Premium Only Content

How GMO companies monopolize agriculture.

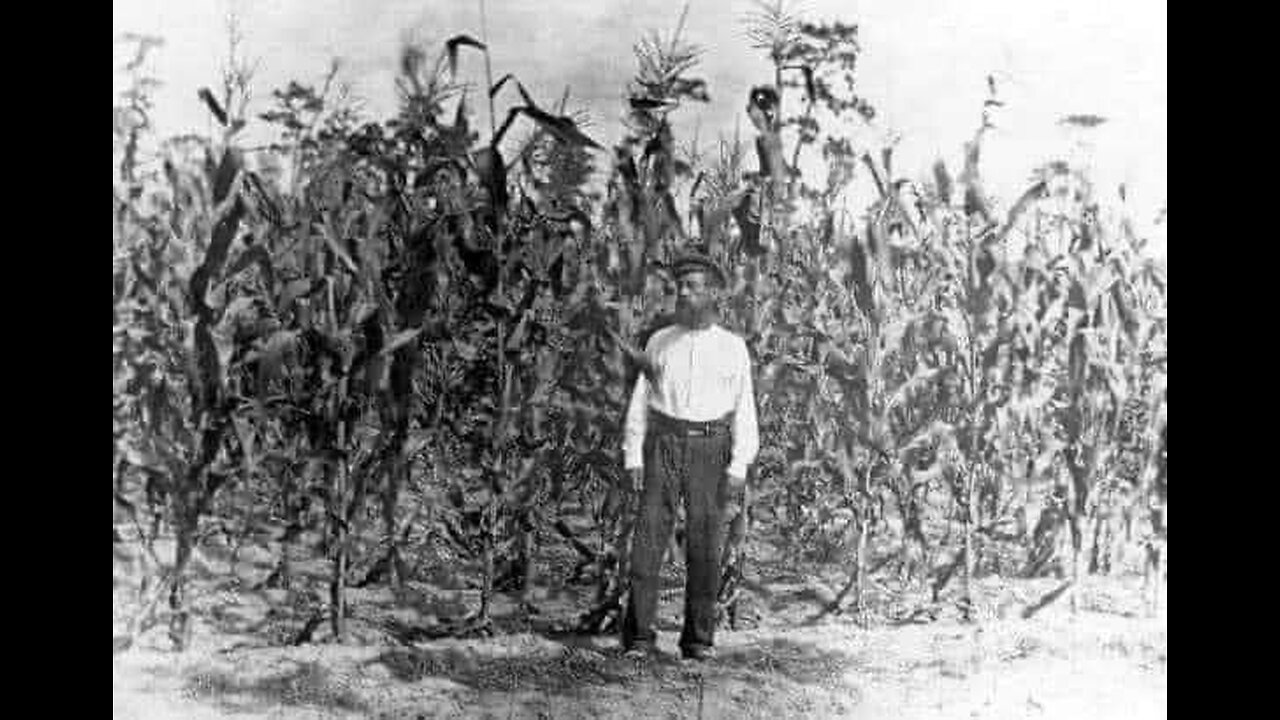

There was a farmer who grew excellent quality corn.

Every year he won the prize for the best corn grown. One year a reporter interviewed him and discovered something interesting about the way he grew corn. The reporter discovered that the farmer shares his seeds with his neighbors. "Why does he share his best seeds with his neighbors if every year they compete with his own?" the reporter asked him.

Why, sir? the farmer replied, didn't you know? The wind picks up the pollen from the ripe corn and swirls it from one field to another. If my neighbors grow inferior corn, cross-pollination will constantly degrade the quality of my corn. If I want to grow good corn, I must help my neighbors grow good corn.

The same is true of our lives. Those who want to live good and meaningful lives must help enrich the lives of others, because the value of a life is measured by the lives it touches, and those who choose to be happy must help others find happiness.

Silver Poised for Significant Price Surge in Early 2025

Here’s Why

The silver market is heating up as 2025 approaches, with a combination of macroeconomic factors, supply-demand imbalances, and historical trends signaling a potential significant price increase.

Silver recently surged over 2% to trade at $32.35 per ounce, and analysts believe this is just the beginning of an upward trajectory for the precious metal.

The Macro Landscape: A Perfect Storm

Silver’s role as both an industrial metal and a safe-haven asset makes it highly sensitive to macroeconomic factors.

