Premium Only Content

EARNING: APPLE, MICROSOFT, META, TESLA

Claim your Moomoo welcome rewards https://j.moomoo.com/01Iik6

Gate.io Crypto exchange, Web3, NFT, Defi

https://www.gate.io/ref/X1NDAVk?ref_type=102

OKX Crypto exchange and Wallet

https://okx.com/join/9458250

Bridget, enjoy the crypto trading joiner together.

https://bit.ly/3Bx99Mn

Enjoy the sharing ideas and earning

https://rumble.com/register/themarkets

Check out https://linktr.ee/thecapmarkets for complete coverage along with all the latest financial news and data!

#invest #longterm #stock #money #bitcoin #financialfreedom

---

An overall investment strategy during earnings season (and beyond) should balance growth opportunities, defensive plays, and risk management. Here's a detailed plan:

---

1. Diversify Your Portfolio

Growth Stocks (40%): Focus on companies with strong earnings potential and innovation.

Examples: Meta, Microsoft, Tesla, Apple.

Strategy: Buy on dips after earnings volatility and hold for long-term capital appreciation.

Dividend Stocks (30%): Build stability through companies with consistent dividends.

Examples: ExxonMobil, Chevron, AbbVie, Mastercard.

Strategy: Reinvest dividends to leverage compounding over time.

Defensive Stocks (20%): Add stability with companies less sensitive to economic cycles.

Examples: Visa, UPS, healthcare stocks like AbbVie.

Speculative or Small-Cap Plays (10%): Allocate a smaller portion to riskier growth or turnaround stocks.

Examples: LendingClub, Wolfspeed.

---

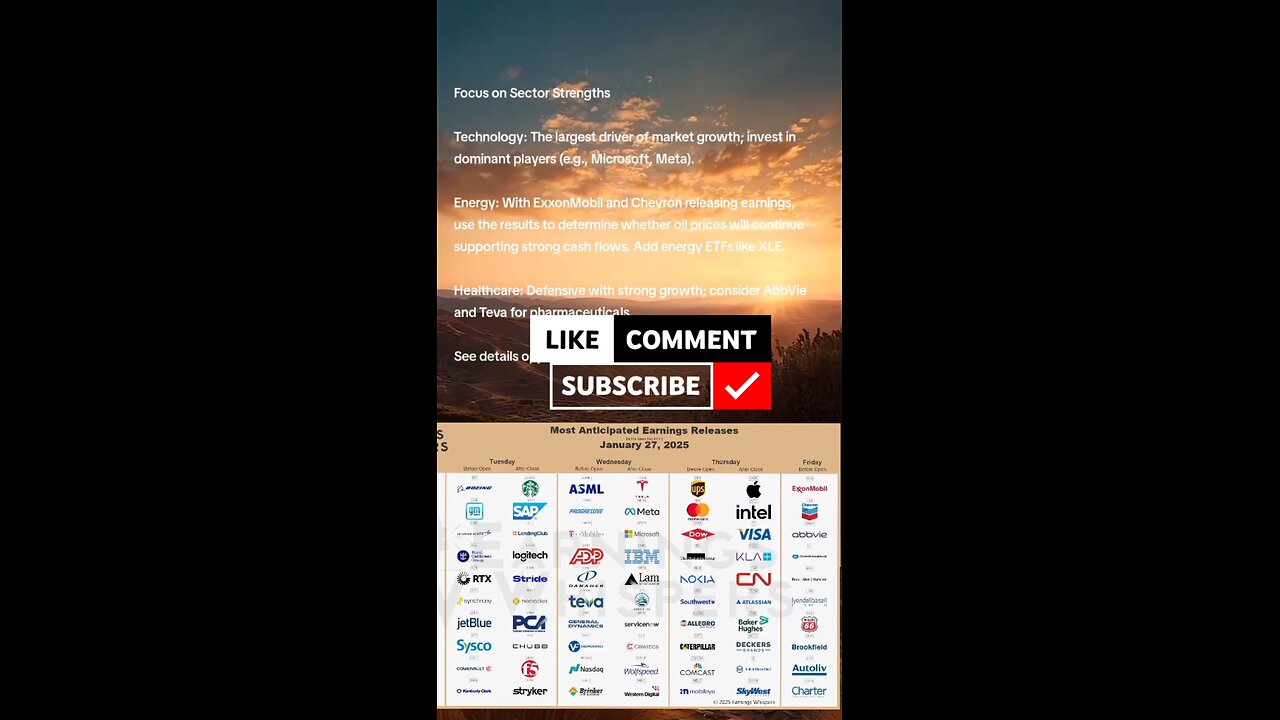

2. Focus on Sector Strengths

Technology: The largest driver of market growth; invest in dominant players (e.g., Microsoft, Meta).

