Premium Only Content

Cracking the Code: Understanding Customs Fees and Duties

ISF Depot // 661-246-8217 // customs@isfdepot.com // www.isfdepot.com

In this video, we delved into the important concepts of ISF compliance and customs fees in the realm of customs brokerage. Understanding these concepts is crucial for individuals involved in international trade, whether as importers, exporters, or customs brokers. A customs broker acts as a facilitator between the importer/exporter and customs authorities, ensuring that all necessary documentation and procedures are accurately completed in line with the law.

ISF compliance refers to the Importer Security Filing requirement introduced by US Customs and Border Protection (CBP) to enhance the security of imported goods. Importers must submit specific information about the cargo at least 24 hours before it is loaded onto a vessel bound for the United States. This filing process includes information on buyer/seller, manufacturer/supplier, consignee, container stuffing location, HTSUS codes, container/seal numbers, and shipping vessel details.

Meeting ISF compliance is advantageous as it enhances supply chain security, facilitates expedited customs clearance, and ensures smoother shipping operations. Customs fees, on the other hand, are levies imposed on imported goods by governments and are typically based on the value of the goods and applicable tariff rates. Factors such as the classification of goods, their origin, and the declared value all influence the amount of customs fees payable by importers.

Importers may also be subject to various other fees such as customs processing fees, merchandise processing fees, and harbor maintenance fees. These fees cover the costs associated with customs clearance, inspections, and maintaining port infrastructure.

By understanding ISF compliance and customs fees, importers and customs brokers can navigate the complexities of international trade, ensuring compliance with regulations and avoiding delays and penalties.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This tutorial is independent and not affiliated with any US governmental entities.

-

14:36

14:36

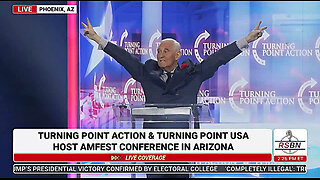

The StoneZONE with Roger Stone

1 day agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

94.4K24 -

18:59

18:59

Fit'n Fire

13 hours ago $5.89 earnedZenith ZF5 The Best MP5 Clone available

50.8K2 -

58:34

58:34

Rethinking the Dollar

22 hours agoTrump Faces 'Big Mess' Ahead | RTD News Update

49K5 -

5:35

5:35

Dermatologist Dr. Dustin Portela

22 hours ago $1.95 earnedUnboxing Neutrogena PR Box: Skincare Products and Surprises!

40.5K5 -

11:20

11:20

China Uncensored

21 hours agoCan the US Exploit a Rift Between China and Russia?

64.2K21 -

2:08:48

2:08:48

TheSaltyCracker

17 hours agoLefty Grifters Go MAGA ReeEEeE Stream 12-22-24

272K709 -

1:15:40

1:15:40

Man in America

20 hours agoThe DISTURBING Truth: How Seed Oils, the Vatican, and Procter & Gamble Are Connected w/ Dan Lyons

154K140 -

6:46:07

6:46:07

Rance's Gaming Corner

21 hours agoTime for some RUMBLE FPS!! Get in here.. w/Fragniac

177K5 -

1:30:48

1:30:48

Josh Pate's College Football Show

21 hours ago $11.42 earnedCFP Reaction Special | Early Quarterfinal Thoughts | Transfer Portal Intel | Fixing The Playoff

112K2 -

23:55

23:55

CartierFamily

3 days agoElon & Vivek TRIGGER Congress as DOGE SHUTS DOWN Government

145K162