Premium Only Content

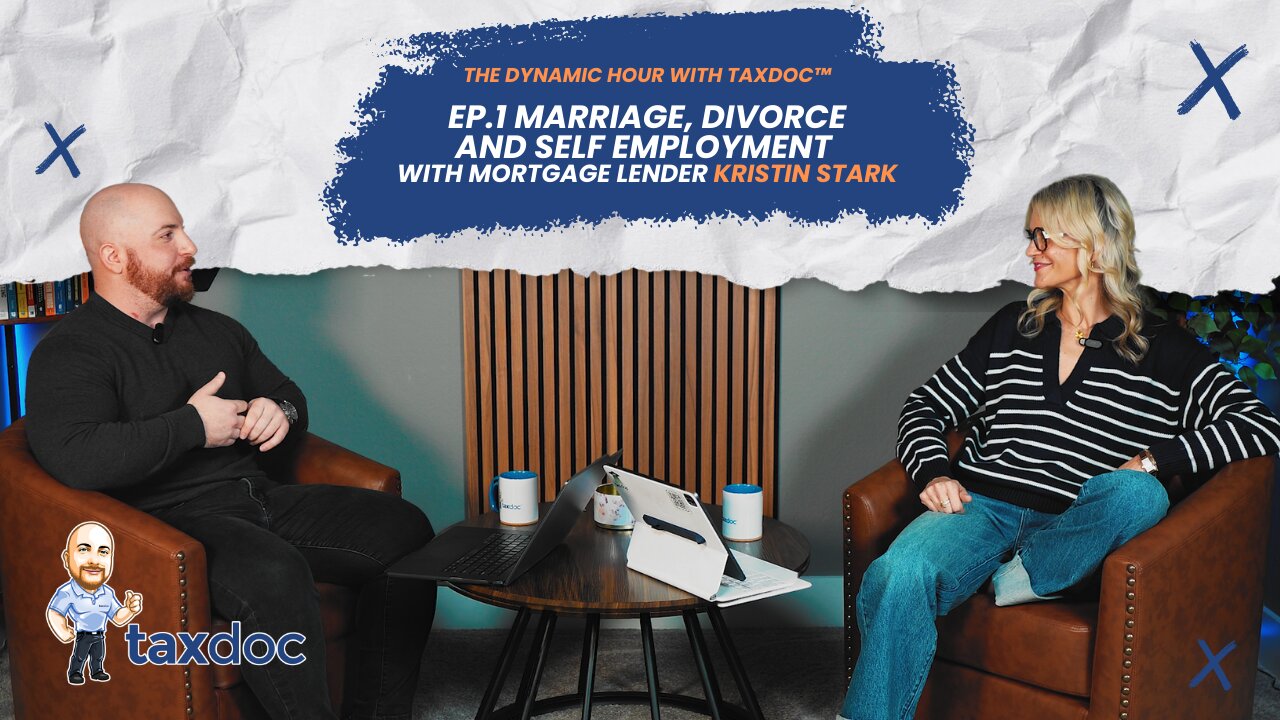

Ep. 1 - Marriage, Divorce and Self Employment with Mortgage lender Kristin Stark

In this episode of The Dynamic Hour with Taxdoc™, I sit down with my friend Kristin Stark, a seasoned and highly knowledgeable mortgage lender. Together, we dive into the fascinating intersections of marriage, divorce, self-employment, and how they impact both tax returns and mortgage qualifications.

We explore the unique challenges that come with these life events, including the setbacks and solutions for navigating them effectively. Whether you're curious about how self-employment income affects your mortgage application or how marital status can influence your tax filings, this episode has you covered.

We also share valuable insights and extra nuggets of information throughout our hour-long chat—making it both an informative and engaging conversation.

Don't miss out on this discussion packed with practical advice and relatable stories!

------------------------------------------------------

To reach Kristin:

Schedule a call! - https://calendly.com/kstark-cmgfi

See her website! - https://www.dsphomeloans.com

Shoot her an email! - KStark@cmgfi.com

Follow her on insta! - https://www.instagram.com/kristinstarkcmg/

------------------------------------------------------

Hit the like button, subscribe to the channel, and leave a comment below to share your thoughts or questions!

------------------------------------------------------

🔥 Looking for a consult? US Tax Planning & Returns, Accounting, and IRS Tax Resolution: https://calendly.com/realtaxdoc/consult

🔥 Follow on Instagram for additional content: @realtaxdoc

------------------------------------------------------

Disclaimer: The information on this channel and in this episode is for educational purposes only and should not be mistaken for professional legal, financial or tax advice. Always consult a professional about your specific situation.

-

LIVE

LIVE

Precision Rifle Network

1 day agoS4E5 Guns & Grub - The Best Rifle Under $2000

20 watching -

1:02:54

1:02:54

Glenn Greenwald

23 hours agoSouth Korean Economist Ha-Joon Chang on the Economic World Order, Trump's Tariffs, China & More | SYSTEM UPDATE #410

29.3K23 -

1:02:27

1:02:27

Donald Trump Jr.

6 hours agoBye Mitch, plus Kash confirmed, Interview with AJ Rice | Triggered Ep.218

81.8K57 -

LIVE

LIVE

The Amber May Show

8 hours agoWomen Of Rumble 02-20-25

325 watching -

41:18

41:18

Kimberly Guilfoyle

6 hours agoToday, We Kash in on Equal Justice, Live with Ryan Walters & Daniel Turner | Ep.198

66.2K20 -

1:36:50

1:36:50

Redacted News

5 hours agoThe TRUTH in Ukraine has been EXPOSED by Trump and they are melting down | Redacted w Clayton Morris

104K170 -

2:05:35

2:05:35

The White House

7 hours agoPresident Trump Hosts a Reception Honoring Black History Month

64.7K43 -

1:05:09

1:05:09

Josh Pate's College Football Show

6 hours ago $0.40 earnedCFP Expansion: Latest Intel | CFB’s Schedule Problem | Arch Manning Hype | ACC Program Rankings

15.6K3 -

55:52

55:52

LFA TV

1 day agoTrump vs. Europe | TRUMPET DAILY 2.20.25 7PM

21K4 -

31:02

31:02

Chrissy Clark

3 hours agoAn IVF Nightmare, Trump’s Illegal Immigration Crackdown, & Biden’s Student Loan Plan BLOCKED I URS

14.1K15