Energy: With ExxonMobil and Chevron releasing earnings, use the results to determine whether oil prices will continue supporting strong cash flows. Add energy ETFs like XLE.

Healthcare: Defensive with strong growth; consider AbbVie and Teva for pharmaceuticals.

Industrial: Look into Caterpillar or RTX for exposure to infrastructure growth.

Financials: Rising interest rates can benefit financial institutions (e.g., Synchrony, banks like Bank of Hawaii).

---

3. Timing Your Investments

Pre-Earnings:

Identify undervalued stocks or sectors before earnings (e.g., tech if the NASDAQ shows momentum).

Avoid speculative plays unless you are willing to take on significant short-term risk.

Post-Earnings:

Use pullbacks to buy quality stocks that miss earnings due to temporary issues (e.g., Apple or Microsoft in case of supply chain commentary).

Focus on companies with strong forward guidance, as markets reward growth outlooks.

---

4. Long-Term Wealth Building

Dollar-Cost Averaging (DCA):

Regularly invest fixed amounts into key sectors like tech, healthcare, and energy to reduce timing risks.

Compounding:

Reinvest dividends from stocks like AbbVie or Chevron to maximize returns over time.

Index Funds or ETFs:

For broad exposure, invest in index funds like the S&P 500 (SPY), Nasdaq-100 (QQQ), or sector-specific ETFs like XLK (tech) or XLE (energy).

---

5. Risk Management

Set a Stop-Loss: Protect yourself from significant losses during volatile earnings season by setting predefined exit points.

Portfolio Rebalancing: After earnings, reassess your portfolio to ensure you remain aligned with your goals (growth vs. income).

Diversify Across Geographies: Add international exposure to reduce dependency on U.S. markets (e.g., through ETFs like VXUS).

---

6. Look for Long-Term Themes

AI & Tech Growth: Microsoft, Meta, and Nvidia (though not reporting this week) are leaders in AI. Invest with a multi-year horizon.

Energy Transition: Companies like ExxonMobil and Chevron may focus on renewables; monitor their plans during earnings calls.

Healthcare Innovation: Biopharma stocks like Teva and AbbVie are good long-term plays as populations age.

---

7. Avoid Common Pitfalls

Overreacting to Earnings Misses: Don't sell high-quality stocks unless there's a fundamental problem.

Speculation Over Fundamentals: Avoid chasing hype (e.g., buying after a massive earnings rally without clear upside left).

Ignoring Guidance: Focus on forward-looking statements from management, as these drive future performance.

---

Example Allocation:

Tech (35%): Microsoft, Meta, Apple, ETFs like QQQ.

Energy (20%): ExxonMobil, Chevron, XLE.

Healthcare (15%): AbbVie, Teva, or XLV.

Consumer/Financial (15%): Visa, UPS, and Synchrony.

Industrials (10%): Caterpillar, RTX.

Speculative/Other (5%): Small-cap or high-risk growth plays like LendingClub.

---

This strategy combines long-term stability with opportunities for growth and capitalizes on the post-earnings market movements. Would you like more details on any specific sector or stock?

-

1:16:36

1:16:36

Glenn Greenwald

6 hours agoGlenn Takes Your Questions: On Banning Candidates in the Democratic World, Expanding Executive Power, and Trump's Tariffs | SYSTEM UPDATE #437

104K43 -

40:09

40:09

Friday Beers

4 hours ago $0.72 earnedWii Golf Gets Heated: Friday Beers vs Full Squad Gaming

26.1K -

44:53

44:53

Man in America

11 hours agoThe DISTURBING Truth About Tariffs That NO ONE Is Talking About

26.3K13 -

32:30

32:30

Stephen Gardner

4 hours ago🚨BREAKING: Trump under INVESTIGATION for Stock Market Manipulation!

18.8K91 -

59:50

59:50

Motherland Casino

1 hour agoMel x Zofie

3.86K3 -

44:54

44:54

Ami's House

2 days agoThe Dave Smith Debate is Broken. Here's a Better Way In | Dave's Rogan Appearance

18.4K2 -

LIVE

LIVE

SlingerGames

3 hours agoDiving (get it?) Back Into Subnautica!

100 watching -

58:35

58:35

BonginoReport

7 hours agoFormer Trans Athlete Accepts Biological Reality - Nightly Scroll w/Hayley Caronia (Ep.24) - 04/10/25

136K80 -

LIVE

LIVE

The Sufari Hub

2 hours ago🔴NOT ENDING STREAM TILL I WIN - ROAD TO #1 GAMER ON RUMBLE - #RumbleGaming

18 watching -

1:49:21

1:49:21

Joker Effect

3 hours ago250$$ Giveaway! MOTHERLAND TAKEOVER!

18.5K