Premium Only Content

Understanding Your Debt-to-Income (DTI)

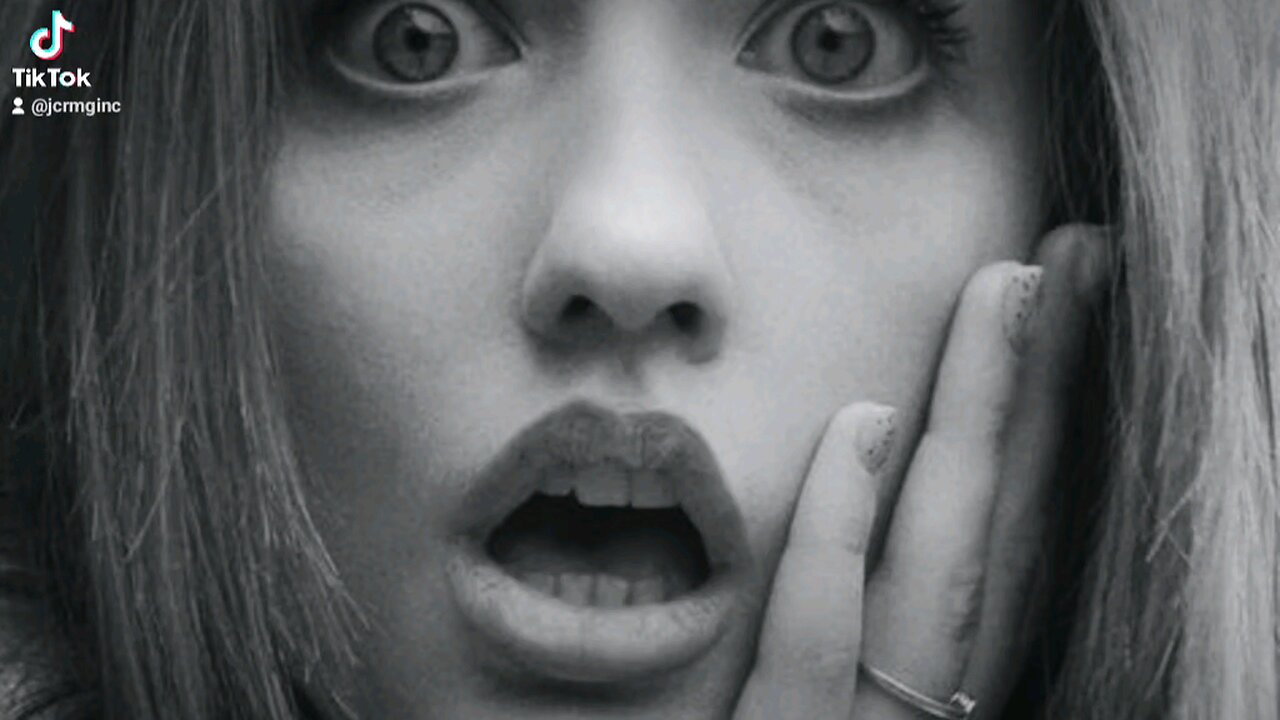

Understanding Your Debt-to-Income (DTI) Ratio This is going to blow your mind… Your financial future hinges on one little number- the DTI ratio. The Debt-to-Income, or DTI ratio, is like your financial report card. It tells lenders how well you can handle monthly payments and repay debts. Here’s the scoop- DTI is your total monthly debt payments divided by your gross monthly income, then multiplied by 100. Imagine you have $2,000 in debt payments and earn $6,000 a month. Your DTI would be 2,000 divided by 6,000, multiplied by 100, equaling 33%. Easy, right? A lower DTI means you’re in good shape—below 45% is great! But if you’re above 45%, lenders might get nervous. For tips on improving your DTI, or other financial advice, Joe Frank Cerros, loan Officer at JCRMG INC Mortgage Broker, is here to help. Call Joe at 1-888-600-7577 - Look forward to hearing from you! Read the full Disclaimer at https://www.joecerros.com -Doing business in California. DRE 02173635 NMLS 2418994 #jcrmginc #jcrmg #joefrankcerros #jcrmgincltv #jcrmgltv #ltv #jcrmgincloantovalue #jcrmgincmortgage #jcrmgincprequalification #jcrmgprequalification #jcrmgincpre-qualificarion #jcrmgincmortgagebroker

-

40:01

40:01

CarlCrusher

15 hours agoSkinwalker Encounters in the Haunted Canyons of Magic Mesa - ep 4

2.4K2 -

59:44

59:44

PMG

1 day ago $0.16 earned"BETRAYAL - Johnson's New Spending Bill EXPANDS COVID Plandemic Powers"

22.1K -

6:48:50

6:48:50

Akademiks

13 hours agoKendrick Lamar and SZA disses Drake and BIG AK? HOLD UP! Diddy, Durk, JayZ update. Travis Hunter RUN

151K27 -

11:45:14

11:45:14

Right Side Broadcasting Network

9 days agoLIVE REPLAY: TPUSA's America Fest Conference: Day Three - 12/21/24

336K28 -

12:19

12:19

Tundra Tactical

13 hours ago $12.62 earnedDaniel Penny Beats Charges in NYC Subway Killing

60K11 -

29:53

29:53

MYLUNCHBREAK CHANNEL PAGE

1 day agoUnder The Necropolis - Pt 1

151K51 -

2:00:10

2:00:10

Bare Knuckle Fighting Championship

3 days agoCountdown to BKFC on DAZN HOLLYWOOD & FREE LIVE FIGHTS!

54K3 -

2:53:01

2:53:01

Jewels Jones Live ®

1 day agoA MAGA-NIFICENT YEAR | A Political Rendezvous - Ep. 103

146K36 -

29:54

29:54

Michael Franzese

17 hours agoCan Trump accomplish everything he promised? Piers Morgan Article Breakdown

132K56 -

2:08:19

2:08:19

Tactical Advisor

21 hours agoThe Vault Room Podcast 006 | Farwell 2024 New Plans for 2025

197K11