Premium Only Content

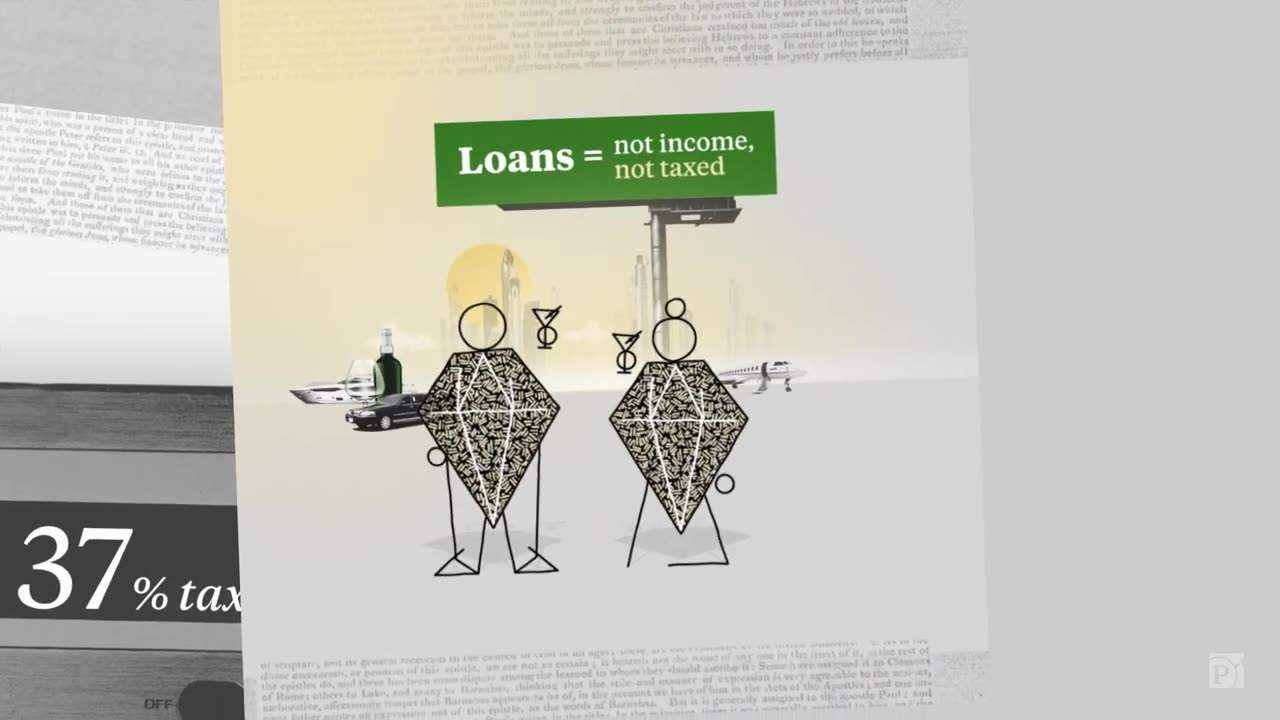

How America's Ultrawealthy Stay Wealthy

The ultrawealthy in America maintain their financial empires through a combination of strategic financial management, legal loopholes, generational planning, and diversified investments.

Access it here : https://tinyurl.com/MillionaireSystem28

Here's how they do it:

1. Tax Optimization

- Using Legal Loopholes: The ultrawealthy often leverage tax codes, such as carried interest provisions or offshore tax havens, to minimize liabilities. Strategies like depreciation and tax-loss harvesting further reduce their tax burdens.

- Trusts and Foundations: By placing assets in trusts or charitable foundations, they preserve wealth for future generations while gaining tax benefits.

2. Investments and Diversification

- Asset Allocation: Wealth is distributed across stocks, bonds, real estate, private equity, and alternative assets like art or collectibles. This reduces risk while ensuring steady growth.

- Private Investments: They invest in hedge funds, venture capital, or private equity, often accessing exclusive opportunities unavailable to average investors.

- Reinvestment: Rather than liquidating assets, they reinvest profits to compound wealth.

3. Business Ownership

- Many ultrawealthy individuals own or control private companies, allowing them to retain greater control over their income and decision-making.

- Family offices and holding companies manage their wealth and businesses, ensuring efficiency and centralized oversight.

4. Estate Planning

- Generational Wealth Transfer: Estate planning tools like GRATs (Grantor Retained Annuity Trusts) and ILITs (Irrevocable Life Insurance Trusts) minimize estate taxes while transferring wealth.

- Dynasty Trusts: These allow wealth to be passed down across multiple generations without incurring additional estate taxes.

5. Lobbying and Influence

- Shaping Policy: Wealthy individuals and corporations fund lobbying efforts to influence legislation and protect favorable financial environments.

- Political Contributions: Campaign financing secures influence, ensuring policies align with their interests.

6. Philanthropy with a Strategy

- Impact Investments: Many ultrawealthy individuals use philanthropy to support causes while enhancing their public image.

- Tax Deductions: Charitable contributions often reduce taxable income, creating a dual benefit.

7. Risk Management

- Insurance Policies: Comprehensive insurance, including life, liability, and property, protects their assets.

- Legal Teams: Teams of lawyers ensure compliance with regulations while shielding assets from lawsuits.

8. Education and Networking

- They ensure heirs receive financial literacy education and maintain networks of advisors—lawyers, accountants, and wealth managers—to preserve and grow their fortunes.

Through these combined efforts, America’s ultrawealthy not only preserve their wealth but also ensure its growth across generations, reinforcing their economic dominance.

-

1:10:17

1:10:17

Sarah Westall

5 hours agoWorld Leaders Increasingly Display Panic Behavior as Economic Change Accelerates w/ Andy Schectman

34.5K9 -

59:54

59:54

Motherland Casino

2 hours agoScar x Ayanna

1.13K1 -

41:57

41:57

BonginoReport

7 hours agoProtecting Kids From WOKE Ideology in School (Ep. 35) - Nightly Scroll with Hayley Caronia -04/25/25

90.5K27 -

LIVE

LIVE

SpartakusLIVE

5 hours agoFriday Night HYPE w/ #1 All-American Solo NUKE Hero

120 watching -

1:24:15

1:24:15

crystalkittn

1 hour agohappy friday lets get littt✨ !motherland

5663 -

1:15:07

1:15:07

Kim Iversen

1 day agoThe Left Is Dead — What And Who Will Rise From the Ashes?

91.1K70 -

2:06:17

2:06:17

Joker Effect

2 hours agoYOU DON'T UNDERSTAND FREEDOM OF SPEECH IF THIS MAKES YOU MAD!

7.67K -

1:45:26

1:45:26

vivafrei

9 hours agoSantos Sentenced to 87 MONTHS! Corrupt Judges ARRESTED! Some Canada Stuff & MORE!

136K87 -

4:34:03

4:34:03

Nerdrotic

8 hours ago $22.93 earnedStar Wars GRAPED? Hollywood In Freefall, Silver Surfer is a MAN! | Friday Night Tights 351

93.3K23 -

1:33:35

1:33:35

Keepslidin

4 hours ago $0.84 earned$5000 START | ROAD TO 100K | Mother.land

28.1K2