Premium Only Content

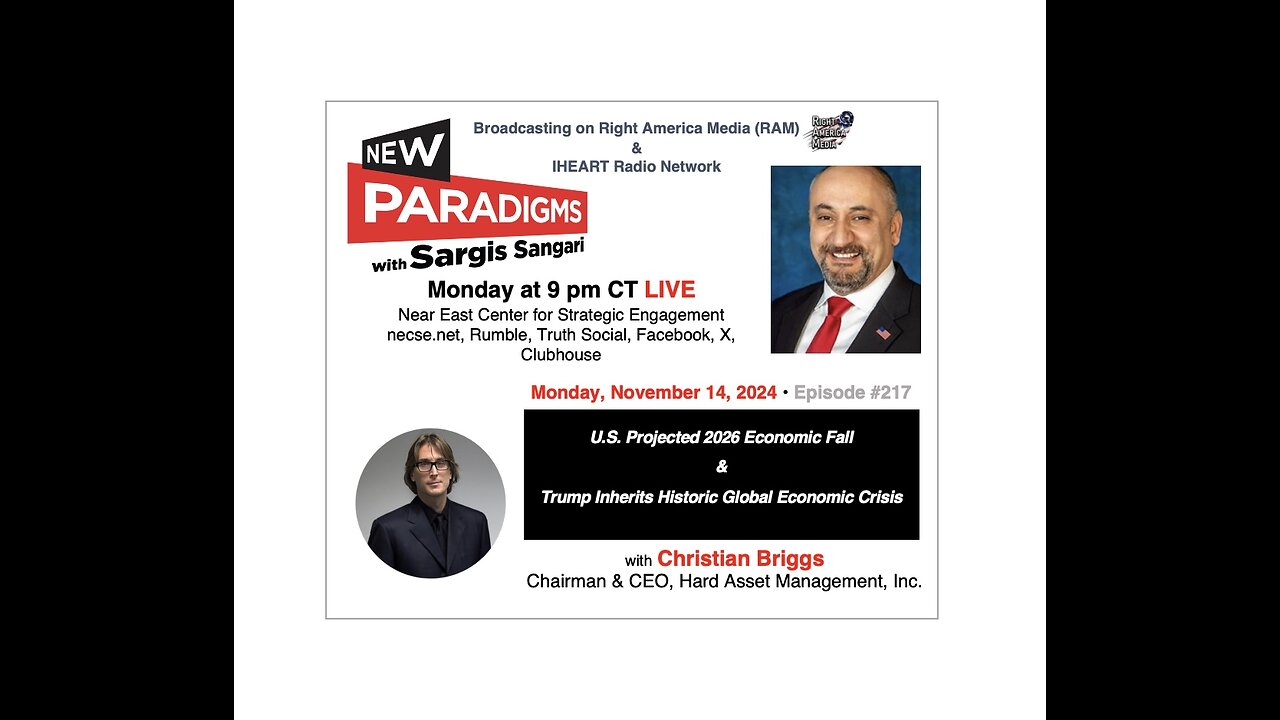

Christian Briggs- Chairman/CEO Hard Asset Management, Inc., New Paradigms w/Sargis Sangari EP 217

On Monday, 18 NOV 24, on New Paradigms with Sargis Sangari, Episode 217, Christian Briggs, founder and CEO of BMC Capital Inc. and Hard Asset Management, which specializes in the full-service management of hard assets for individuals and family offices around the world and I discuss U.S. Projected 2026 Economic Fall as President-Elect Trump inherits the worst global economy in 500 years.

On August 3, 2024, Ron Reece, NEC-SE Director of Technical Analysis, Special Projects, discussed the impending ramifications of the historical length of the current inverted yield curve in short-term yields versus long-term yield rates. Historically, when the short-term yield un-inverts, it signals the onset of a recession in the coming months.

Ron pointed out that Treasury Secretary Janet Yellen has been manipulating the short-term yield curve by funding government operations by issuing short versus lower-yielding longer-term debt to extend the inevitable until after the presidential election.

The next administration, from whatever political party, will be blamed for this economic downturn, potentially of equal magnitude to the 1929 market crash, as the length of the current inversion has now well-exceeded the inversion that occurred before 1929.

On Thursday, October 24, 2024, Russian President Vladimir Putin closed this year’s summit of The Association of Brazil, Russia, India, China, and South Africa (BRICS) bloc of developing economies, praising the BRICS’s role as a counterbalance to the West’s “perverse methods.”

The three-day summit in Kazan, Russia, was attended by leaders or representatives of 36 countries, including President Xi of China and Prime Minister Modi of India, who held their first formal talks in five years, where the talks are expected to result in more Chinese investment into India.

The successful summit highlighted what the Shanghai Cooperation Organization (SCO) wanted to show as the failure of U.S.-led efforts to isolate Russia and Putin over the invasion of Ukraine.

On The night of November 5, 2024, as President Trump’s victory became apparent, Reuters reported that all three major indexes hit record highs the next day, with the Dow going up 3.57%, S&P 500 2.53%, Nasdaq 2.95%. Trump-linked stocks, like Tesla, jumped, the market volatility gauge fell sharply, and shares of small-cap companies soared.

On Thursday, November 7, 2024, the Fed cut rates by a quarter of a percentage, scuttling the market’s economic hope. By pouring fuel on American inflation, the Fed ensured it could help the Biden administration scuttle the American economy before handing it over to the new President-Elect, Trump.

Please join us for this deep-dive discussion with Christian Briggs, an expert in analytic gathering and AI.

-

1:57:54

1:57:54

The Quartering

5 hours agoRand Paul Praises Trump, Amazon Takes Control of Bond, and Delta Gives Passengers $30,000

54.8K26 -

1:01:59

1:01:59

The White House

3 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Feb. 20, 2025

51.2K50 -

59:58

59:58

Russell Brand

5 hours agoLive from Mar-a-Lago: The Globalist Empire’s Last Stand – SF541

117K138 -

35:23

35:23

CryptoWendyO

3 hours ago $1.35 earnedCrypto Chaos Unleashed: Trump Making USA The Bitcoin Capital Of The World

17K1 -

1:03:00

1:03:00

The Dan Bongino Show

7 hours agoTrump Keeps Delivering And The Libs Are Seething (Ep. 2427) - 02/20/2025

745K1.85K -

1:20:26

1:20:26

Nerdrotic

5 hours ago $4.43 earnedSuper Chat Square Up - Nerdrotic Nooner 466

66.9K2 -

2:05:00

2:05:00

Steven Crowder

7 hours agoTrump Slams Dictator Zelensky: Why He NOW Has a Point

476K310 -

2:58:22

2:58:22

LFA TV

20 hours agoKASH CONFIRMATION & PRESS BRIEFING! | LIVE FROM AMERICA 2.20.25 11AM

114K55 -

2:14:42

2:14:42

Matt Kohrs

16 hours agoIt's A Bull Trap, Partner! || The MK Show

100K3 -

40:25

40:25

BonginoReport

10 hours agoTrump Cancels Zelensky’s 'Gravy Train' (Ep.144) - 02/20/2025

153K167