The resumption of gold purchases by China’s central bank in November, after a six-month pause, has sent bullish signals across the precious metals market. This indicates renewed confidence in hard assets, with silver often following gold’s lead.

Furthermore, investors are closely watching U.S. inflation data and Federal Reserve policy decisions.

The expectation of potential interest rate cuts could weaken the dollar, driving up demand for commodities like silver.

Historically, silver prices also benefit from seasonal strength, with January to March often marking a period of significant gains.

Supply Constraints and Surging Demand

A crucial driver for silver’s bullish outlook lies in its supply-demand dynamics. Silver has faced a supply deficit for four consecutive years, largely due to its essential role in industrial applications, particularly in the rapidly expanding solar energy sector.

The solar industry’s consumption of silver is expected to continue climbing, exacerbating supply shortages.

On the supply side, new silver mine development has been constrained by rising costs and declining ore grades.

These challenges limit the ability of producers to respond to growing demand, further tightening the market.

Silver Miners Are Breaking Out

Silver mining stocks have also signaled a breakout, ending a two-decade slump.

The Global X Silver Miners ETF (SIL), a key benchmark, recently surged past its $36 to $38 resistance level on strong trading volume. This breakout reflects growing investor confidence in the silver sector and suggests that miners are poised to capitalize on rising prices.

The Monetary Metal Argument

Silver’s dual role as an industrial and monetary metal positions it uniquely in times of economic uncertainty.

With ongoing geopolitical tensions and fears of global economic instability, silver’s appeal as a store of value is gaining traction.

Investors are increasingly turning to silver as a hedge against inflation and market volatility, further bolstering demand.

Triggers for a Silver Rally

While silver’s recent price action is promising, the market awaits a clear trigger to propel it into a full-scale rally. Potential catalysts include:

•Worsening Supply Deficits: Accelerated industrial demand from sectors like solar could further strain already tight supplies.

•Limited Mine Development: A lack of new mining projects will exacerbate long-term supply constraints.

•Increased Monetary Demand: Rising concerns about inflation and currency devaluation may lead to a surge in silver investment.

A Historical Perspective

Silver’s seasonality adds another layer of optimism.

Historically, the metal sees its strongest performance early in the year, with January through March often marking significant price increases.

This pattern, coupled with strong macroeconomic fundamentals, suggests that silver is entering a sweet spot for price appreciation.

Outlook for 2025

While no forecast is without risks, the evidence overwhelmingly points to higher silver prices in the months ahead.

Supply constraints, industrial demand, and favorable macroeconomic conditions create a compelling case for investors to watch this market closely.

There’s too much evidence points to gold and silver prices going much higher.

For silver, the time to shine may be just around the corner.

-

DVR

DVR

Kim Iversen

2 hours agoThe Rise Of The New Nazis: Free Speech Is DEAD in Europe — And It’s Coming Here Next | CJ Hopkins

4.38K21 -

13:24

13:24

Exploring With Nug

9 hours agoSearching For Missing Woman Using Underwater Drone!

211 -

1:35:42

1:35:42

Redacted News

2 hours ago"STOP WHINING!" China slams Trump after new 245% Tariff War explodes, Xi ready to talk? | Redacted

67.5K85 -

1:09:29

1:09:29

vivafrei

5 hours agoBig Trouble for Letitia! Auto-Pen "Scandal"? More Tyranny & Conservative Cowardice in Canada! & MORE

41.8K32 -

7:32

7:32

WhaddoYouMeme

1 hour agoShe Mocked Christians—Didn’t Go as Planned!

102 -

43:03

43:03

The White House

2 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media with a Special Guest, Apr. 16, 2025

20.1K25 -

47:12

47:12

Friday Beers

4 hours ago $0.55 earnedWho Survived Our First Game of Dungeons and Dragons? (Ft. Almost Friday TV)

6.57K1 -

1:21:59

1:21:59

RiftTV/Slightly Offensive

2 hours ago $2.77 earnedDid RFK Just EXPOSE a SHOCKING REALITY About Autism? | The Rift Report

17.4K9 -

LIVE

LIVE

LFA TV

21 hours agoLFA TV - ALL DAY LIVE STREAM 4/16/25

695 watching -

2:16:41

2:16:41

The Quartering

5 hours agoKarmelo Anthony Buys $150,000 Cadillac, Maryland Man Psyop, Blue Origin Flight FAKED & More

140K90