Premium Only Content

Sukuk (Islamic Bonds) ? Meaning, Definition, and Example

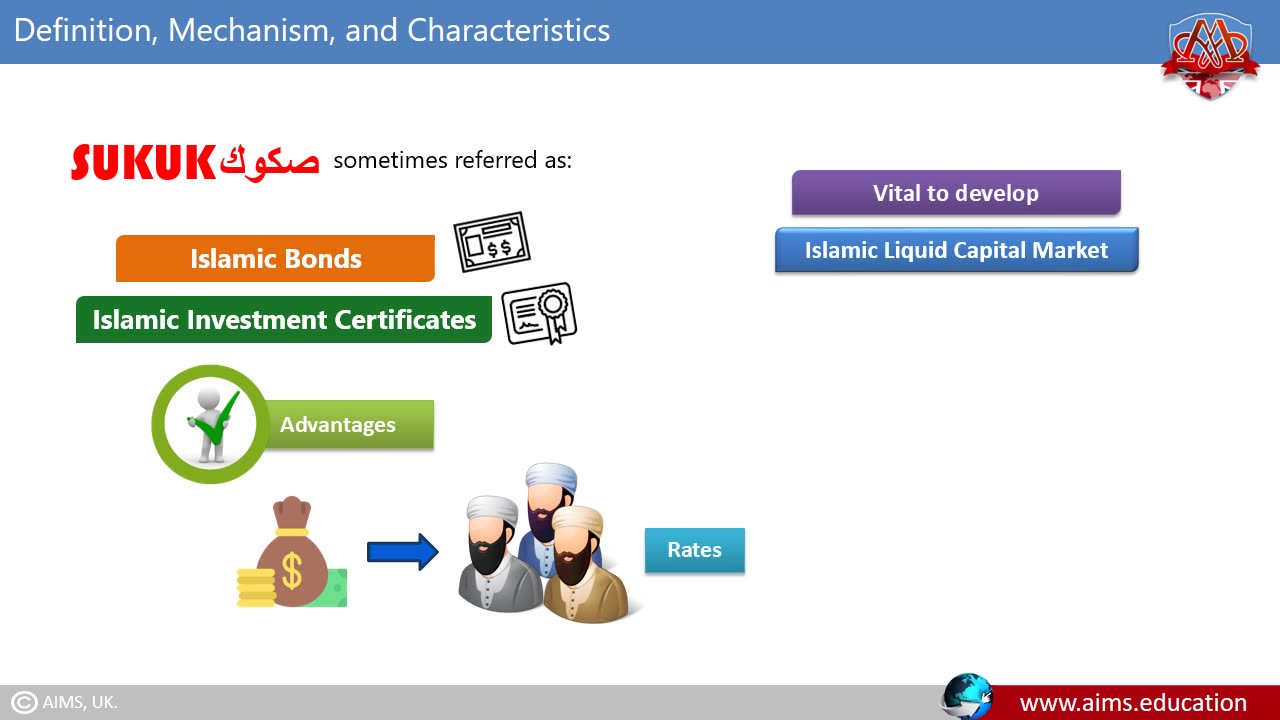

Sukuk, often referred to as Islamic bonds, are financial instruments that comply with Islamic law (Shariah). Unlike traditional bonds, sukuk bonds represent ownership in a tangible asset or a pool of assets, rather than a debt obligation.

For complete lecture on Sukuk (Islamic Bonds) , and for more lectures on Islamic Banking and Finance visit: https://aims.education/sukuk-islamic-bond-meaning-structuring-types/

The primary types of sukuk include Ijarah (leasing), Mudarabah (profit-sharing), Musharakah (partnership), and Murabaha (cost-plus financing). The sukuk bond meaning lies in its structure, where investors receive returns based on the performance of the underlying assets, rather than earning interest, which is prohibited in Islam.

As such, sukuk bonds offer an ethical and Shariah-compliant alternative to conventional debt securities.

#sukuk #sukukdefinition #sukukmeaning #Islamicbond #sukukbond #AIMS #AIMSEducation #Education #elearning #Training #OnlineCourses #WhatIs #OnlineCourses #IslamicBanking #IslamicFinance #Takaful #IslamicFinancing #IslamicBankingandFinance #Banking #Finance #IslamicStudies #IslamicEducation

Institute of Islamic Banking and Finance

https://aims.education/islamic-banking-and-finance-institute/

Certified Islamic Banker (CIB)

https://aims.education/islamic-banking-certification-courses/

Certified Islamic Finance Expert (CIFE)

https://aims.education/islamic-finance-certification-courses/

Master Diploma in Islamic Finance (MDIF)

https://aims.education/diploma-in-islamic-banking-and-finance/

MBA in Islamic Banking and Finance

https://aims.education/islamic-banking-and-finance-mba-masters-degree/

PhD Islamic Finance

https://aims.education/phd-islamic-finance-and-banking/

-

1:15:45

1:15:45

Roseanne Barr

11 hours ago $30.29 earnedJFK case solved!? with Shane Stevens | The Roseanne Barr Podcast #85

116K46 -

10:36:04

10:36:04

Dr Disrespect

17 hours ago🔴LIVE - DR DISRESPECT - PUBG - WHAT WINNING LOOKS LIKE

256K38 -

4:41:07

4:41:07

Nerdrotic

13 hours ago $36.08 earnedCap 4 and Emelia Perez BACKLASH! Acolyte is Still CANCELED! Hollywood STFU | Friday Night Tights 339

194K35 -

57:41

57:41

The StoneZONE with Roger Stone

10 hours agoWhy Are They So Afraid of Tulsi Gabbard? | The StoneZONE w/ Roger Stone

59.2K15 -

2:41:03

2:41:03

I_Came_With_Fire_Podcast

15 hours ago🔥🔥Suing CHINA, Hillary AIDED RUSSIA, and DEI REMOVED from Military🔥🔥

98.4K24 -

LIVE

LIVE

SoniCentric

16 hours agoCozy Up With SNOWY Lakeside Cabin Jazz Vibes

438 watching -

1:36:16

1:36:16

PMG

1 day ago $1.10 earnedSPECIAL: JUSTICE FOR JEREMY - NOW!

41.4K4 -

1:01:01

1:01:01

TheTapeLibrary

18 hours ago $3.80 earnedThe Horrifying True Story of Summerwind Mansion

49.9K7 -

29:28

29:28

Afshin Rattansi's Going Underground

1 day agoMax Blumenthal on US’ Ukraine Aid Corruption, 'Psychotic' Israel Turning the West Bank into Gaza

50.9K4 -

57:12

57:12

Flyover Conservatives

1 day agoCovid, Control, & Corruption —Dr. Stella Immanuel’s Plan to BEAT the System! | FOC Show

37.8K