Premium Only Content

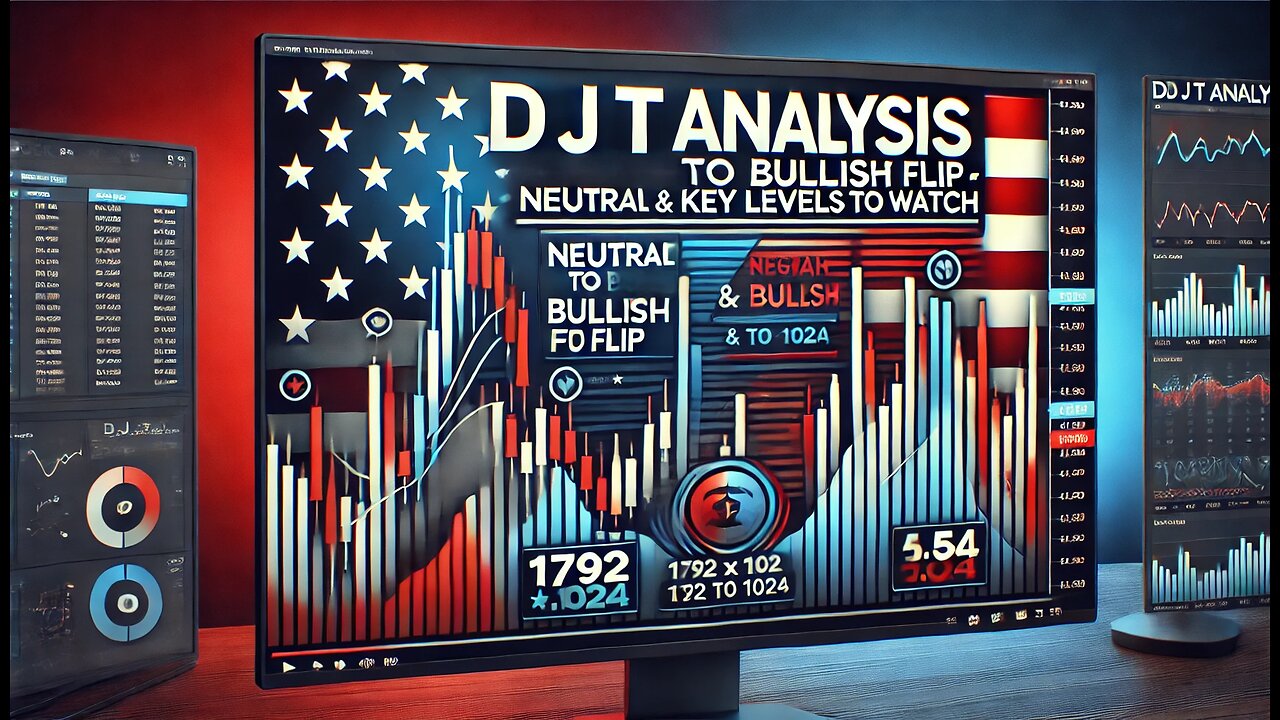

$DJT: Neutral to Bullish Flip & Key Levels to Watch

$DJT Analysis: The previously anticipated low-risk setup did not trigger as the scenario shifted from bearish to neutral, and then unexpectedly flipped to bullish, contrary to the planned entry. The price action gapped below the 5 DMA, a classic sign of a trend reversal, especially after the recent shift to bullish. This warrants caution as it aligns with a textbook play for potential downside continuation.

Currently monitoring to see if $DJT can trade above the 34.49 and WTD VWAP area. A break above this level could fuel a push into the declining 5 DMA at 35.30 and the previous high VWAP at 34.99. If this rally persists into Tuesday and Wednesday, a low-risk setup could potentially materialize.

If $DJT cannot trade above 34.19 and holds below the daily VWAP, monitor further declines down into the 33.15, 32.85, and then the 30.25 area. Remember, price action under the 5 DMA should be considered "guilty until proven innocent."

-

3:13:59

3:13:59

SilverFox

6 hours ago🔴LIVE - OBLIVION IS BETTER THAN SKYRIM NOW

37.6K1 -

8:00:00

8:00:00

SpartakusLIVE

10 hours agoDuos w/ StevieT || Trios or Quads Later?!

31.3K1 -

7:19:12

7:19:12

OhHiMark1776

11 hours ago🟢04-27-25 ||||| Halo Multiplayer Rumble: No. 13 ||||| Halo MCC (2019)

88.7K -

2:12:28

2:12:28

TheSaltyCracker

8 hours agoThey Killed Her ReeEEEe Stream 04-27-25

158K321 -

2:33:51

2:33:51

vivafrei

18 hours agoEp. 261: Criminal Judges ARRESTED! Election in Canada! Santos Sentenced! RFK Jr. & Autism & MORE!

196K133 -

6:24:31

6:24:31

Amish Zaku

11 hours agoRumble Spartans "The One Year" Event

50.6K1 -

7:28:41

7:28:41

Illyes Jr Gaming

9 hours agoLaid Back Sunday Night Warzone Stream!

22.4K -

1:51:18

1:51:18

Nerdrotic

10 hours ago $7.41 earnedDiscoveries From Graham Hancock's "Fight for the Past" | Forbidden Frontier 099

51.6K13 -

1:09:42

1:09:42

Sarah Westall

9 hours agoHidden Tech Resembles Star Trek: Malaysian Airline, Portals & Wormholes w/ Ashton Forbes

58.8K30 -

1:13:46

1:13:46

Josh Pate's College Football Show

10 hours ago $1.94 earnedCFB Truth About NFL Draft | Sheduer & Ewers Slide | James Franklin vs Fans | 2025’s Biggest What-Ifs

23.4K5