Premium Only Content

From Drilling to Deals with Blaine McLaghlin

The Dentist's Guide to Passive Income: Real Estate Investing with Blaine McLaughlin

In this episode of Passive Income Adventures, host Emma welcomes Blaine McLaughlin, a dentist turned real estate investor from Iowa. They discuss the various types of real estate investing, including the pros and cons of active vs. passive investments. Blaine shares his journey from dentistry to real estate, providing valuable insights into the challenges and rewards of both careers. They also dive into the misconceptions about wealth in high-paying professions and the importance of diversification in investment portfolios. This episode offers practical advice for professionals looking to diversify their income streams through real estate.

Bio:

Blaine McLaughlin DDS

Dentist for 29 years and owner of a multimillion dollar business

I’ve been involved in real estate for 25 years but have been heavily involved sine 2021

Owner of a $2.5 mill commercial property

Partial owner of 1300 doors of multifamily real estate in Texas and Georgia

Partial owner of an RV park

Partial owner of 118 units of a build to rent community in texas

Connect:

https://caniretirecalculator.com

Connect with Emma:

https://InvestWithEmma.com

https://Highrise.group

https://PartnerWithRise.com

00:00 Introduction and Welcome

00:10 Meet Blaine McLaughlin: From Dentistry to Real Estate

00:52 Deciding Between Active and Passive Investing

02:16 Blaine's Early Real Estate Ventures

04:55 Challenges and Lessons Learned

05:53 Planning for Retirement and Diversification

23:01 The Importance of Diversification

27:42 Tax Benefits of Real Estate Investing

29:47 Discussing Property Taxes and School Funding

30:19 Tax Benefits of Real Estate Investments

32:06 Transitioning to Real Estate Professional Status

33:44 Burnout in Healthcare and Real Estate as an Alternative

40:22 Challenges and Benefits of Passive Investing

44:02 Impact of COVID-19 on Healthcare and Real Estate

46:18 Building Trust in Real Estate Investments

48:57 Retirement Planning and Diversification

56:16 Conclusion and Contact Information

-

16:13

16:13

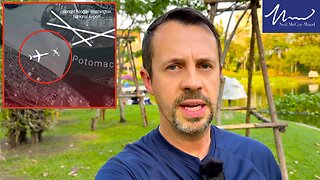

Neil McCoy-Ward

23 hours agoWhat We're Not Being Told About The DC Plane Crash Tragedy

18.1K15 -

11:24

11:24

IsaacButterfield

1 day ago $2.36 earnedWhy I Hate Gen Z TikTok

20.1K5 -

11:27

11:27

RTT: Guns & Gear

19 hours ago $0.82 earnedX2 Dev Group - 14 5" Fluted Trident Barrel

13.3K1 -

1:00:08

1:00:08

Trumpet Daily

22 hours ago $6.01 earnedDemocrats’ Greatest Fear Is Accountability - Trumpet Daily | Jan. 31, 2025

21.7K8 -

5:11

5:11

BIG NEM

14 hours agoHilarious Street Interviews: Advice for Adult Virgins!

20.9K1 -

1:21:32

1:21:32

PMG

1 day ago $1.44 earnedThe Death of Big Pharma! We MUST Confirm RFK!! Hearing Happening NOW!

15.1K4 -

3:34:56

3:34:56

FreshandFit

11 hours agoAverage Spoiled Brat Claims She Doe NOT Need To Do Anytning To Get A Man! 🤣

108K72 -

2:11:11

2:11:11

TheSaltyCracker

14 hours agoTrump Fires Everyone ReeEEeE Stream 01-31-25

262K391 -

1:15:45

1:15:45

Roseanne Barr

16 hours ago $40.54 earnedJFK case solved!? with Shane Stevens | The Roseanne Barr Podcast #85

150K97 -

10:36:04

10:36:04

Dr Disrespect

22 hours ago🔴LIVE - DR DISRESPECT - PUBG - WHAT WINNING LOOKS LIKE

278K50