Premium Only Content

The Consequences of Title Jumping and Tax Evasion in the Vehicle Industry

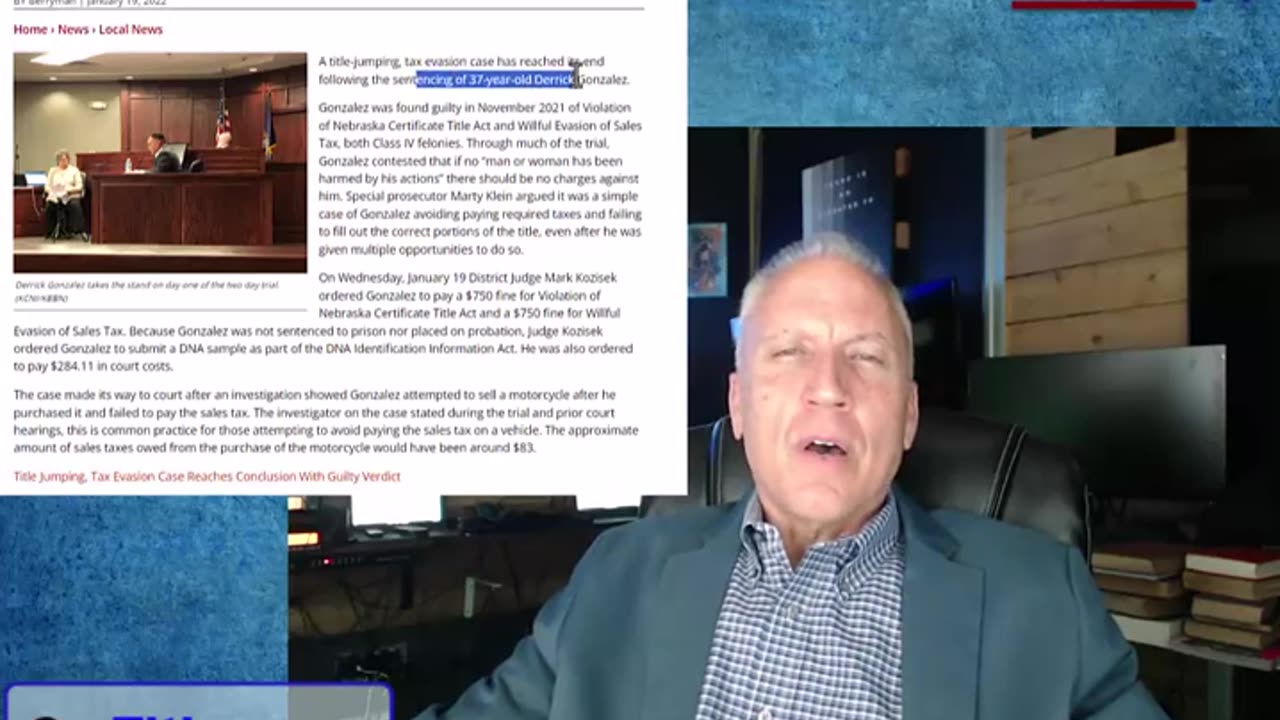

Avoiding taxes, skipping inspections, or attempting to bypass legal requirements when dealing with vehicle titles might seem tempting, but it can lead to serious consequences. A recent case highlighted a 37-year-old man convicted of title jumping and sales tax evasion in Nebraska. Despite claiming no harm was done, he was sentenced to a felony and faced significant legal costs. In this case, he tried to sell a motorcycle without paying sales tax, which amounted to just $83—but cost him far more in legal fees and a criminal conviction.

If you're thinking about using shady tactics to avoid paying taxes or skipping necessary title processes like VIN verification or inspections, think again. The risk of criminal prosecution is real, and it can lead to felony charges, jail time, and significant financial losses. Instead, use legitimate title processes such as bonded titles, court-ordered titles, or contacting prior owners to navigate any title issues legally. It may take more paperwork and time, but it's a far safer option than facing charges for attempting to cut corners.

If you have questions about title processes, tax evasion risks, or need help with legal title matters, remember that ActualHuman.com offers one-on-one, private consultations with licensed experts. Speak with professionals like private investigators, real estate title examiners, or legal advisors for personalized guidance on your specific situation. Avoid the risks, and make sure you're handling your vehicle titles the right way.

-

14:54

14:54

BlackDiamondGunsandGear

8 hours agoIs this BUDGET Optic WORTH your $$$ / Gideon Optics Advocate

1.28K -

DVR

DVR

Space Ice

7 hours agoSpace Ice & Redeye: Seagal's Born To Raise Hell & Movie Ideas Feat Alex Lantz

14.1K -

57:58

57:58

The StoneZONE with Roger Stone

3 hours agoCliff Maloney Defends Elon Musk as Liberal Heads EXPLODE over DOGE | The StoneZONE w/ Roger Stone

29.5K4 -

1:14:39

1:14:39

Redacted News

6 hours agoBREAKING! Trump's Gaza Ceasefire in Trouble, Peace in Ukraine Imminent | Redacted w Clayton Morris

154K116 -

7:18:36

7:18:36

Dr Disrespect

10 hours ago🔴LIVE - DR DISRESPECT - THE SHOTTY BOYS - WARZONE CHALLENGE

190K18 -

57:12

57:12

Candace Show Podcast

6 hours agoJudge Slaps Down Blake Lively. Colleen Hoover Returns. | Candace Ep 146

124K87 -

1:02:51

1:02:51

LFA TV

1 day agoDEEP STATE ATTEMPTS TO SABOTAGE DOGE | BASED AMERICA 2.12.25 6PM

40K19 -

1:33:01

1:33:01

Michael Feyrer Jr

5 hours agoGet Your Live Streaming Questions Answered! LIVE

32.3K1 -

1:46:14

1:46:14

2 MIKES LIVE

5 hours ago2 MIKES LIVE #179 News Breakdown Wednesday!

21.7K2 -

40:48

40:48

The Based Mother

9 hours ago $0.73 earnedAGENDA 47 & THE BORDER CRISIS - Is Trump keeping his campaign promises? Elena breaks it down.

17.6K3