer

4 hours agoEP100: MAGA Goes Scorched Earth On USAID

46.2K33 -

51:45

51:45

Talk Nerdy 2 Us

5 hours ago🔥 Talk Nerdy 2 Us – Feb 7th: HACKED, TRACKED & UNDER ATTACK! 🔥

13.2K2 -

58:33

58:33

Man in America

12 hours agoFluoride & the Sinister Plot to Poison Us From Birth w/ Larry Oberheu

23.2K11 -

LIVE

LIVE

I_Came_With_Fire_Podcast

12 hours ago🔥USAID SCANDAL | MA-GAZA | Cartel VIOLENCE Ramps Up🔥

1,132 watching -

LIVE

LIVE

SpartakusLIVE

6 hours agoShadow BANNED, but we PARTY ON || Friday Night HYPE

597 watching